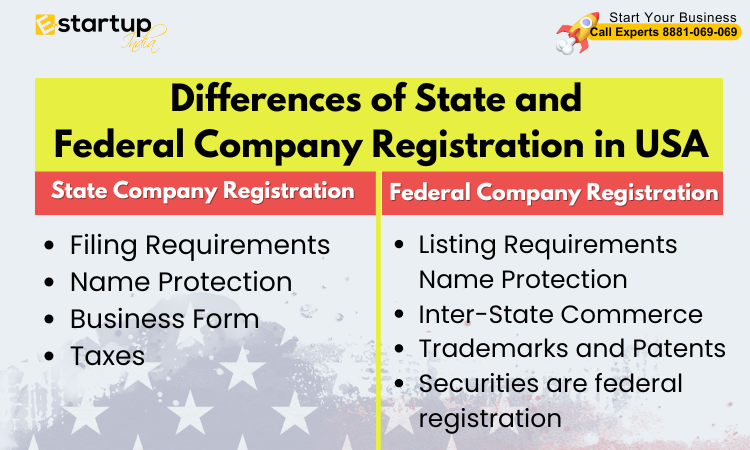

Company registration in USA has many business owners scratching their heads over the question of state and federal registration. Both are indeed vital, but they all have different purposes and benefits. This article lays out some of the key differences between state and federal company registration in USA that will make it easier for you to decide on your business venture.

State Company Registration

In the United States, the usual place of registration for companies is at the state level. Each state has put down rules and regulations regarding how one ought to go about registering a business. The following are some of the key aspects relating to state company registration:

- Filing Requirements: Typically, the State of operation of any business must see an incorporation filing with the Secretary of State office. This is through the filing of articles of incorporation, articles of organization, or a certificate of formation-whichever applies.

- Business Form: From registration with the state, one can be able to ascertain whether an organization is a corporation, LLC, partnership, or sole proprietorship.

- Name Protection: State registration guarantees protection of name within the state in such a way that no other business can function with the same name.

- Taxes: Generally, state registration encompasses the obtaining of required tax IDs and licenses.

Federal Company Registration

Whereas, in cases where a company’s operation extends to more than one state or involves certain activities, the federal registration becomes imperative. The major features of federal company registration in USA will be briefed as under:

- Listing Requirements: Companies listed in the Stock Exchanges should be registered with the federal government, mostly under the Securities and Exchange Commission (SEC) or under the Federal Trade Commission (FTC).

- Inter-State Commerce: Businesses dealing with inter-state commerce-for instance, those selling their products or services across states-have to federallly get themselves registered.

- Trademarks and Patents: Federal registration provides national protection for trademarks and patents.

- Securities are federal registration that involves the issue of securities and looking for investors.

Key Differences

The scope of State registration is within a state while the federal registration extends to all states.

The purpose of state registration is basically to establish the structure of the business and the protection of name while the purpose for federal registration is to help in interstate commerce and protection of the intellectual property.

Requirements: State registration usually requires the articles of incorporation, while federal registration requires more detailed documentation like financial statements and business plans.

Conclusion

In short, state and federal company registrations are imperative when setting up a venture in the USA. Being in a position to differentiate the two would allow you to take the right steps toward registration, respectively, and make sure that you don’t run afoul of any relevant regulations. Suppose you want to register your company in the USA. In that case, you will have to consult with an attorney or a business expert to rest assured about the requirements necessary for your business.

Moreover, If you want any other guidance relating to opening a in USA Company Registration or filing taxes, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.