According to the government’s March 31 announcement, the 45th GST Council Meeting’s suggested modifications on construction bricks, earthen or roofing tiles, fly ash blocks, as well as bricks of fossil fuels, are in effect from April 1, 2022. In this article, you will know about GST on Brick Manufacturers.

Updates for GST on Brick Manufacturers

As per the government notification, brick kilns can choose a composition plan to pay a GST of 6% without the need for an input tax credit (ITC), up from a GST of 5% prior.

Businesses that do not choose to participate in the composition system under GST will be charged a 12% Goods and Services Tax (GST) with the option of ITC(Input Tax Credit).

According to the announcement, manufacturers of construction bricks, earthen or roofing tiles, fly ash bricks and blocks, and fossil bricks can choose a composition scheme.

Until now, brick manufacture and selling have been subject to a 5% GST tax, with enterprises entitled to seek input credit.

What is the HSN code of bricks?

HSN Code & GST Rate for Bricks & ceramic products – Chapter 69

| Rates (%) | Products Description | HSN Codes |

| 5% | Building bricks | 6904 10 00 |

| 5% | Earthen or roofing tiles | 6905 10 00 |

| 12% | Pots, jars, and similar articles of a kind used for the conveyance and packing of goods of ceramic | 6909 |

What is the Composition Scheme under GST Registration in India?

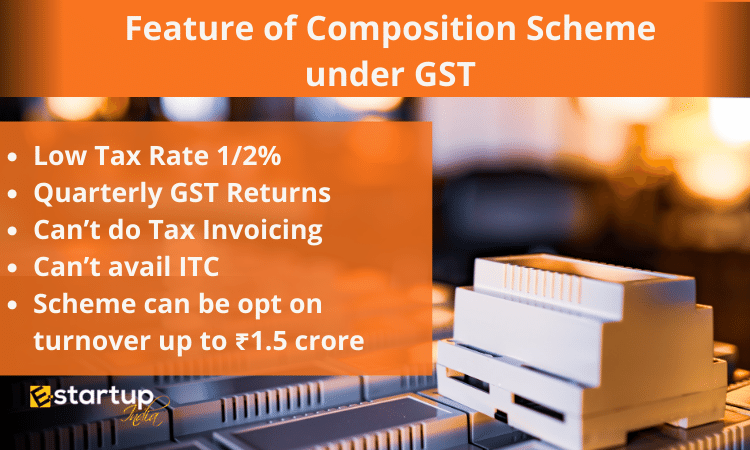

- A composition scheme under GST Registration is for businesses whose turnover is less than ₹1.5 Crores. To compute turnover for the composition system, all enterprises with the same PAN number must have their sales totaled.

- The composite scheme has two advantages over the standard GST Return Filing: it requires less paperwork and compliance, and it lowers your tax burden.

Can a dealer in compositions produce tax invoices?

A Bill of Supply must be issued by a composition dealer. They won’t be able to provide you with a tax invoice. This is due to the fact that the dealer is responsible for paying the tax. The GST is not recoverable from customers by a composition dealer.

Is it true that composition dealers may offer a product for less than ordinary dealers?

Yes. In the bill of supply, composition dealers are exempt from charging GST. As a result, the final customer ends up paying less than typical.

Moreover, If you want any other guidance relating to GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.