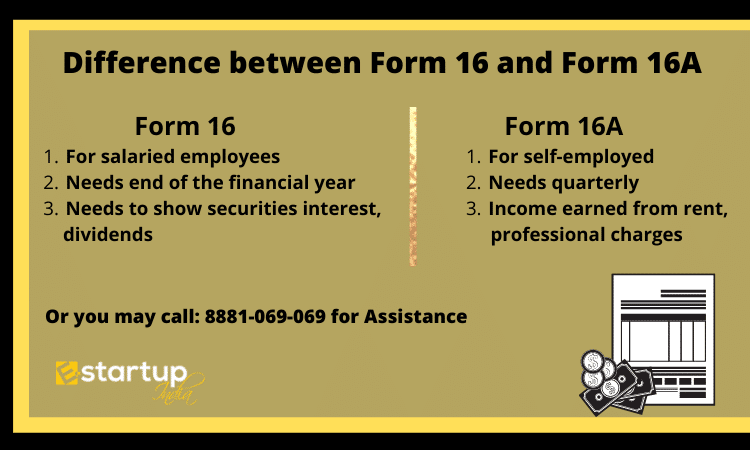

Form 16 and Form 16A are both required for Income tax return filing. These forms are furnished by the employers to the employees specifying the tax deduction during the assessment year. However, there is a significant difference between Form 16 and Form 16A. In this article, you will understand the difference between Form 16 and Form 16A.

What is Form 16?

The employers endow this form to the employees if the income exceeds the prescribed limit of the Income Tax Act. It provides a financial narration of the salary and taxes of the previous year. The main contents of Form 16 are PAN, TAN, allowances, personal details, perquisites, challan number income details, etc. This form also provides comprehensive information about the deduction of taxes on income after considering exemptions and other declarations.

What is Form 16A?

It is a statement of income provided to the individuals earning income from a business, profession, short-term investments, etc. Form 16A provides information about name, address PAN, TAN, date of deposit, and details of the total income and TDS. To deduct TDS from savings such as bank interest, insurance commission, Form 16A is required. For freelancers or professionals, the client’s issue this form revealing the amount of taxes deducted.

What is the Difference between Form 16 and Form 16A?

The difference is written below:

| Form 16 | Form 16A |

| It is a certificate issued to salaried employees. | The professionals and self-employed individuals should submit Form 16A. |

| Employers endow such forms to their employees. | The organizations such as banks, insurance companies, or financial institutions who deduct TDS on interests issue this form. |

| It comprises information about basic income, incentives, perquisites, and other allowances of the salaried individual along with deductions towards PF, and TDS at a prescribed rate. | It is a certificate that explains about other incomes than salary. |

| It is provided to the employees at the end of the financial year. | The deductees receive this form quarterly. |

| In this form, the PAN and TAN number is mentioned along with the name, address, education cess, and surcharges

|

It contains PAN details of the deductee and TAN details of the deductor along with the TDS payment receipt number. |

| Only the TDS details in form 16 are provided in Form 26AS.

|

But all details of Form 16A are available in Form 26AS. |

| It comprises information of long-term gains of investment such as securities interest, dividends, etc

|

It contains information about income earned from rent, professional charges, commission acquired from agents, etc |

Conclusion

Both the forms Form 16 and Form 16A are immensely useful for ITR filing. The authorities verify some important financial details and easily detect and rectify discrepancies using both forms.

Moreover, If you want any other guidance relating to ITR Filling, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.