We are entering into the new year 2022. Therefore, for businesses, it is a crucial time. Because if they do GST year end activities, only then a smooth and viable transition to a new year is possible. Missing out on some important GST Year end activities can result in difficulties for audits and other tasks. Therefore, In this article, let’s now understand the most important GST year end Activities.

Outward Supplies GST year end Activities for FY 2020-21

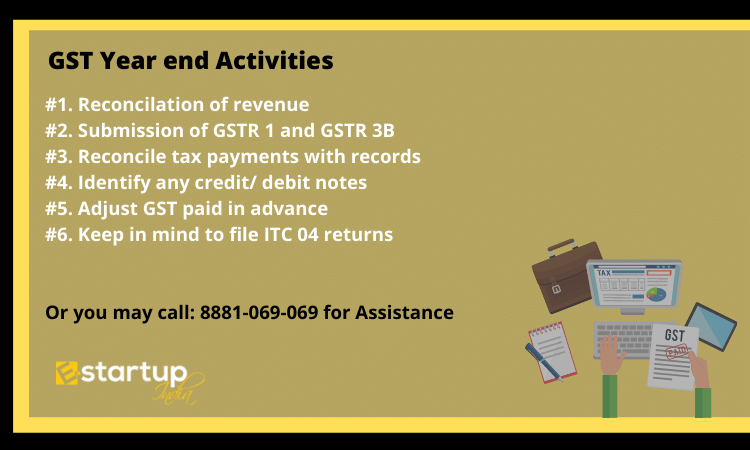

Below are the Year end activities in brief.

- Reconcile revenue (taxable, exempt, and non-taxable supplies) with books and records, and submit GSTR 1 and GSTR 3B.

- Reconcile tax payments with books and records, as well as GST Return Filing including GSTR 1 and GSTR 3B filings. Check the invoices and e-way bills for accuracy (cases where e-way is required but not generated)

- Check for IRNs on all Business-to-business, Exporting Invoices, and Debit/Credit Notes wherever E-Invoice provisions apply. Learn about e-way bills in detail at – ewaybill guide.pdf

- Reconcile invoices sent to customers with GSTR 1 submitted. Remember that no amendments may be made after submitting GSTR 1 for Sept 2021.

- Identify any credit/ debit notes that need to be documented and report them. If you haven’t paid your taxes or haven’t paid them on time, you must pay them as well as any interest that may be due.

- Adjust the GST paid in advance against the prospective liability and record the difference in GSTR 1 and 3B. (Applicable on Services)

- Examine and see if GST has been paid on other sources of income, such as the sale of an automobile or other possessions.

- RCM obligations must be reconciled and paid.

- Examine and reconcile documents for job functions that have been sent (Time limit for return – Inputs – 1 year and Capital goods – 3 years)

- Keep in mind to file ITC 04 returns for Job Work on a quarterly basis.

- Make sure you have a self-invoice ready for any RCM payments.

GST year end Activities for Input Tax Credit of FY 2020-21

- Reconcile ITC according to the general ledger and claim any Input Tax Credit that was not claimed before in GSTR 3B.

- Verify that the missing ITC to be sought is listed in Form GST 2A or 2B.

- Cross-check with suppliers to ensure that transactions are reported in their GTSR 1 so that they may be included in your GSTR 2A/2B.

- Any unclaimed ITC for FY 2020-21 must be reclaimed on or before September 20, 2021, when submitting GSTR 3B.

- Examine whether any invalid ITCs (Blocked credit/ ITC on exempt supply) have been added to the list. If an Input Tax Credit is availed, this ITC must be reversed, as well as the interests.

- Make sure the payment to vendors is not delayed more than 180 days after the invoice is received.

- If an Input Tax Credit is claimed and not compensated within three months of the invoice date, the ITC has to be reversed, together with interest.

- However, the reimbursement of such ITCs is possible if the supplier is paid later (even post-filing of Returns for September 2021). Even if a comparable amount is owed on a supplier invoice, the unpaid component of the ITC must be reversed proportionately.

- Inspect to see whether any of your suppliers are registered with the Composition Scheme and have collected GST. Reverse the ITC as well as the interest if it is the case.

- If a supplier’s GST Registration in India is revoked on account of tax evasion or isn’t performing GST Return Filing, send a notification to the supplier.

- Take advantage of any unclaimed Input Tax Credit on Reverse Charge Mechanism. In other words, reconcile Input Tax Credit availed on the amount paid under Reverse Charge Mechanism.

In conclusion, these are some of the most important GST Year End activities that businesses must do. However, there can be some other essential GST year end Activities as per the business type.

Moreover, If you want any other guidance relating to GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.