Timely Income Tax Return Filing (ITR) is essential for individuals and businesses to avoid penalties and ensure smooth processing of refunds. However, there are situations where a delay in filing ITR becomes unavoidable. To address such cases, the Central Board of Direct Taxes (CBDT) recently issued a circular revising the guidelines for condoning delays in ITR filing. Let’s understand all about the latest CBDT Circular on ITR Filing Delay Condonation.

CBDT’s Revised Time Limit for Delay Condonation

In its latest circular, the CBDT has reduced the time allowed to apply for delay condonation.

For earlier years, taxpayers had plenty of time to seek approval, but under the new norms:

- Applications for condonation must be made within six months of the end of the fiscal year when the ITR filing deadline expires.

- This policy seeks to streamline and accelerate the determination of income tax refund requests.

Condonation for Forms 10-IC and 10-ID

Forms 10-IC and 10-ID are critical for firms looking to take advantage of concessional tax rates. The CBDT has provided relief by permitting a condonation in completing these documents from Assessment Years (AYs) 2020-21 to 2022-23.

Thus, if a taxpayer fails to file these forms owing to technological issues or unforeseen circumstances, they can now contact the department to file income tax online and take advantage of lower tax rates under the Income Tax Act.

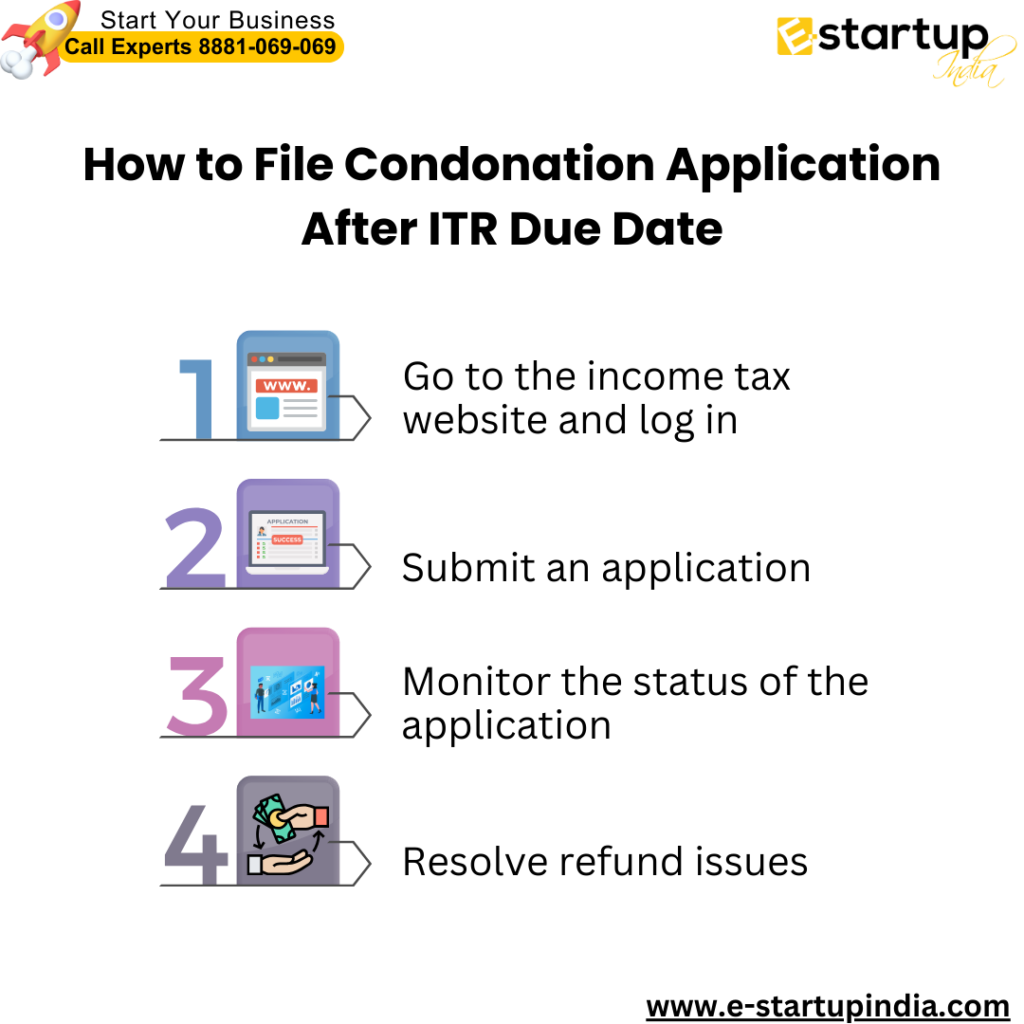

How to file a Condonation Application after ITR due date

To apply for delay condonation, take the following steps:

- Access the Income Tax e-Filing Portal

Visit the income tax portal and log in with your e-filing login information.

- Submit an application

Under the condonation request section, include information about the delay, supporting documentation, and reasons for noncompliance.

- Monitor the status of the application.

Track your application through the income tax e-filing system to receive timely updates.

- Resolve refund issues.

If your application is approved, the department will process any outstanding income tax refunds due to the late filing.

Read Also: How to Claim an Income Tax Refund After The ITR filing Deadline?

For an easier way and to get it done properly, it’s best to get advice and assistance from professionals.

Conclusion

In Conclusion, the deadline for requesting a delayed condonation has been reduced to five years from the end of the fiscal year when the ITR was due. The CBDT’s circular on the condonation of delay underlines the significance of complying with tax legislation on time. While the amended guidelines allow assistance to taxpayers with legitimate causes, they also emphasise the importance of timely income tax return filing.

Declare Foreign Assets or Face ₹10 Lakh Penalty: IT Dept Warns

Moreover, if you need any other guidance on Income Tax Refund Filing, Income Tax Refund, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.