When GST was launched, it was mandatory to have GST Registration to start an online or e-commerce business. However, in the 48th GST Council Meeting the government notified a significant exemption allowing businesses below threshold to run their business online without having to obtain GSTIN. Lets learn about the process to do online business without GST through this article.

When can you do online business without GST?

You can do online business without GST through getting a UIN while staying below the threshold limit and selling only in your state.

1. Stay below the Threshold limit

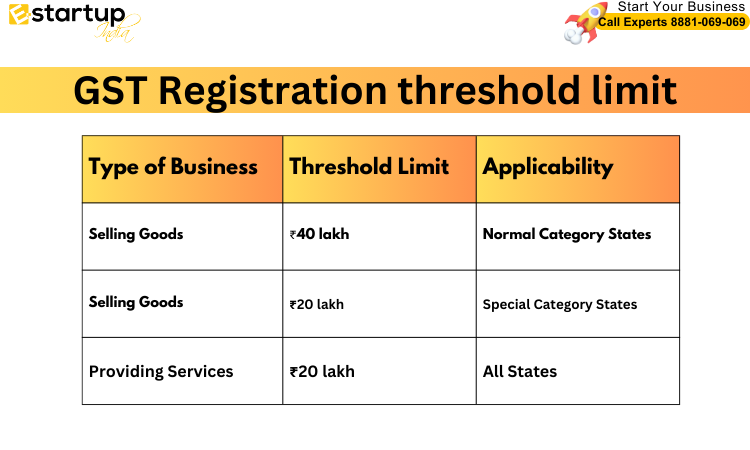

The government sets a minimum sales amount (threshold) each year. If your annual sales stay below this limit, you don’t need to get GST Registration. At present, the GST Registration threshold limit is as follows:

2. Sell within your state

This exemption only applies if you sell products within the same state (intra-state sales). If you sell across state borders (interstate supplies), you must register for GST regardless of your sales amount.

3. Sell with UIN

UIN stands for Unique Identification Number. It’s a temporary identification number assigned by the GST portal to unregistered sellers on e-commerce platforms.

UIN serves a specific purpose of enabling unregistered sellers to participate in e-commerce activities while they are still below the registration threshold or are in the process of obtaining GST Registration. UIN also allows you to do business online without having to worry about GST Return Filing as long as you are below the threshold limit.

You should also read our guide at: How to get GST Registration if I am starting a new online business if you are above the threshold limit or you need to voluntarily get GST Registration for your online business.

Stepwise Process to do online business without GST

- Check eligibility: See if your organisation qualifies for a UIN as per above two criterias.

- Submit the application form: The organisation must apply for UIN using Form GST REG- 13 along with necessary documents.

- Wait for approval: If everything’s okay and the proper officer is satisfied, you’ll get a UIN assigned for your business.

