While filing the GST return, the taxpayers face many obstacles regarding the turnover Gross Receipt for GST return. Now, the CBDT has issued a new notification for uploading the Information relating to GST return filing information Form 26AS as per Rule 114-I.

Let’s summaries the Notifications issued:-

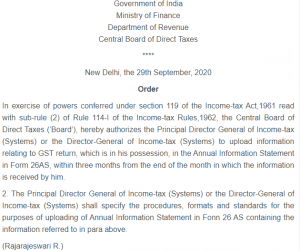

CBDT Notification on New Form 26AS (Annual Information Statement)

The CBDT has issued the new notification for uploading the information to GST return filing statements in new form 26AS containing the details of Tax Credit in the account of a taxpayer as per the records of the department. It is necessary to prepare traces to form 26AS under Rule 114I.

If you need any assistance regarding the annual GST return filing or the GST Registration, please feel free to contact our business advisor at 8881-069-069.

Now you can further Download E-Startup Mobile App and never miss the latest updates relating to your business.