For registration under the Goods and Services Tax (GST) in India, there is a cap on the amount of exemption. If a person’s yearly turnover exceeds the exemption ceiling, he must register for the Goods and Services Tax regime. This is additionally referred to as a GST registration limit or GST threshold. Let us understand GST Registration on Limit for Services in FY 2022-23.

What is GST Registration?

A taxpayer can become registered for GST by going through the GST Registration process. A successful business registration under GST results in the assignment of a special registration number, known as the Goods and Services Tax Identification Number (GSTIN). Businesses have to use this GSTIN for all their GST Compliances including GST Return Filing.

Understand about GST Registration, GST Return Filing and get your queries resolved about GST through contacting us at: 8881-069-069 or read our guides mentioned below:

- GST Registration PDF

- GST Return Filing PDF

- HOW TO MAKE GST PAYMENT ONLINE?

- What are the benefits of gst registration under law

GST Registration Limit in Case of Goods

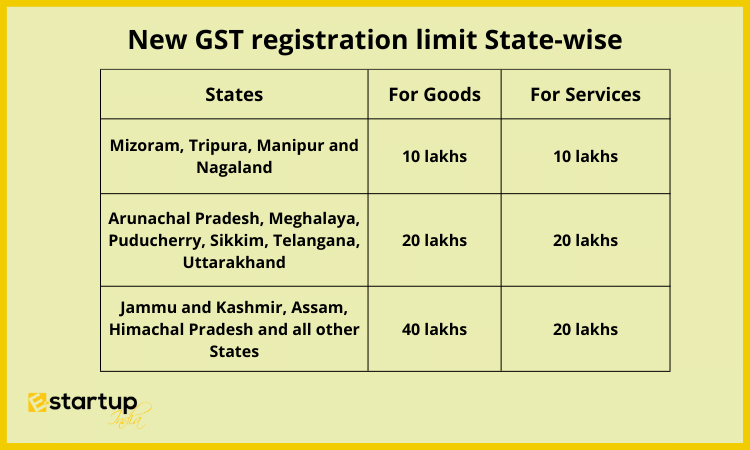

Every individual who engages in the sole supply of products and has an annual aggregate turnover of more than Rs 40 lakh is required to register for GST. Previously, the limit for a provider of products was 20 lakhs. By notification No. 10/2019-Central Tax, dated 07.03.2019, the amount was raised to 40 lakhs.

The increased exemption amount of 40 lakhs does not apply to the following:

- Businesses who are service providers.

- Persons engaged in making supplies of ice cream and other edible ice, whether or not containing cocoa [2105 00 00], Pan masala [2106 90 20] and all goods of Chapter 24, i.e. Tobacco and manufactured tobacco substitutes.

- Businesses who mandatorily need business registration regardless of their turnover

- Businesses who voluntarily apply for GST Registration

- Persons engaged in making intra-State supplies in the States of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura, Uttarakhand and the Special Category States as per section 22.

What is GST Registration on Limit for Services?

In India, there is a Rs. 20 lakh registration turnover threshold for service providers. Thus, The barrier for service providers hasn’t changed at all since the GST was launched. If the total value of the services they provide in a financial year exceeds Rs. 20 lakhs, they must register under the GST online and do GST Return Filing. For special category states the GST Registration limit is set at Rs. 10 Lakhs.

Composition Scheme under GST for Service Providers

The Composition Scheme under GST for service providers provides a new tax structure offering a set tax rate of 6% with 3% CGST and 3% SGST. The composition scheme is open to independent service providers as well as mixed suppliers of products and services with a prior fiscal year’s annual turnover of up to Rs. 50 lakh.

How is aggregate turnover determined for the GST threshold?

One thing is now abundantly clear: the primary factor in determining whether a person qualifies for GST exemption or not is their total annual turnover. Section 2(6) of the CGST Act defines “aggregate turnover.”

In simple words, you can define turnover as inclusive of:

- Taxable supplies

- Exempted supplies

- Non-GST supplies

- Interstate supplies

- Zero-rated supplies

- Goods sent for job work

The turnover excludes:

- Goods or services received on which tax payable under reverse charge mechanism

- GST paid

- Goods received for job work

Important Note: The total turnover will be calculated on a PAN India basis rather than a state basis.

How to appeal against cancellation of GST registration in India

Moreover, If you want any other guidance relating to GST Registration online , please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.