Choosing a company structure that is appropriate for your venture is one of the most critical choices you will make as a new entrepreneur. There is a wide range of structures available to company owners. However, the most common in India are LLP company Registration and Sole Proprietorship Registration. In this article, you will understand the difference between LLP vs Sole Proprietorship.

What is LLP Company Registration?

A limited liability partnership (LLP) is a form of partnership firm in which some or all partners have limited responsibility.

Consequently, it combines aspects of partnership and corporate structure. Partners in an LLP are not held accountable for the wrongdoings of their other partners.

Under the 2008 Limited Liability Partnership Act, the owner of this firm is referred to as a Partner. Legally, it is a distinct entity from you.

This sort of company registration is founded by two or more partners, each of whom is shielded from personal risk by limited liability.

In the event that one or more of its partners passes away, the LLP will continue in its current form.

What is Sole Proprietorship?

Sole Proprietorship is also referred to as a sole trader or a proprietorship. In other words, A one-person business is known as a Sole Proprietorship.

The owner and the entities are one and the same. The owner is solely responsible for any and all damages. In the same way, he is responsible for all gains and losses.

As a result, it is an unincorporated firm with a single owner who is personally liable for paying taxes on the earnings it generates as a sole proprietorship.

A sole proprietor may carry on business using a fictional name such as “Naresh Automobile repair shop” or the owner’s own identity.

This kind of company formation is best suited for small business owners who don’t have a lot of money and don’t want to deal with the hassle of registering a legal corporation.

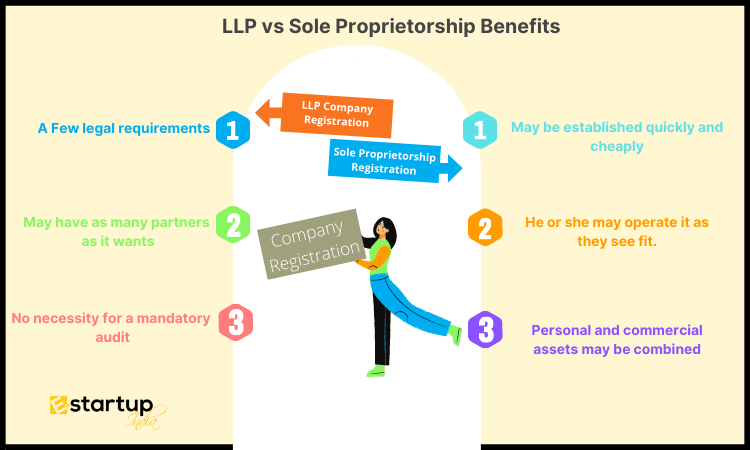

LLP vs Sole Proprietorship Benefits

LLP Company Formation Advantages

- The incorporation procedure for an LLP is rather straightforward, and there are few legal requirements.

- There is complete openness and flexibility in company administration in an LLP since the written contract includes all information, including the profit distribution ratio among the partners.

- Limited liability protects the company’s owners from all of the firm’s obligations and liabilities.

- A limited liability partnership (LLP) may have as many partners as it wants.

- CAs, CPAs, lawyers, and others choose LLPs since their partners are immune from paying DDT.

- For LLPs, there is no necessity for a mandatory audit.

- In order to create an LLP, you do not need a certain amount of money upfront. Ultimately, the partners will decide how much money they contribute to the venture.

Sole Proprietorship Advantages

- One person is accountable for everything that happens in his or her company, and he or she may operate it as they see fit.

- A sole proprietorship may be established quickly and cheaply by business owners.

- It is not necessary for a single owner to pay corporation taxes, as is the case for most businesses.

- A sole proprietorship may simply be set up by a single individual.

- Personal and commercial assets may be combined in any way the owner chooses.

LLP vs Sole Proprietorship Disadvantages

LLP Company Registration Disadvantages

- Because LLP does not have the ability to issue equity shares, it is unable to generate cash from its members. As a result, even venture capitalists, angel investors, and other types of investors may choose to invest in a private limited company rather than an LLP.

- LLPs are taxed at a flat rate of 30%, no matter how much money they make. Except for LLP, which has a yearly revenue of up to Rs. 250 crores, the standard tax rate is 25%.

- For LLP Registration, there must be at least two members.

- Tax and MCA filings must be filed every year even if the LLP does not engage in any business activities. Failure to submit returns on time may result in a penalty of Rs100/day.

Sole Proprietorship Registration Disadvantages

- In the event of the owner’s death or insolvency, a sole proprietorship business has a low chance of surviving.

- Due to the fact that the sole owner manages the whole organization, the sole proprietor cannot obtain further funds.

- A Sole proprietorship Registration has no protection for the owner’s personal assets.

Moreover, If you want any other guidance relating to LLP Registration. please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.