If you own a business in India, you probably know about the Goods and Services Tax (GST). It’s a kind of tax on goods you sell or services you provide. An HSN Code is a special kind of code that is assigned to each good so that the tax rates for that particular item can be implemented. Thus, the HSN code helps figure out how much GST to charge. In this article, we’ll help you understand how to add an HSN code to the GST portal.

What is the Process to Add HSN Codes in the GST Portal?

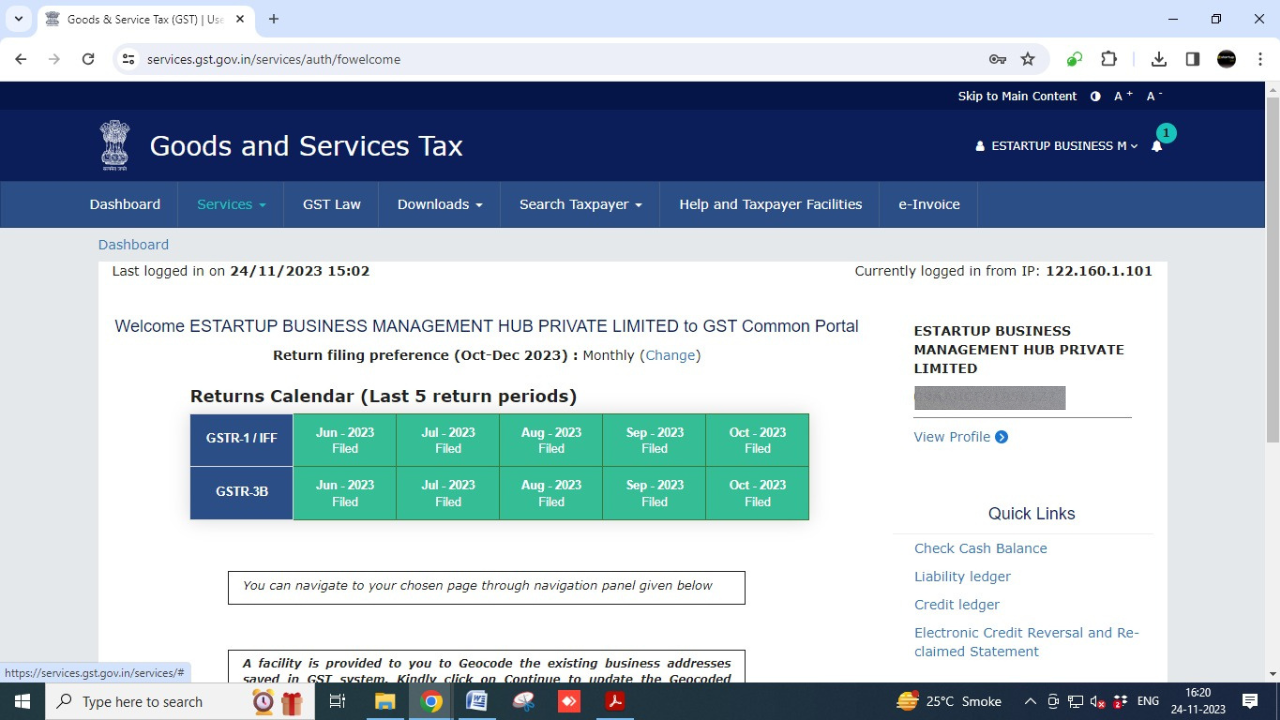

Step 1: Log in to the GST portal

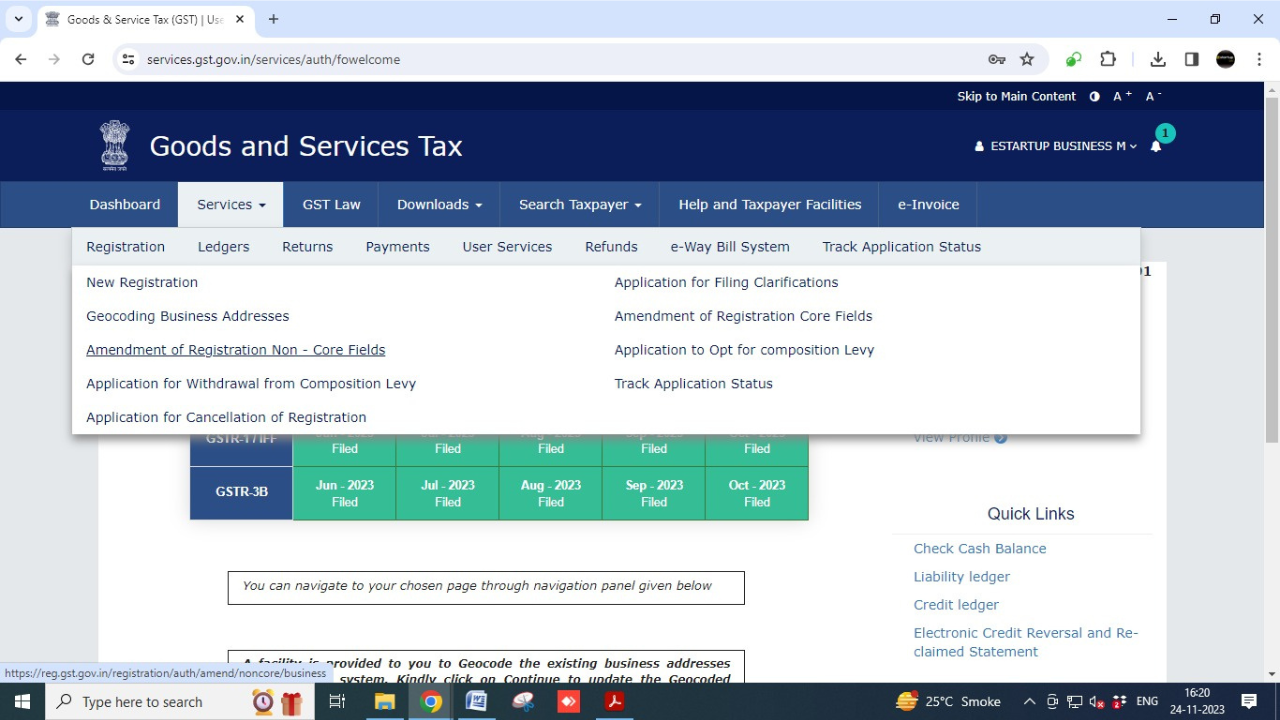

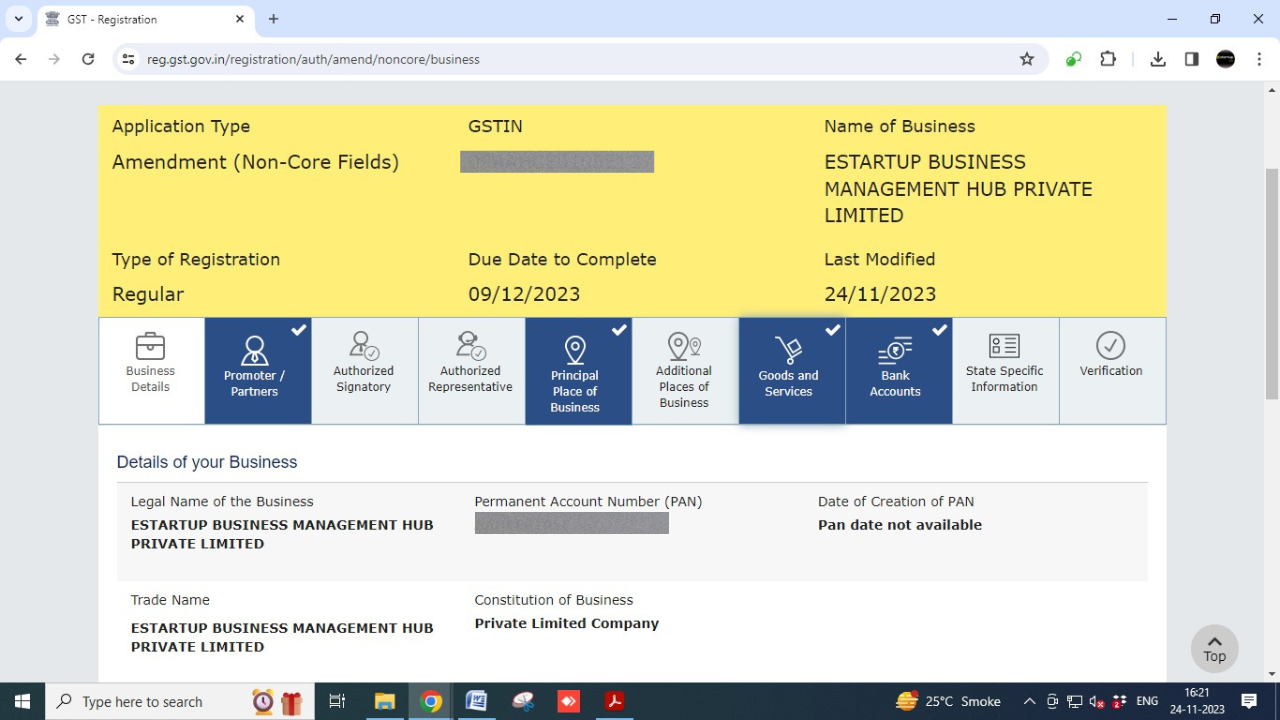

Step 2: Navigate to ‘Services’ > ‘Registration’ > ‘Amendment of Registration Non-core fields’ on the dashboard.

