In today’s world, anyone can begin their own online business from home without investing lots of money. This has become possible because of E-Commerce companies such as Meesho. One of the essentials to start your business on Meesho is having GST Registration.

Stepwise Process to have GST Registration for Meesho Supplier

Part 1: Initiating the Registration Process

- Access the GST portal at https://www.gst.gov.in/.

- Go to the “Services” tab and select “New Registration.”

- You will be presented with a form requiring various details. Fill out this form completely, ensuring you:

- Select “Taxpayer” under “I am a.”

- Specify your state and district.

- Provide your business name.

- Enter your business PAN number.

- Input a valid email ID and mobile number for verification purposes (one-time passwords or OTPs will be sent here).

- Enter the displayed image text and click “Proceed.”

- Enter the OTPs received on your email and mobile number, then click “Proceed” again.

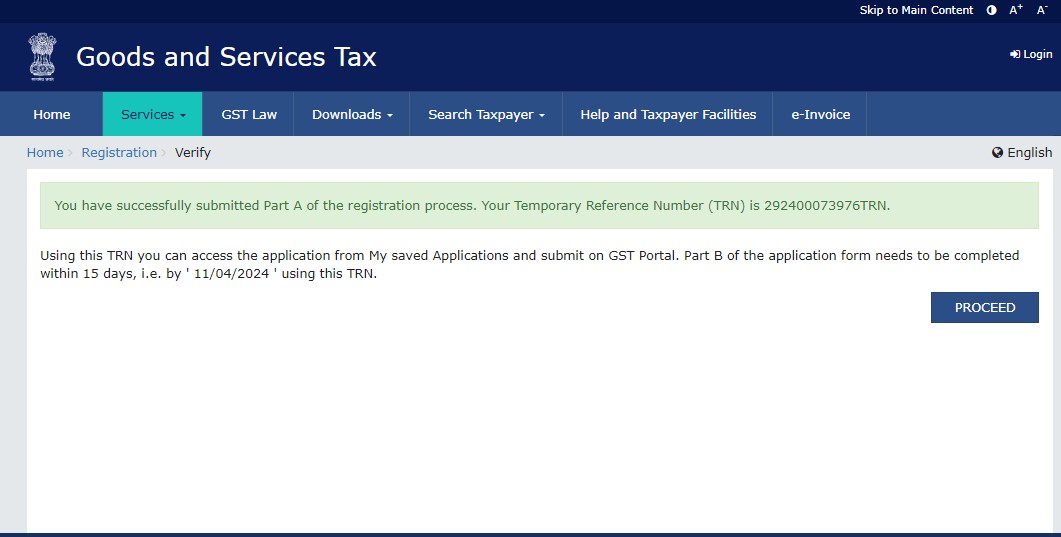

- Note down the Temporary Reference Number (TRN) displayed on the screen for future reference.

Part 2: Completing the Registration Application

- Return to the GST portal and Go to “Services” again. This time, select “Register.”

- Choose “Temporary Reference Number (TRN)” and enter your TRN along with the captcha code. Click “Proceed.”

- Enter the OTPs sent to your registered email and mobile number, followed by “Proceed.”

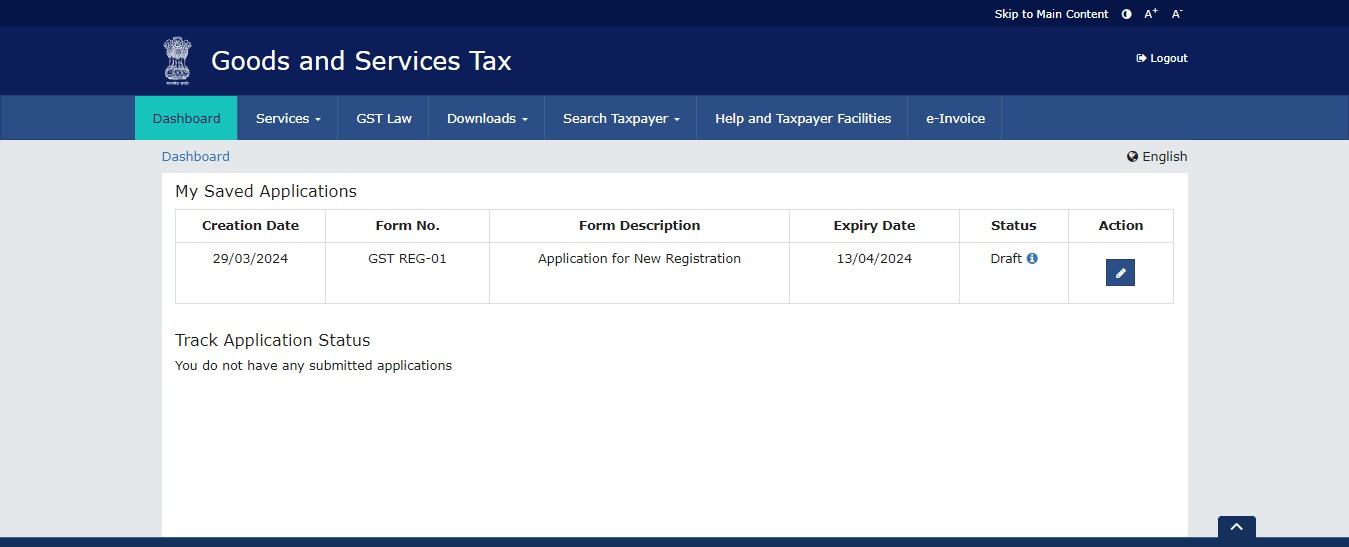

- The next page will display the status of your application. To complete the application, locate and click the “Edit” icon on the right side.

- You will be presented with 10 sections to fill out. Ensure you complete all sections and upload the required documents, which may include:

- Photographs of authorised signatories

- Proof of business address

- Bank account details

- Authorization form

- Taxpayer constitution (depending on your business structure)

- Once all documents are uploaded, proceed to the next step.

- Visit the “Verification” page, carefully review the application declaration, and submit it using one of the following methods:

- Electronic Verification Code (EVC) received on your registered mobile number.

- Digital Signature Certificate (DSC) for company registrations.

- e-Sign method with OTP sent to your Aadhaar-linked mobile number.

Upon successful completion, you will receive a confirmation message, and the Application Reference Number (ARN) will be sent to your registered email and mobile number for your records. You can use the ARN number to track the status of your GST Registration Application.

If you have any doubts or want to get GST Registration without any hassle, you can contact our GST Registration Experts at: 8881-069-069.

Can I do Business on Meesho without GST Registration?

Yes, you can do business on meesho even without GST Registration. To do so, you will need to get UIN Registration.

Learn more about it at: https://www.e-startupindia.com/learn/how-to-do-online-business-without-gst/