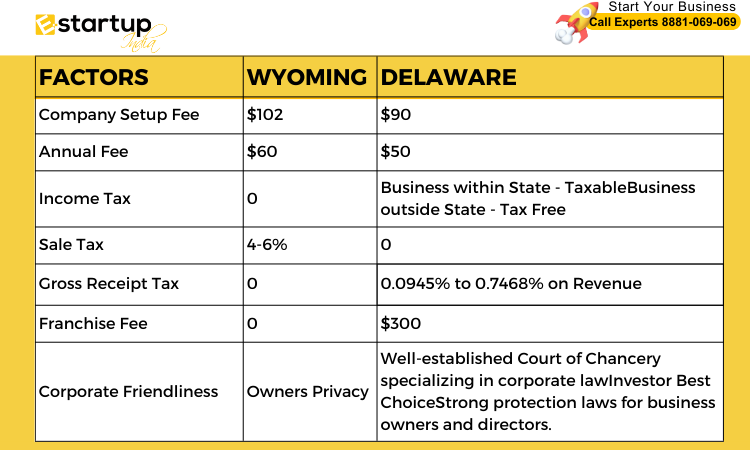

When you’re thinking about forming a Limited Liability Company (LLC) in the United States, one of your most important decisions will be choosing the state of incorporation. Two popular states for US LLC registration are Wyoming and Delaware. Both have no cons but many pros are better over each other. Let’s understand Wyoming vs Delaware USA LLC so that you can make the right decision for your business.

1. Company Setup Fee

Wyoming USA LLC Formation Fee is $102 for filing the usa company registration application with the Secretary of State.

On the other side, Delaware Formation Fee is $90 for filing the usa company registration application with the Division of Corporations.

You can open corporate bank accounts online with ease in both the states. Read more at: How to open USA Bank Account without going USA

2. Annual Renewal Fees

Wyoming Annual filing Fee is $60 or a fee based on the company’s assets located in Wyoming but minimum $60 per year.

Delaware Annual Franchise Tax is $300 per year and US Annual filing Fee is Flat $50 per year which is mandatory for LLCs.

3. State Income Tax

In Wyoming there is No state income tax on LLCs or individuals at all.

On the other hand, in Delaware there is No state income tax on LLCs that do not conduct business within Delaware.However if you’re conducting business within Delaware, then such income is taxed according to Delaware’s rates.

4. Sales Tax

Wyoming sales tax rate on sale of goods and services ranges from 4%-6% on sale value.

There is no sales tax if you sell any goods or services from Delaware state.

5. Gross Receipts Tax

Wyoming does not impose any gross receipts tax on revenue

In Delaware, Gross receipts tax applies to the total gross revenues of a business, without deductions for the cost of goods or services. Rates vary by industry but generally range from 0.0945% to 0.7468%. However there is no GRT on export of goods and services.

6. Franchise Tax

There is No franchise tax for LLCs incorporated in Wyoming. However, Delaware has a flat Annual franchise tax of $300.

7. Corporate Friendliness

Wyoming is the top state in terms of privacy. Anonymous ownership is allowed in Wyoming, Wyoming shall never disclose the name of real owners of LLC publicly hence ensuring significant privacy protection.

Across the globe Wyoming is known for its business-friendly environment, privacy, and minimal regulatory requirements.

On the other side, Delaware is renowned for its business-friendly legal environment and has a well-established Court of Chancery specializing in corporate law.

- Offers strong protection for USA LLC business owners and directors.

- Privacy is less stringent compared to Wyoming, as the names of LLC members and managers are required in annual reports.

8. Other Relevant Factors

Wyoming:

- Privacy: Offers excellent privacy protection for business owners.

- Maintenance: Minimal paperwork and administrative requirements.

- Asset Protection: Strong asset protection laws.

- Business Climate: Favorable for small and medium-sized businesses due to its lenient tax regime and business-friendly policies.

Delaware:

- Legal Framework: Delaware has an extensive body of corporate case law, providing predictability and clarity.

- Reputation: Highly regarded for large corporations due to its sophisticated legal infrastructure.

- Funding: Easier access to venture capital and investors, as many investors prefer Delaware corporations.

- Flexibility: Allows series LLCs, which can be beneficial for companies looking to segregate assets and liabilities.

Conclusion

Both Wyoming and Delaware offer unique advantages for global entrepreneurs looking to incorporate an LLC in the USA. Wyoming stands out for its low fees, strong privacy protections, and minimal tax burdens, making it ideal for smaller businesses and those seeking anonymity.

Delaware, on the other hand, is preferred for its robust legal framework, excellent investor relations, and corporate-friendly environment, making it suitable for larger businesses and those planning to raise significant capital.

By carefully considering the above explained factors, Global entrepreneurs can make an informed decision on where to incorporate their LLC in the USA, aligning with their business goals and strategic priorities.

Also Read:

A lawyer or business consultant from E-StartupIndia can give you helpful advice on choosing the best State and setting up a USA LLC Incorporation. Feel free to call experts at 8881-069-069.