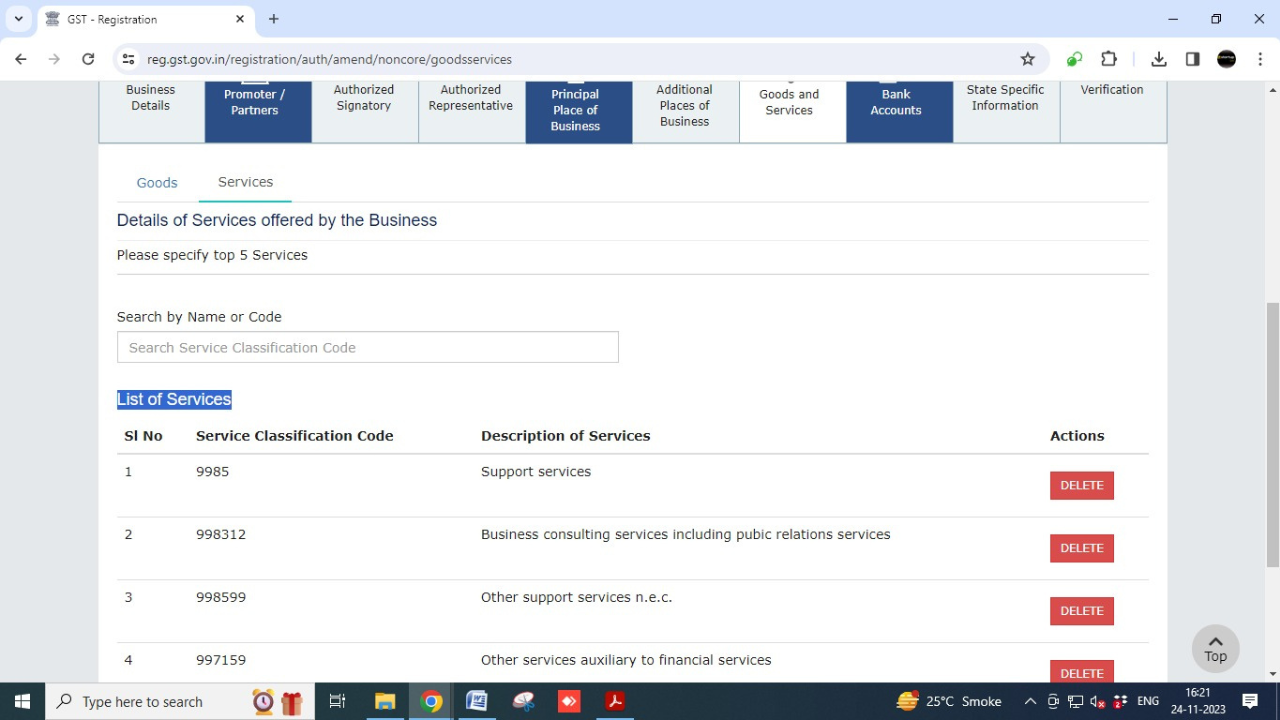

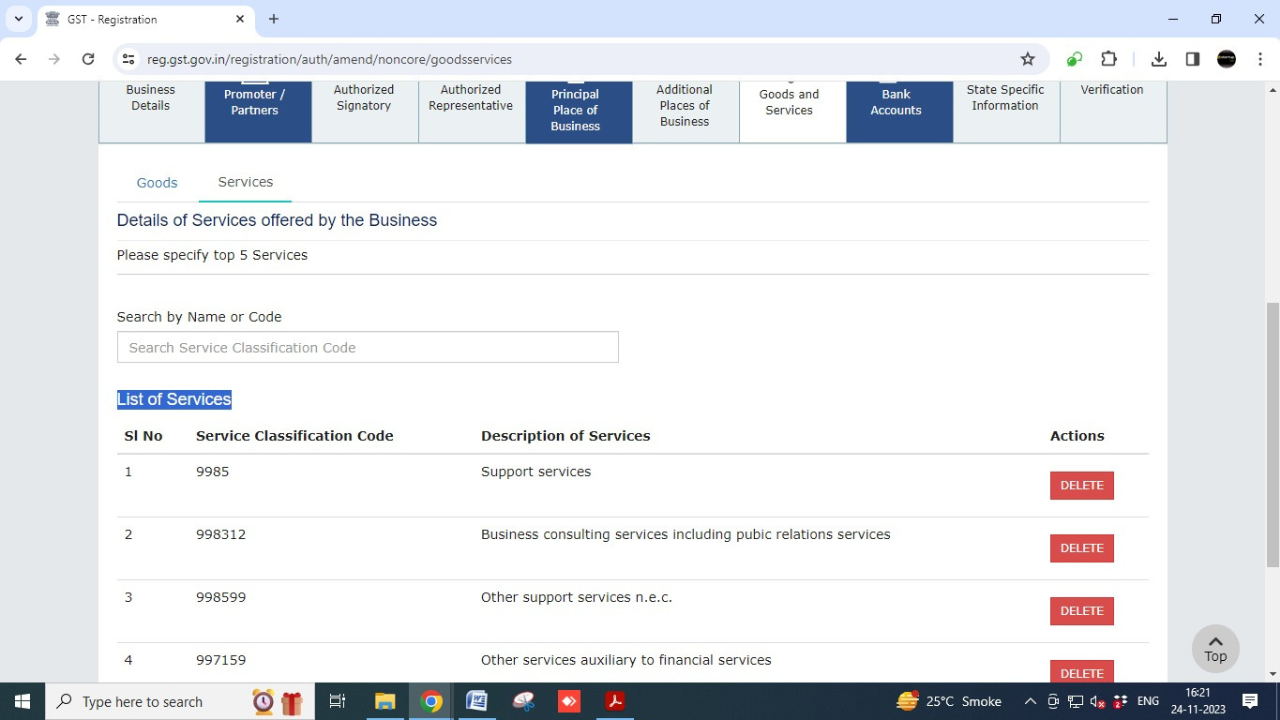

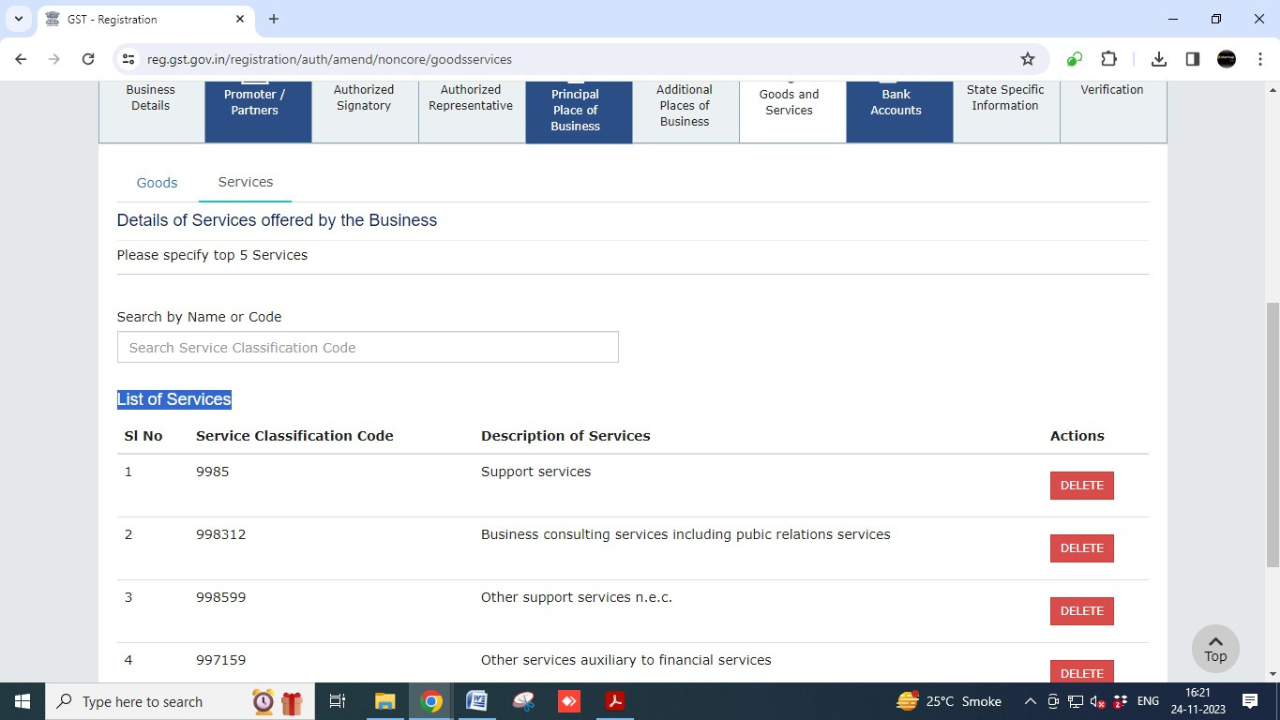

Step 3: Select the ‘Goods and Services’ tab

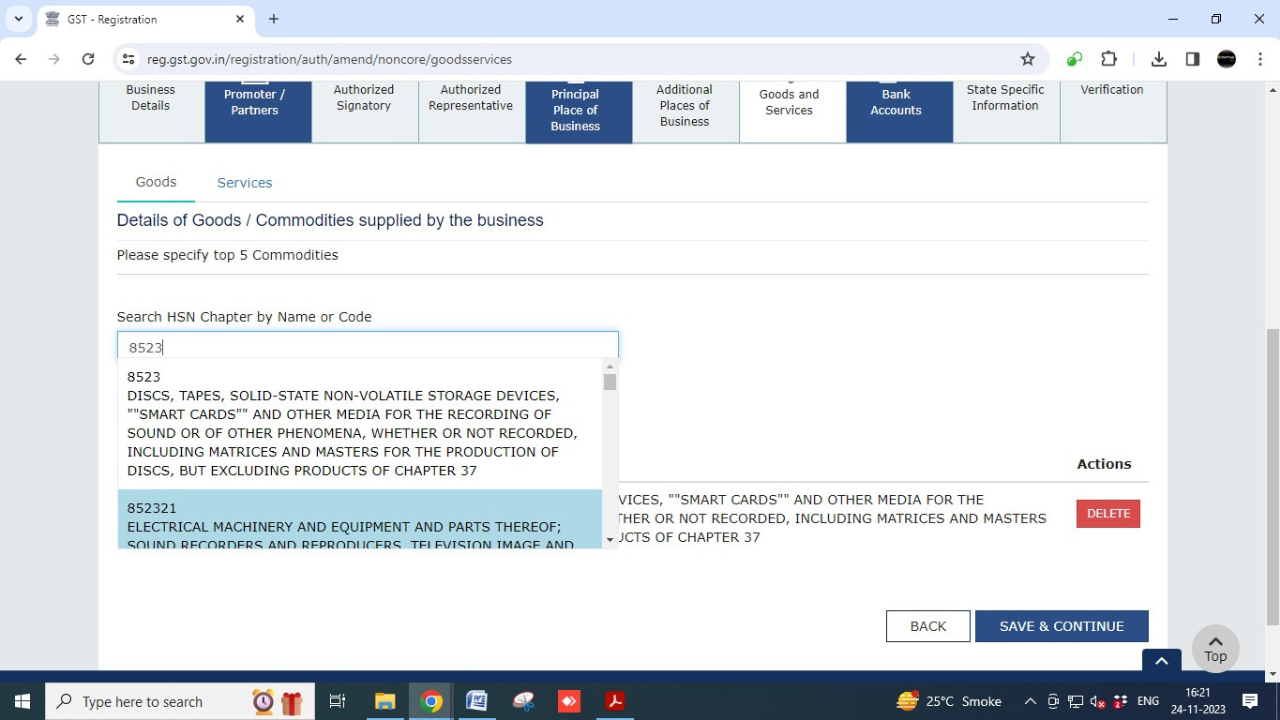

Step 4: Access the ‘Goods’ tab

Step 5: Locate the applicable HSN chapter by entering either the HSN code or the item’s name

Step 6: Click on ‘Save and continue’ and continue saving until reaching the verification step

Step 7: Complete the verification process and submit using either Digital Signature Certificate or EVC

Important things to remember while adding HSN Code in the GST Portal

- Use the right HSN code: Each product or service has a specific HSN code that tells the government what it is. Use the wrong code and you could get in trouble.

- Keep your HSN codes up to date: The government sometimes changes the HSN codes and GST rates for products and services. Make sure you’re using the latest codes.

- Know your GST rates: GST rates are different for different products and services. Make sure you’re charging the right amount of GST.

- Use SAC codes for services: Services have SAC codes instead of HSN codes. Use the right SAC code to make sure you’re charging the right amount of GST.

- Keep records of your HSN codes: Keep track of all your HSN codes so you can easily find them later.

Also Read:

If you want any other guidance related to GST Registration or GST Return Filing, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the freshest updates narrating to your business.