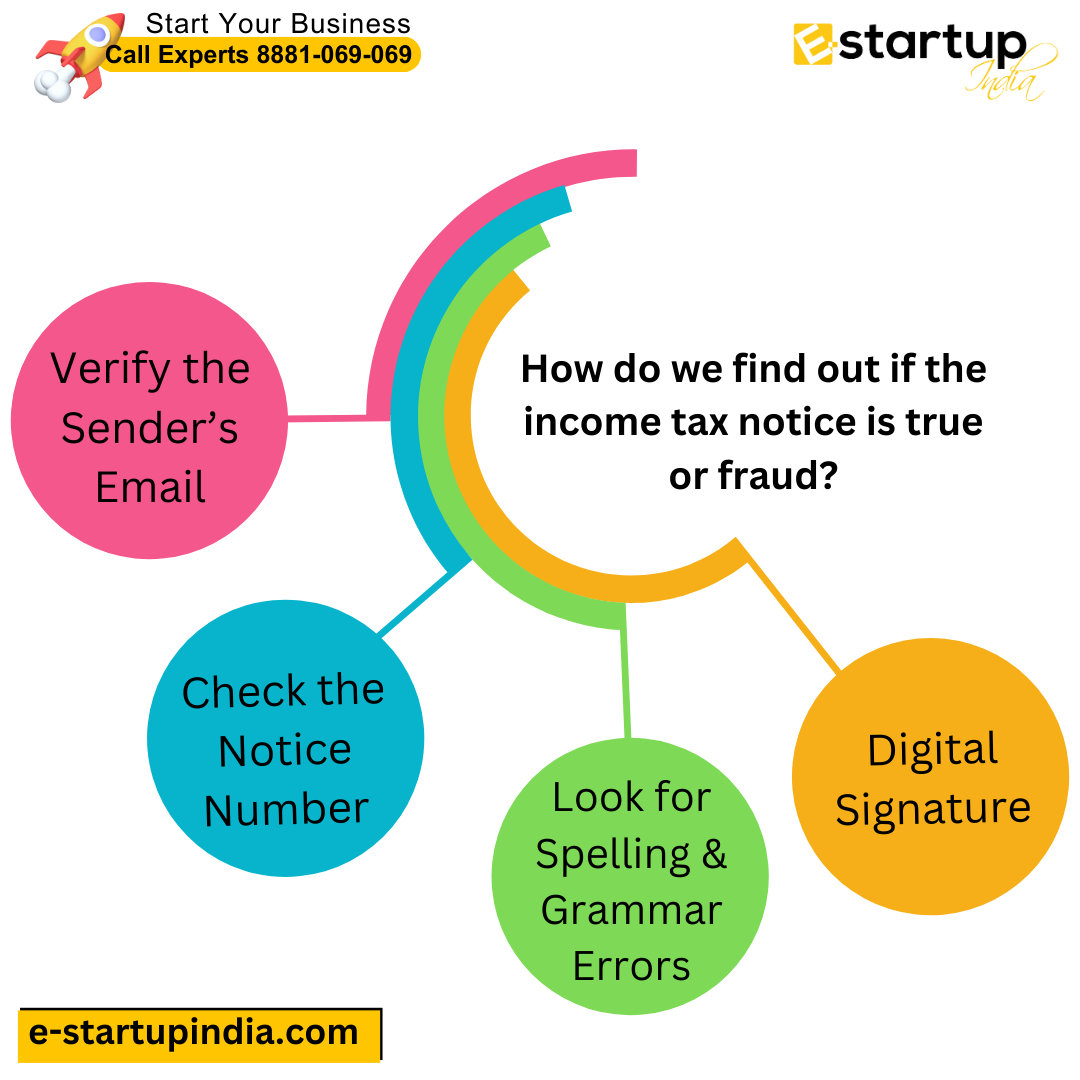

The first step when you receive an income tax notice is not to panic. Because it can be a fake one also. There are simple ways to confirm whether the notice is authentic or a fraud. With income tax departments issuing notices online, scammers have found opportunities to trick people. Let’s learn how to spot the difference between fake and true income tax notices.

Verify the Sender’s Email

One of the easiest ways to check the legitimacy of an income tax notice is by examining the sender’s email. Official communication from the Income Tax Department will come from email addresses ending in @incometax.gov.in or @gov.in. If the email appears suspicious or there is any other email address, it’s a red flag and you should avoid that email.

Thus, you must always check the source before proceeding with any tax filing or responding to an email from the income tax department.

Check the Notice Number

Every valid income tax notification bears a unique Document Identification Number (DIN).

You may quickly validate this DIN using the Income Tax e-Filing portal. If the number does not match or the website is unable to locate it, the email is most likely fraudulent.

You can log in with your income tax return filing credentials to see if the notice you got is included in your official correspondence.

Look for Spelling and Grammar Errors

Fraudulent notices often contain poor spelling, incorrect grammar, or odd formatting. Official notices from the government are professional and free from such errors. You must also pay close attention to any strange phrasing since this is a common trait in scams.

How to Spot Red Flags in Fake Income Tax Notices

Scammers are known to be making calls for money and putting some threat of court cases as they make those calls. Therefore, this means that a legitimate notice from the tax authority will not sue or declare that you must pay instantly. It will provide details about the discrepancies in your income tax return and offer clear steps to resolve them.

Furthermore, you should be wary of any notice that asks for sensitive information like bank details or passwords. The Income Tax Department will never ask for such details through email or phone calls.

Learn More: How many types of Income Tax Notices

What to Do If You Receive a Fake Notice

If you suspect that the income tax notice you’ve received is fraudulent, here are the steps you should take:

- Don’t reply to the sender.

- The helpline of the Income Tax Department must be used to report the case or a complaint submitted on their website.

- Make sure that it really is a notice by checking out the e-filing portal.

Taking these steps will protect you from scams and prevent you from falling victim to fraud.

Conclusion

In today’s digital age, anyone might fall victim to a scam. It is critical to be knowledgeable and careful while dealing with income tax letters. By following these easy tips, you can easily determine if the message is legitimate or fraudulent. In short, protect yourself, verify first, and make sure your tax filing procedure is secure and don’t hesitate to take assistance from experts.

How to Claim an Income Tax Refund After The ITR filing Deadline?

Moreover, If you want any other guidance relating to Income Tax Return Filing or Income Tax Refund please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.