Liquidated damages has well-known term applied by the parties under a contract. Concerning the implication of indirect taxes, both in the former law and also the present GST law, there has always been an argument on the taxability of the liquidated damages, and the Government has never simplified this issue. In this article, we will discuss on GST on Liquidated Damages and its implications.

Know about Liquidated Damages

The Liquidated damages indicate compensation agreed upon by the parties entering into the contract and is payable by the party who breaches the contract to a non-breaching party. Also, it has fixed amount contractually defined as a reasonable estimate of actual damages to recovered by one party in case the other party breaking the contract.

Also, if the parties in a contract have properly settled the number of liquidated damages, the sum fixed is the measure of damages for violation of contract. It does not matter if the actual damages are more than or less than the fixed damage amount. The distinction between a penalty and substantial liquidated damages is complex to apply.

Consequences of Liquidated Damages

The main essence of a contract is performance. The parties in the contract generally involve their expectation in terms of damage, which is caused by the failure of either party to perform its duty. Also, it includes –

- Liquidated damages specify the number of damages to be compensated by the breaching party if it fails to perform specified obligations and otherwise in the event of certain types of breaches under the contract.

- Also, the amount agreed as liquidated damages describe the estimate of the parties regarding the actual damages suffered by the non-breaching party in the event of a specified breach of the contract by the other (breaching) party.

- By this, the parties can save on a lot of time, money and energy on potential conflicts in Liquidated damages.

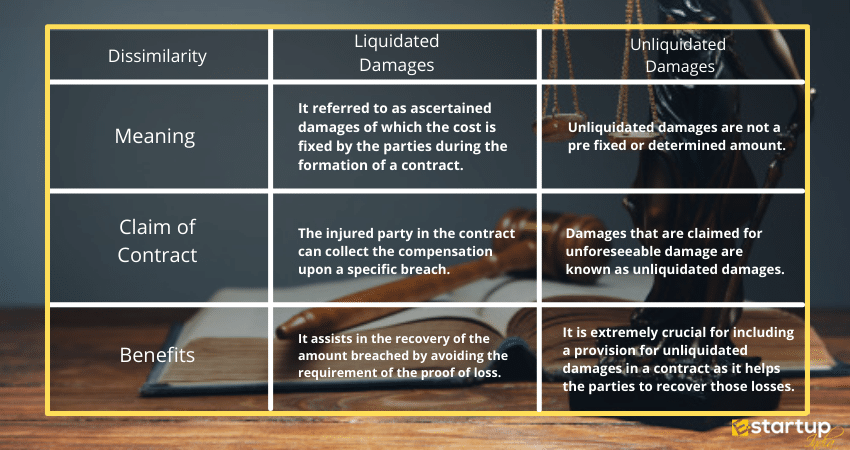

The dissimilarity between Liquidated Damages and Unliquidated Damages

Liquidated Damages

Liquidated damages referred to as ascertained damages of which the cost has fixed by the parties during the formation of a contract. The wounded party in the contract can accumulate the compensation upon a specific breach. It also aids in the recovery of the amount breached by avoiding the necessity of the proof of loss.

Further, Liquidated damages clarify the procedure relating to any types of conflicts and may persuade the performance of a contract. The liquidated damage clause directs the right of the parties after the breach of contract.

Unliquidated Damages

Unliquidated damages are not a pre-fixed or restricted amount. Damages that claimed for unforeseeable damage are known as unliquidated damages. However, ascertaining the exact amount for compensation has a bit difficult in this case since the amount is unliquidated.

Further, it is extremely necessary for including a provision for unliquidated damages in a contract. As it assists the parties to recover those losses which are not possible to estimate.

GST on Liquidated Damages

As per the new declaration of the Maharashtra Advance Ruling Authority. In the case of Maharashtra State Power Generation Company Limited,18% GST (9% CGST and 9% SGST) apply to the liquidated damages.

GST Apply on other Damages

- Liquidated Damages and other Fines.

- Default Interest in state of any delay in payment of EMI

- Advance Forfeited in case of revocation of the agreement,

- Forfeiture of Security for Damages.

- Compensation is provided for termination of the contract,

- Non-Compete Fee for not Competing,

- Cancellation Charges imposed for Cancelling Travel Tickets.

If you want any other guidance related to GST Registration please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the freshest updates narrating to your business.

I need to to thank you for this fantastic read!!

I definitely enjoyed eveey bit of it.I have got you book-marked to look at new things you post…