To tap into the UK’s vibrant market, you need to get a UK Business bank account. The process is intricate however with right guidance as provided in this blog will make it simple for you.

Why is it important to have a UK Business Bank Account?

You get lots of advantages of having a UK Business Bank Account.

- It streamlines financial management, facilitates seamless transactions with local clients and suppliers, and enhances your company’s credibility within the UK market.

- Moreover, it ensures compliance with local financial regulations, which is crucial for smooth business operations.

Eligibility Criteria to get UK Business Bank Account

Before diving into banking, it’s essential to establish your company’s legal presence in the UK. Having UK Company Registration even as a non-resident allows you to open a UK Business Bank Account. The process for non-residents is quite similar to that of UK residents, requiring a unique company name, a physical UK address corresponding to the company’s base (which can be a PO box or an accountant’s address), and registration with Companies House.

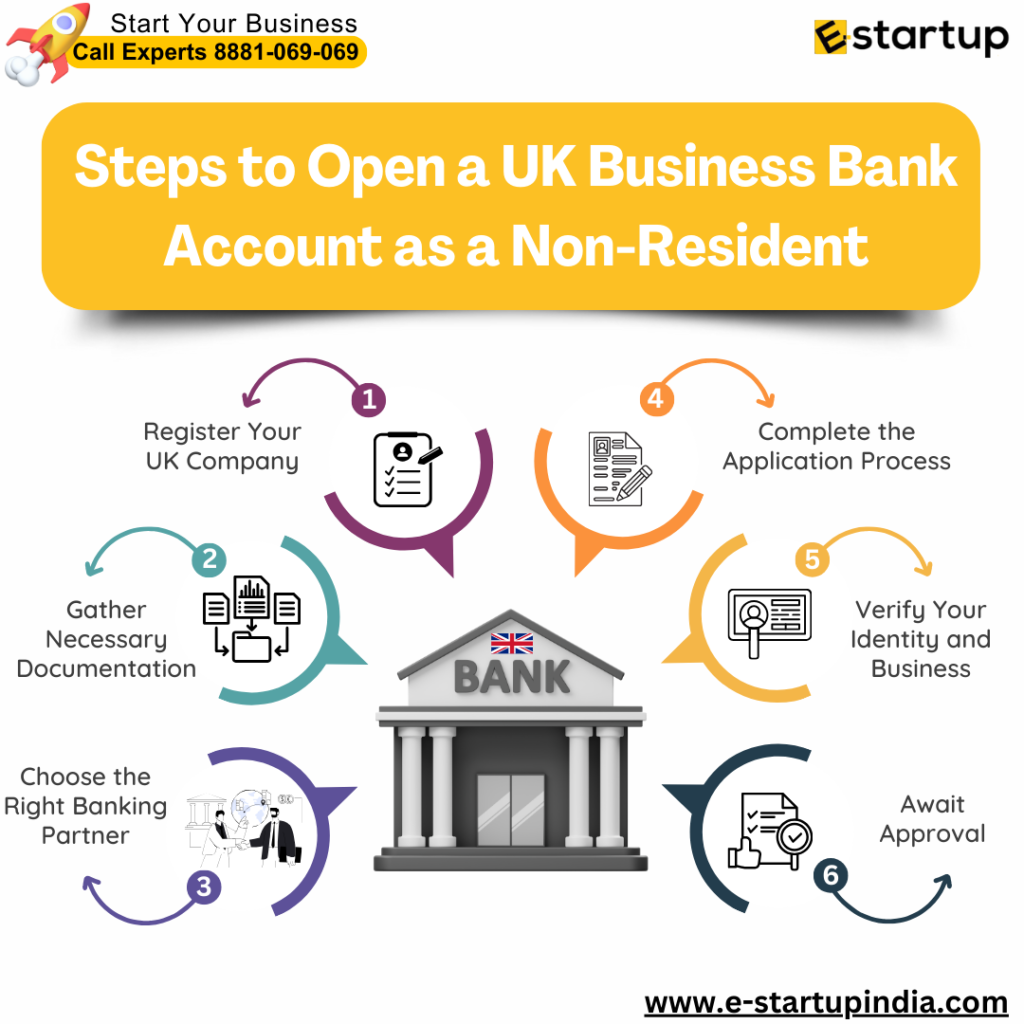

Stepwise

Step 1: Register Your UK Company

The first step is to ensure your company is registered with Companies House and has a valid UK address.

Step 2: Gather Necessary Documentation

Next, you need to prepare essential documents such as your passport, proof of address, company incorporation documents, and details of directors and shareholders.

Essential Documents that you need to provide to open UK Business Bank Account

Proof of Identity (Passport, National ID card)

Proof of Address (Utility bill, Bank statement, Government-issued letter)

- Company Registration Documents (Certificate of Incorporation, Memorandum & Articles of Association, Company Share Register, UK Business Address)

- Proof of Business Activities (Business plan, Invoices, Contracts, Website)

- Tax and Regulatory Compliance Documents (Unique Taxpayer Reference (UTR), VAT registration)

- Additional Bank-Specific Requirements (UK resident director or partner, Local phone number, Bank references from home country)

Read Also: Corporate Taxes in UK for Company Registered in India

Step 3: Choose the Right Banking Partner

Third, Research and select a bank or financial institution that accommodates non-resident business accounts. You must consider important factors like account features, fees, and application processes.

Step 4: Complete the Application Process

Now once everything is ready, you can submit your application along with the required documents. Some institutions offer online applications, while others may require physical presence.

Step 5: Verify Your Identity and Business

Banks will verify your identity and company registration through documents submitted. Some banks may require video verification or additional questions about your business operations.

Step 6: Await Approval

Lastly, the review process duration varies across institutions. Once approved, you’ll receive your account details to commence business transactions.

Challenges in Opening a UK Business Bank Account

While company registration in the UK is straightforward, opening a business bank account presents more challenges for non-residents. Traditional UK banks often require in-person visits and extensive background checks, which can be cumbersome for foreign directors. Furthermore, the stringent Anti-Money Laundering (AML) regulations necessitate thorough verification processes. Hence, it is best to consult our expert who can file your application and ensure you get your UK Business Account without any hassle saving you your time and money. We also have a reliable team of experts that can help you in getting your UK Company Registration with ease and speed. Feel free to get your doubts cleared by calling us at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.