Stepwise Process to Apply for UIN Registration

Step 1: Go to Services and Click on Generate User ID for Unregistered Applicant

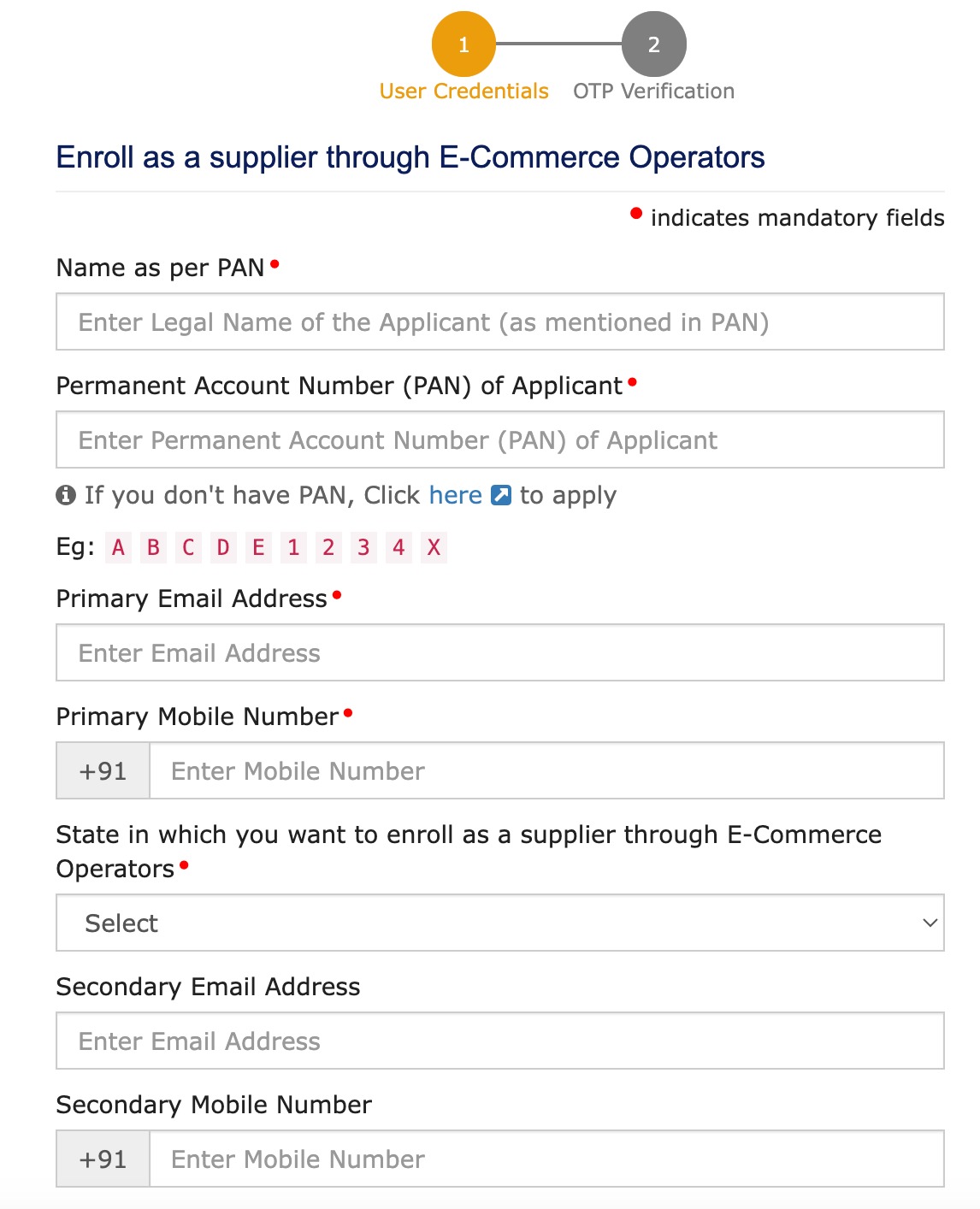

Step 2: Select the option To apply as a Supplier to e-commerce operators

Step 3: Enter all the necessary details as requested and submit.

How to grow and protect your business without GST?

- Get MSME Registration to gain access to government benefits and simplify compliance.

- Consider ISO certification to demonstrate quality commitment and improve internal processes.

- Have Trademark Registration to safeguard your brand identity and build customer loyalty.

Remember, these steps can be valuable regardless of your GST registration status. Consult a professional from our team for more specific guidance on GST.

Conclusion

Starting an online business without GST is now easier for small businesses selling within their state and staying below the annual sales threshold. Obtaining a UIN simplifies the process, allowing you to participate in e-commerce without the complexities of GST registration and filing. However, you still need to explore options like MSME registration and trademark protection for long-term growth and security.

Also Read:

In addition, if you need anymore guidance related to UIN Registration, you can talk to the UINExperts at: 8881-069-069

Furthermore, Download E-Startup Mobile App and Never miss the latest updates narrating to your business.