Startup India Certification opens the doors to a world of opportunities for new startups.

Startup India scheme was launched on January 16, 2016 by DPIIT Government of India, the StartupIndia Certification is a game-changer for entrepreneurs like yourself, fostering innovation and creating a thriving startup environment.

Till now 116,618 recognized startups have been recognized under the Startup India scheme. If you are also a startup, you can also get various benefits for your business and make it a success.

From scheme benefits, eligibility criteria and process to apply under the scheme and knowing all about other related schemes available for startups, read this blog till the end.

Benefits of Startup India Certification

1. Rebates & Support in Intellectual Property Rights

1. Rebates & Support in Intellectual Property Rights

In today’s competitive business world, Intellectual Property Rights (IPRs) such as trademark, patents are like secret weapons that can help your startup stand out.

To make this happen, it’s super important to not only come up with new ideas but also to protect them in India and beyond.

Company recognised under the Startup India Scheme:-

- Get fast-track processing of startup patent applications.

- Get Free Support from IPR Facilitators appointed by the government’s side. Offer guidance on various intellectual property rights (IPRs) and support startups in safeguarding and advancing their IPRs globally.

- Get 50% rebate on trademark registration government fees.

- Enjoy 80% rebate on Patent application and design registration.

2. Relaxation In Public Procurement Norms

2. Relaxation In Public Procurement Norms

- The DPIIT-recognized startups can easily apply for government tenders and list themselves on India’s largest e-procurement government portal

- In addition, Startups having StartupIndia Certification can also become preferred bidders on CPPP portals at eprocure.gov.in and etenders.gov.in

- Startups shall get relaxation on earnest money deposit [EMD] while applying government tenders.

- Startups do not need to comply with Minimum Turnover & Prior Experience Criteria to apply for government tenders.

- For grievance resolution related to public procurement, DPIIT-recognized startups can submit their concerns through a form on the Startup India website. The DPIIT will review and address valid grievances in coordination with relevant government departments.

3. Relaxation on Environmental & Labour law compliance for Startups

3. Relaxation on Environmental & Labour law compliance for Startups

- Startups can self-certify to 9 Labour and 3 Environment Laws.

- No inspection shall be conducted by Labour and Environmental officers for 3 to 5 years after their establishment.

- For 3 Environmental laws, 36 white category industries (listed on the Central Pollution Control Board’s website) are exempt from clearance for the initial 3 years.

- All 29 States Offer Self-Certification to startups under 9 Labour Laws thus allowing them to focus on their core business and keep compliance costs low.

4. Quick & Easy Exit for Startups

4. Quick & Easy Exit for Startups

The Ministry of Corporate Affairs [MCA] allows startups to “apply fast track form for strike off the company.” They can close the company within 90 days.

Additional Advantages with Startup India Certification

The below benefits available to companies recognised under the Startup India scheme based on post-approval of the Inter-Ministerial Board [IMB].

1. Income Tax Exemption for 3 Years

1. Income Tax Exemption for 3 Years

- Startups obtaining an Inter-Ministerial Board approval can enjoy no tax on profit for any 3-years out of the first 10 years of their incorporation.

- Businesses having company incorporation between April 1, 2016, and April 1, 2023, can seek this benefit through Section 80-IAC of the Income Tax Act.

2. Other Tax Benefits

2. Other Tax Benefits

Startups after getting Startup India Certification and being recognized by DPITT are also eligible for the following exemptions:

- Section 79: Carry Forward and Set Off of Losses

- Section 54GB: Capital Gain on Transfer of Residential Property

- Sections 156, 191, and 192: Deferment of Tax Liability on ESOPs

Eligibility Criteria to get Startup India Certification

Eligibility Criteria to get Startup India Certification

- The business should be registered as a Private Limited Company, LLP, or have a Registered Partnership Firm.

- The company’s age should be under 10 years from the date of its incorporation.

- The annual turnover since incorporation should be less than INR 100 Crore.

- The entity should not have been created by splitting up or reconstructing an existing business.

- The business idea must focus on developing or enhancing a product, process, or service.

