The company entity can be structured, managed, and operated in a number of different ways. The simplest and oldest kinds of business are sole proprietorship and partnership, both of which are still widely used across the world. Thus, a common question for start-ups or enterprises is to decide the type of company formation. Each Company Formation comes with unique benefits and drawbacks. Therefore, before you begin the business, you must know about the difference between company formation types. In this article, you will understand the difference between sole proprietorship and partnership firm.

Why have a Company Formation?

Company Formation or Company Registration is an online procedure to establish a separate legal entity. The government allows entrepreneurs to conduct business only after they have established a separate legal entity.

In other words, the first step to start a business is to have a company. The Company Formation offers several benefits including:

- Current Bank Account

- Business Loan

- Reduction in Tax Liability

- Reputation in Market

- Security of Personal Assets

However, company formation has a variety of types. Each type offers unique benefits and has different kinds of eligibility criteria. The two most popular and beneficial company formations especially for Micro to Small Scale businesses are Sole Proprietorship and Partnership.

What is a Sole Proprietorship Registration?

Sole Proprietorship Registration allows you to set up a legal firm having only one decision maker. In simple words, a sole proprietorship is one of the earliest types of business structure in which one person is in charge of the company. He or she will be responsible for both the earnings and losses generated by the firm.

Furthermore, there is no separation between the assets and liabilities of the firm and those of the owner.

It is one of the most popular types of businesses to start since it requires little paperwork and compliances. A sole proprietor is a person who owns and operates a sole proprietorship firm.

You can also define sole proprietorship firm as the firm having only a single owner.

Important Note: Even though you are the single owner of a sole proprietorship, you will not have to work individually. To assist you in running your business, you can recruit workers, freelancers, and other professionals. But, you will be the one in charge of making business choices, and you will be liable for any income and expenses.

What is a Partnership Firm Registration?

Partnership Firm Registration is the procedure of registering your business as a partnership firm. In other words, partnership firm registration allows you to form a legal entity that has two or more business owners.

These two or more partners come together and conduct the business. The participants of such a firm agree to share the earnings and failures. The profits of the company are distributed among the partners. As a result, the losses are also split among the partners as well.

Individual members of the Partnership are referred to as partners or promoters of the organization, while the entire group is referred to as a firm. Thus, A firm’s partner will be held accountable for the activities of those other partners.

The Partnership Deed binds the firm’s members, and no one may make a decision without involving the other partners.

Therefore, a partnership firm is simply like a team working toward the same goal and each one of the team members is liable for the success and failure of the business.

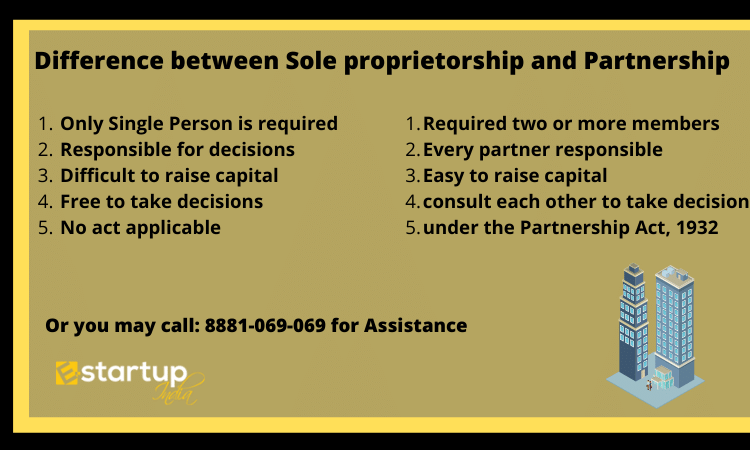

Let’s check Difference between Sole proprietorship and Partnership in India

The basic difference between Sole Proprietorship and Partnership Firm is described below.

| Sole Proprietorship Registration | Partnership Firm Registration |

| Only Single Person is required for the Registration. | You can have Partnership Firm Registration with two or more members. |

| The Proprietor or the business owner is responsible for all the business decisions. | All the partners are responsible for the business decisions. |

| It is difficult to raise capital as a sole proprietor. | it is easier to raise the capital in the Partnership Firm Registration. |

| The business owner has the sole freedom to make the business decision as per his or her choice. | Business Owners need to consult each other and collaboratively take the decision. |

| Sole Proprietorship Registration does not come under any specific act. | Partnership Firm Registration is governed under the Indian Partnership Act, 1932. |

Moreover, you require any kind of guidance related to Company formation. Please feel free to contact us at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.