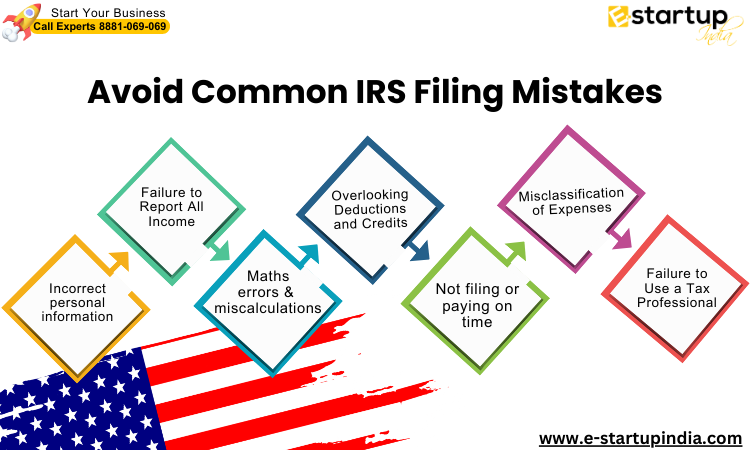

Filing taxes is an important responsibility for both people and corporations. However, understanding the IRS filing procedure can be difficult, especially if you aren’t aware of potential traps. Mistakes in IRS tax filing can result in penalties, delayed refunds, and even audits. Whether you’re an individual taxpayer or a business owner handling USA company registration, avoiding common mistakes is critical to ensuring successful tax compliance.

1. Incorrect personal information.

One of the simplest yet most prevalent errors is supplying wrong personal information. When filing tax returns, make sure to double-check your Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Employer Identification Number. A discrepancy between the IRS’s data and your submission may cause your tax return or refund to be delayed.

Pro Tip: Make sure the names match exactly as they appear on official identification documents.

2. Failure to Report All Income.

Underreporting income is another common concern with IRS tax filing. All sources of income, including salary, freelance earnings, and savings account interest, must be disclosed. Omitting any revenue, whether purposefully or unintentionally, can lead to IRS inquiry and heavy fines.

Solution: Keep a complete record of your revenue throughout the year. Use Forms 1099, W-2, and other statements to guarantee accuracy.

3. Maths errors and miscalculations.

Calculation errors, such as adding income, deducting deductions, or determining tax credits, are among the most prevalent mistakes. These inaccuracies can have an impact on your tax bill or return.

Quick Fix: Use tax software to automate computations or consult with a tax professional to ensure appropriate filing.

4. Overlooking Deductions and Credits.

Failure to claim all relevant deductions and credits represents a squandered chance for tax relief. For example, business owners who have recently completed their US company registration may be eligible for startup cost deductions. Similarly, people frequently miss out on educational credits, child care deductions, and healthcare advantages.

Tip: To optimise your savings, become familiar with the deductions and credits that apply to your financial circumstances, or employ a tax professional.

5. Not filing or paying on time.

Procrastination can be expensive. Missing the tax filing date or failing to pay owed taxes on time incurs penalties and interest. Even if you are unable to pay the whole amount owed, submitting on time may lessen your penalties.

Reminder: Mark your calendar with tax deadlines and consider filing an extension if necessary.

6. Misclassification of Expenses

Misclassifying expenses can raise red flags in an IRS audit. Personal and company spending must be clearly separated, particularly for entrepreneurs and small business owners.

Advice: Keep separate accounts for personal and business transactions, and keep detailed records of all expenses.

7. Failure to Use a Tax Professional

DIY tax filing may initially save you money, but mistakes might result in costly penalties. Seeking advice from knowledgeable tax professionals ensures that your IRS filing is correct and compliant.

Read Also: How to make Zero Federal Tax on USA LLC profit by Non-resident

Why Should You Consult a Tax Expert for IRS Filing?

- They can assist you in filing accurate tax returns.

- They are knowledgeable with tax relief possibilities and can help you claim them.

- They stay up to date on changes in tax laws that may influence your filings.

Moreover, If you want any other guidance relating to opening an LLC Company in the USA or filing taxes, or Company Registration in USA, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.