The introduction of the Goods And Service Tax has overshadowed the other taxation systems like excise duty, service tax, and VAT. It was implemented on the 1st of July 2017 under the unique ideology, ‘one nation, one tax’. In this article, you will understand the difference between GST and VAT.

The aim of introducing GST registration in India was to bring down unwanted inflation in the economy. Both GST and VAT are implemented on the value of the sale or the supply of goods. However, there are a lot of differences between them.

What is the Value Added Tax or VAT?

VAT is the state-level tax that is applied on certain products like petrol, diesel, and alcohol. They are not taxable under the GST act. VAT was introduced in early 2005 as a replacement for the sales tax. It unified the tax rates for various products and services across India.

What is the goods and service tax?

The GST or the Good and Service Tax is the latest method of taxation. It was introduced to eliminate the major problems associated with VAT. GST has also replaced a large number of pre-existing state-level taxes.

Benefits of GST registration in India:

- It is a simple online procedure

- GST is calculated separately for E-commerce companies and you can understand more about it at – GST Registration for E-Commerce

- It reduces the compliance burden with the introduction of a single set of GST rules.

- The latest introduction of Input Tax Credit after GST Return Filing to help various businesses offset GST costs for raw materials.

Why is VAT being merged into GST?

The VAT taxation system had a few drawbacks due to the involvement of indirect taxes. Some of them are:

- The VAT rates were different for different states

- Different VAT laws for different states

- Presence of cascading effect on the taxation system

- The ITC could not be claimed under services controlled by VAT.

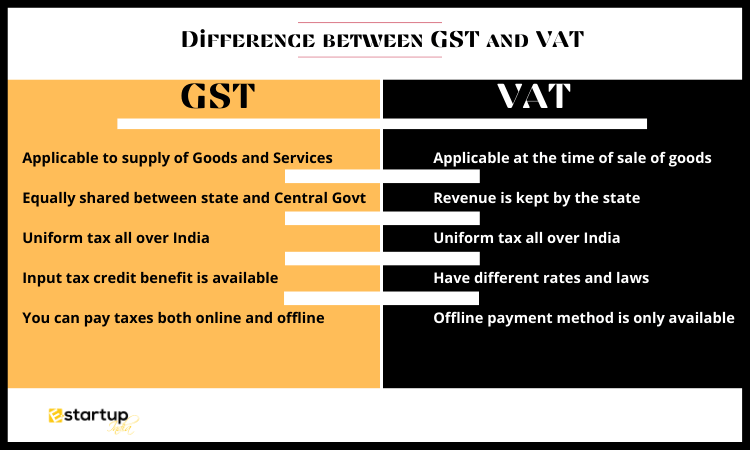

Difference between GST and VAT

The difference is written below for GST and VAT

| Parameter | GST | VAT |

| When is it applicable? | It is applicable to the supply of goods and services | The taxes applicable at the time of sale of goods |

| Where is it charged? | On both goods and services | On the sale of goods, extra service tax for services |

| Authority over tax | The collected revenue is equally shared by the state and the central government | The collected revenue is kept by the state in which the sale has taken place |

| Tax rates and law | The tax rates are uniform all over India | Different states have different rates and laws |

| What is the mode of payment? | You can pay taxes both online and offline. If GST applicable is more than Rs 10,000 online method has to be used | Offline payment method is only available |

| When is the return filed? | You have to file the returns every 20th of the next month for the preceding month | The dates for filing VAT returns on the 10th, 15th, and 20th of the next month for the previous month |

| What is the input tax credit? | Input tax credit benefit is available. In simple words, a taxpayer can claim credit on the goods and supplies received. | The taxpayer does not get any input tax credit benefit on the customs duty. |

| Who collects the tax? | Consumer state | The seller’s state |

| Compliance is the movement of goods | The same set of compliances and rules for the movement of goods between different states | Rules and compliances for the movement of goods differ from one state to another |

| Payment amount | GST payable= GST on supply of goods or services – input tax credit | VAT Payable= VAT on output- VAT on the input |

Final Verdict

There is a significant difference between GST and VAT and, it is obvious that GST is a lot better than VAT. However, there are still many products that are regulated by VAT. Some of them include petrol, diesel, and alcohol for human consumption. With the update in GST and the norms, we can expect more goods and services to be included in the tax. By implementing GST on goods and services, the Indian economy is improving with the elimination of the cascading system.

Moreover, If you want any other guidance relating to GST Return Filing or GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.