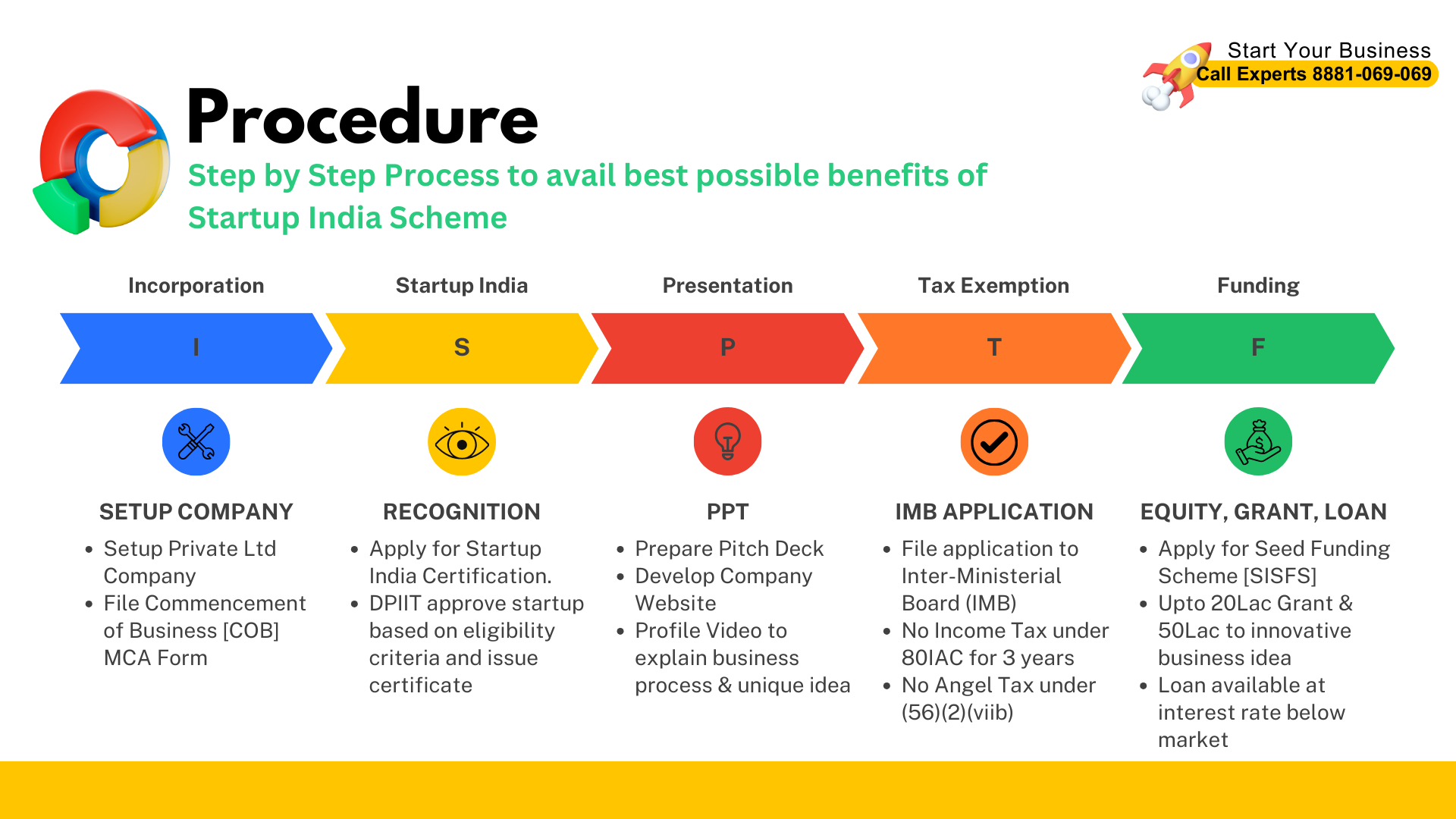

Process to get Startup India Certification & its benefits

1. Setup Company

1. Setup Company

The first step is to establish your company in accordance with legal requirements. This includes registering the business entity, obtaining necessary licenses, and adhering to the regulatory framework.

2. File COB(Commencement of Business)

2. File COB(Commencement of Business)

The COB (Certificate of Incorporation) is a declaration filed by directors within 180 days of a company’s creation, confirming that subscribers to the Memorandum of Association have paid the agreed-upon value of shares.

Accompanied by a Bank Statement as proof of subscription money received from shareholders, this statement is required to be submitted in Form 20A to the Registrar of Companies.

This form-20A must be submitted by chartered accountants, Company Secretaries, or cost accountants, and any errors found must be rectified to avoid undesirable consequences for these professionals.

Know more at: Commencement of Business Certificate

3. Apply for Startup India Certification

3. Apply for Startup India Certification

Apply for the Startup India certification through the Department for Promotion of Industry and Internal Trade (DPIIT). This application is a formal request for recognition as a startup, providing access to various benefits and incentives.

4. Prepare Pitch Deck, Website, Profile Video

4. Prepare Pitch Deck, Website, Profile Video

The next step is to craft a compelling pitch deck that outlines your business model, product or service offering, market potential, and growth strategy. Furthermore, you can develop an engaging website and a professional profile video that effectively communicates your startup’s vision, mission, and unique value proposition.

5. Apply for Tax Exemption under Section 80IAC

5. Apply for Tax Exemption under Section 80IAC

You can get tax benefits by applying for exemption under Section 80 IAC of the Income Tax Act. This section gives tax advantages to startups that qualify, creating a good environment for your business to grow.

6. Get Seed Funding

6. Get Seed Funding

To start your business, you need initial funding called seed funding. You can get this money from different sources like friends, family, angel investors, or venture capital firms that support new startups.

Startup India Certification also offers support during Seed Funding, you can know more at Startup India Seed Fund Scheme.

7. Get Angel Tax Exemption

7. Get Angel Tax Exemption

Angel tax is a tax on money that startups get from angel investors. Getting an exemption is important for making your financial operations run smoothly. You can get this exemption by fulfilling the conditions such as getting DPIIT recognition and aggregate amount of paid-up share capital and share premium of the Startup after the proposed issue of share, if any, does not exceed INR 25 Crore.

Funding Schemes under Startup India Certification

- Seed Fund Scheme

- PMEGP (Prime Minister’s Employment Generation Programme)

- CGTMSE (Credit Guarantee Scheme for Startups)

- Stand Up India Scheme

- IIM K Live X Program

- STAR Scheme (SIDBI Term loan Assistance for Rooftop solar PV Plant)

- FFS (Fund of Funds for Startups)

Our professional can help you obtain a Startup India certificate, and tax exemptions, draft a pitch deck, connect with investors for seed funding, etc. Call our experts at 8881-069-069.

Also Read:

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.