Fixed Deposits are one of the safest investments, with assured returns. If the interest generated on an FD exceeds a specified limit, the banks deduct Tax Deducted at Source (TDS). Many investors might not fall into the taxable bracket and are eligible to claim a TDS refund on a fixed deposit. In this guide, we will walk you through the process of claiming a TDS refund online.

Understanding TDS on Fixed Deposits

Banks deduct TDS at a rate of 10% when the interest earned on FDs exceeds Rs 40,000 per year for regular investors and Rs 50,000 for senior citizens. In case PAN details are not provided, TDS is deducted at 20%. After all, even if you have a total income below your taxable limit, you can claim a refund for TDS deducted by filing a TDS return. If Interest on TDS is Less than Rs 40,000, then it is TDS Exempt.

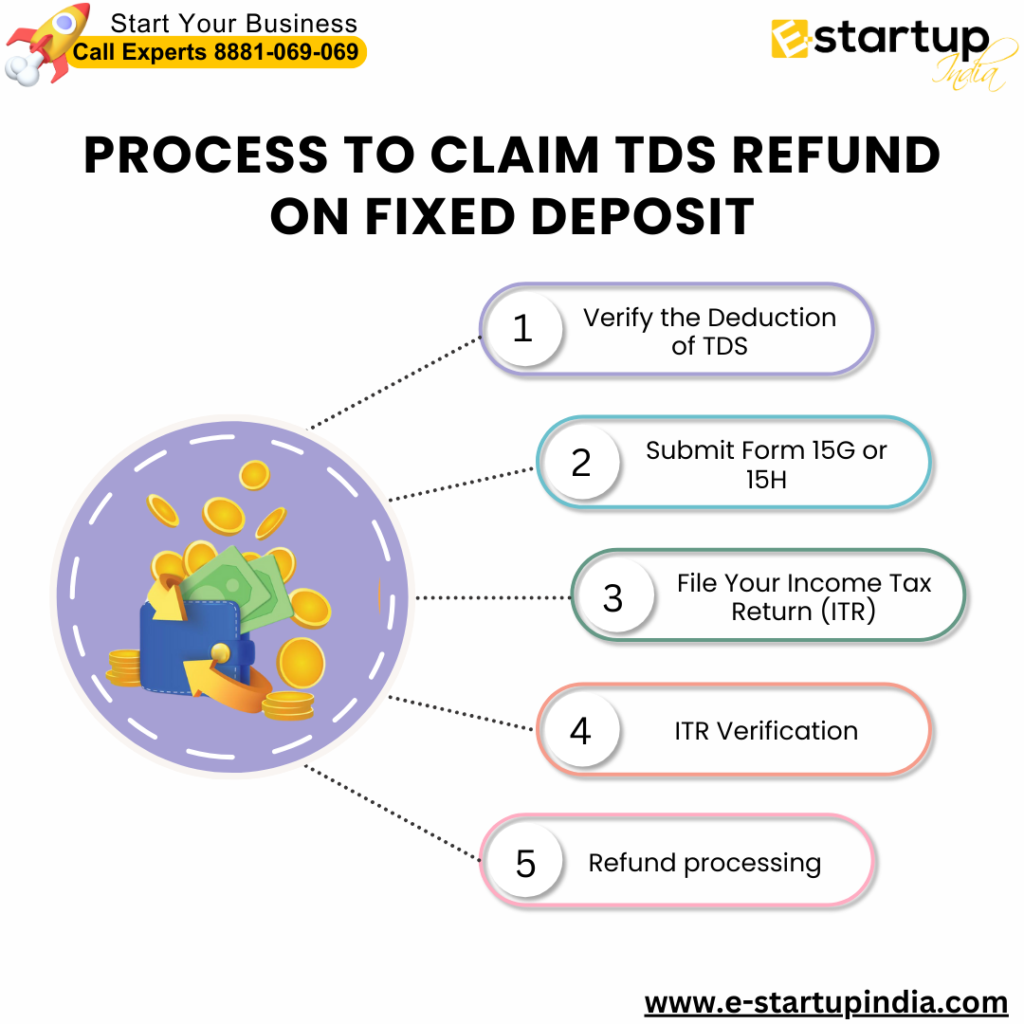

Process to Claim TDS Refund on Fixed Deposit

Step 1: Verify the Deduction of TDS

Log into TRACES, which stands for TDS Reconciliation Analysis and Correction Enabling System. And then Download Form 26AS to confirm what amount the bank has deducted as TDS. After doing all this, Verify all the deduction amounts by matching them with your fixed deposit interest certificate released by the bank.

Step 2: Submit Form 15G or 15H (Prevent Deduction of TDS)

You can avoid TDS deduction by submitting Form 15G (for people below 60 years) or Form 15H (for senior citizens) to the bank at the beginning of the financial year if your income is below the taxable limit.

Step 3: File Your Income Tax Return (ITR)

Visit the official Income Tax e-Filing website, and Login using your PAN credentials, and Understand which ITR to use along with your income category, that is, either ITR-1 for employees or ITR-2 for everyone else. Enter TDS details correctly through Form 26AS. If the deduction exceeds the required amount, claim it under the ‘Taxes Paid’ column. Then, validate all data entries and submit your return.

Step 4: ITR Verification

You shall have to validate the ITR after submission so that the refund gets processed. Aadhaar OTP, Net Banking, and sending signed original copies to the CPC, Bangalore, will verify the same.

Step 5: Refund processing

The return will be processed for refund after validation by the Income Tax Department once it gets verified. You may check the status on the e-filing portal of the Income Tax under the ‘Refund/Demand Status’.

Important Points to Keep in Mind

- Ensure PAN is linked to your bank account so that the refund is directly credited to the account.

- Maintain a record of interest certificates issued by FD and Form 26AS.

- File the TDS return before the due date to avoid penalties.

- You could still claim a refund even if it had been deducted at 20% in case you hadn’t quoted the PAN.

Conclusion:

Claiming a TDS refund on a fixed deposit is very easy if done online. You will be able to get the excess tax deducted from your FD without any hassle if you keep track of the TDS deductions and file your TDS return in time. Always check your Form 26AS and follow the income tax laws to avoid any delay in the refund process.

Moreover, If you want any other guidance concerning TDS Return Filing, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the freshest updates narrating to your business.