In a significant ruling, the Supreme Court of India allowed businesses to claim GST Input Tax Credit on commercial construction costs. As a result, the real estate sector is celebrating it as a huge relief. It is also beneficial for those businesses that are involved in leasing commercial properties.

Boon for Commercial Real Estate Sector in India

Earlier, businesses were not able to claim input tax credits for construction expenses. However, they can do so now as per the new ruling. Thus, reducing the operational costs and increasing profit margins for businesses, especially for those companies who lease out commercial properties.

Encouragement of new investments

By granting ITC on construction spending, the court has encouraged more investment in commercial real estate. Developers now have an incentive to invest in major commercial projects without worrying about missing out on tax breaks. This decision is expected to encourage additional expansion in commercial spaces, benefiting the overall industry.

Key Points of the Ruling

The decision is especially significant for businesses engaged in leasing activities. The court created the ‘functionality and essentially’ test, which implies the ITC claim would be based on how the commercial property is used in business operations. This establishes a clear standard for future claims, providing increased transparency in the system.

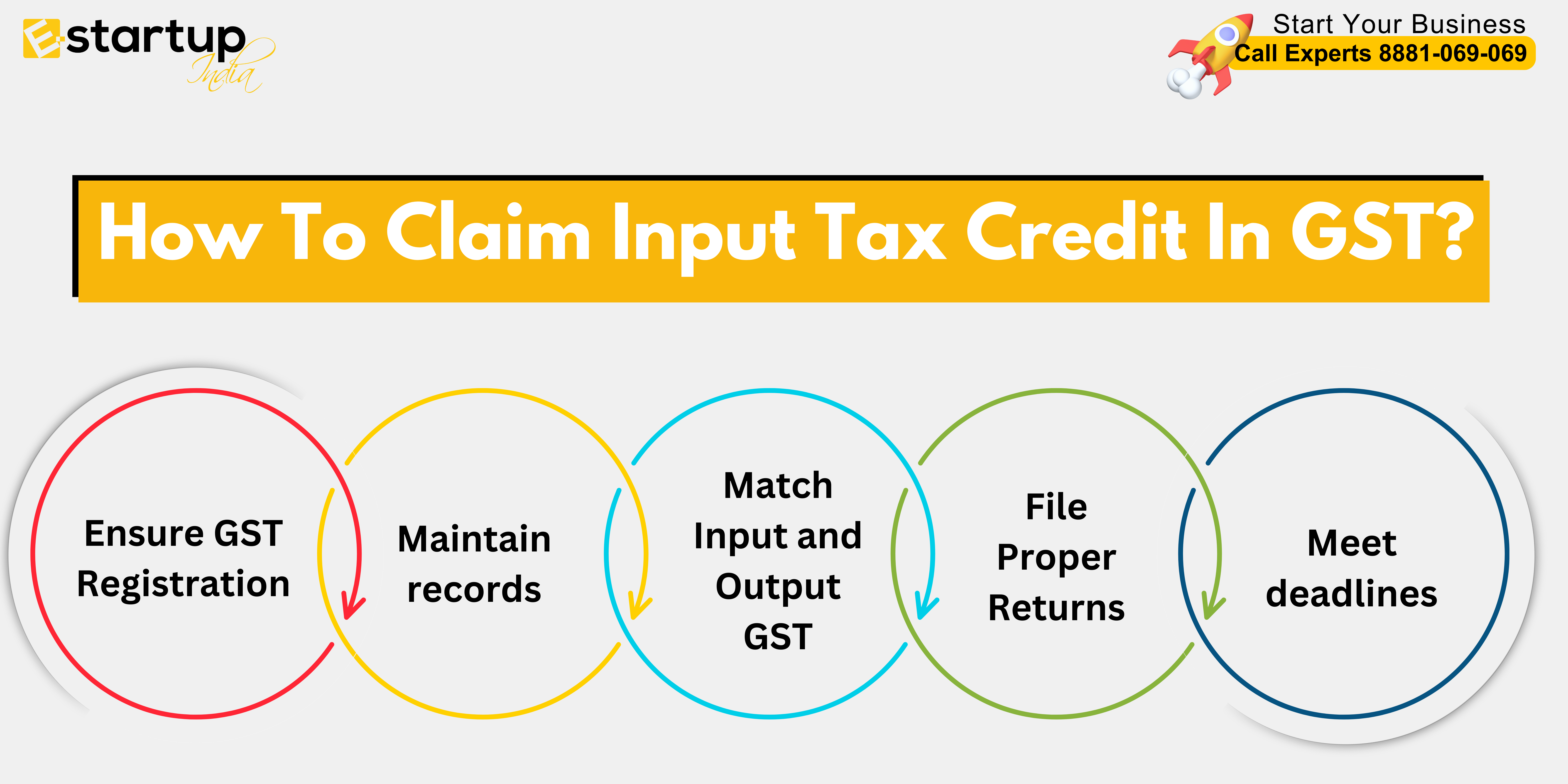

How to claim input tax credit in GST?

Businesses seeking to claim the GST input tax credit for commercial construction expenses must follow the tips below:

Ensure GST Registration

Only companies with an active GST registration can collect input tax credits.

Maintain records

It is critical to keep correct invoices, contracts, and other necessary papers that reflect GST paid on construction expenditures.

Match Input and Output GST

The GST paid on construction should be matched to output GST liabilities, such as rental revenue from leased property.

File Proper Returns

To claim ITC, businesses should file their GST returns, especially GSTR-2.

Meet deadlines

Filing GST returns on time is critical to avoiding fines and ensuring that the claim is handled.

Moreover, If you want any other guidance relating to enabling GST e-invoicing and GST return Filing please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.