An e-invoice, also known as an electronic invoice, is a digital document that businesses exchange with each other and authenticate through the government tax portal. Let us learn the process and other crucial details regarding GST eInvoicing by Business.

Why E-Invoicing Matters?

E-invoicing streamlines the invoicing process, making it more efficient and less prone to errors. It ensures consistency in invoice formats across businesses and facilitates seamless reporting to the GST portal.

Checking E-Invoice Enablement Status

Before registering on the invoice registration portal, it’s crucial to verify if e-invoicing enabled for your business. Follow these steps:

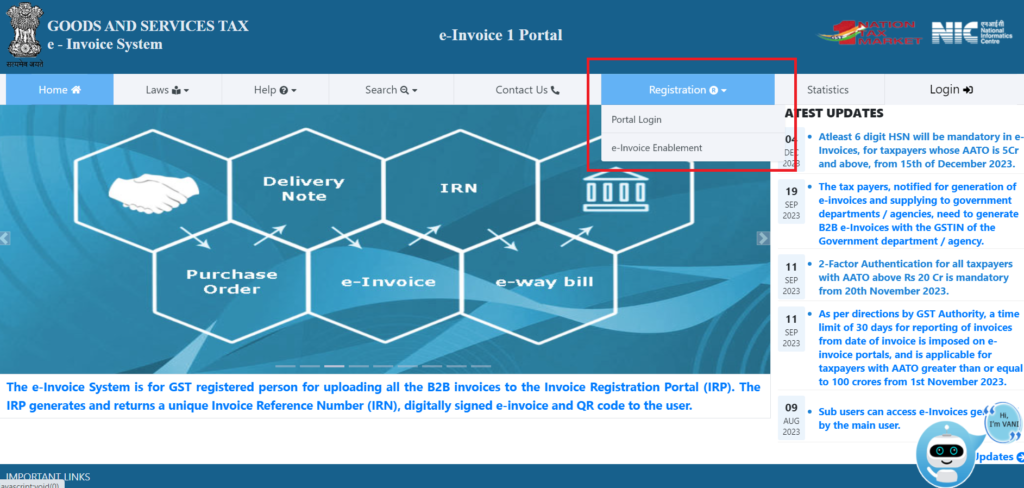

Step 1: Visit the Website

Go to https://einvoice1.gst.gov.in/.

Step 2: Access Registration

Navigate to the ‘Registration’ section and select ‘E-invoice Enablement’ from the dropdown menu.

Step 3: Enter Details

Enter your GSTIN and the characters shown in the image.

Step 4: Confirmation

Click ‘Go’ to proceed.

If your GSTIN is already enabled for e-invoicing, you’ll receive a confirmation message. Otherwise, you’ll need to provide additional details such as your business name, address, and turnover information. If your turnover exceeds INR 50 Crores, you may be eligible for e-invoicing. Simply check the box to confirm and complete the OTP verification process to enable e-invoicing. In addition, Read more on this: How to check whether the GST e-Invoice is enabled or not?

Stepwise Registration process to enable GST eInvoicing for First-Time Users

If you’re registering for e-invoicing for the first time, follow these steps:

- Visit the e-invoice portal.

- Access the registration menu and click on ‘e-invoice Enablement’.

- Provide your company’s GSTIN and complete the OTP verification.

- Enter details of your annual turnover for the relevant financial year and submit.

Benefits of e-Invoicing to businesses

- Data Reconciliation: e-Invoicing helps in resolving and plugging major gaps in data reconciliation under GST, thereby reducing mismatch errors in business transactions.

- Interoperability: Invoices generated through e-Invoicing can be easily read and interpreted by different software systems, ensuring interoperability. This reduces data entry errors and streamlines processes across various platforms.

- Real-Time Tracking: Businesses can track invoices prepared by suppliers in real-time through e-Invoicing systems, enabling better management of transactions and cash flow.

- Automation of GST Return Filing: e-Invoicing facilitates backward integration and automation of the GST return filing process. Relevant invoice details are automatically populated into various returns, simplifying compliance and reducing the administrative burden on businesses.

- Faster Input Tax Credit (ITC) Availability: e-Invoicing enables faster availability of genuine input tax credit, enhancing liquidity and cash flow management for businesses.

- Reduced Audit Risks: With detailed transaction-level information readily available through e-Invoicing systems, there is a lesser possibility of audits or surveys by tax authorities. This reduces compliance risks and administrative burdens on businesses.

- Access to Formal Credit Routes: e-Invoicing facilitates faster and easier access to formal credit routes such as invoice discounting or financing, particularly beneficial for small businesses looking to manage working capital effectively.

- Improved Customer Relations: By streamlining invoicing processes and ensuring accuracy, businesses can improve customer relations. Additionally, e-Invoicing opens up growth opportunities for small businesses to engage with larger enterprises, fostering business expansion and development.

Also Read:

Strict Deadline issued for Timely Reporting of GST e-Invoices

Moreover, If you want any other guidance relating to enabling GST einvoicing, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.