Every assessee files tax returns during the assessment year to fulfill statutory requirements. The organizations pay different types of taxes such as income tax, sales, tax, and services taxes to the government according to the prescribed rate. In this article, you will understand the difference between PAN, TAN and TIN.

The assesses should be familiarized with certain concepts such as PAN, TAN and TIN. An assessee can have only one PAN, TAN and TIN number. If they possess one more than a number, then they are penalized according to respective laws. These numbers are issued by the income tax department for filing different types of returns. Hence, it is a common question.

What is PAN, TAN and TIN?

You should understand these terms clearly so you can easily file returns. The meaning of PAN, TAN and TIN is as follows:

PAN

Permanent Account Number is a 10-digit number provided to the taxpayers. The Income-tax Department allocates a number to an individual or a firm to pay income tax or perform any financial transaction.

TAN

A person should pay income tax if his income exceeds the prescribed limit during the assessment year. From the Gross Profit obtained at the end of the year, some amount of taxes should be deducted known as Tax Deducted at Source. So, when a person or a firm is filling out a form for deducting taxes from his income, he should mention his TAN number. It is also a 10-digit number issued by the Income Tax Department.

The TAN is simply a Tax Deduction and Collection Account Number mandatory to obtain for every individual or business who is liable to collect tax.

TIN

TIN known as Taxpayer Identification Number is applicable to the traders who pay sales tax during the year. Any trader who is engaged in buying and selling goods in other states should compulsorily have a TIN number.

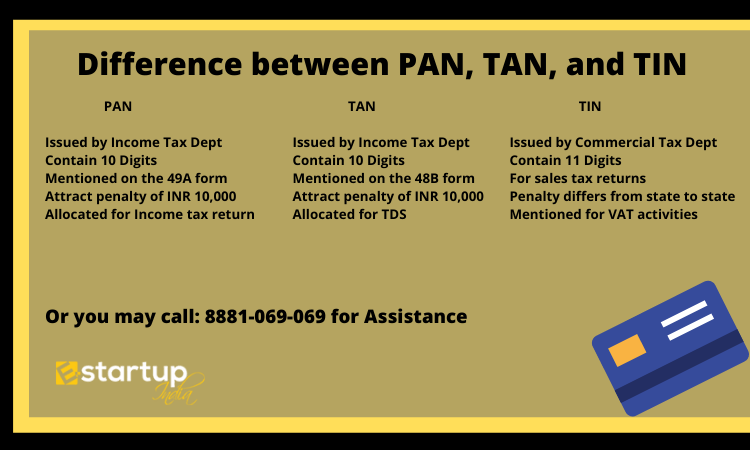

Understand the difference between PAN, TAN, and TIN

The difference is written below:

| PAN | TAN | TIN |

| The PAN card number is issued by the Income Tax Department | The TAN number is also issued by the Income Tax Department | It is issued by the Commercial Tax department of the state |

| It has 10 digits 5 are alphabets, followed by the last 4 numerals and an alphabet at the ending | It is 10-digit containing 4 alphabets 5 numerals and a last alphabet | It has 11 digits as all 11 digits are numerals |

| The PAN number is allocated to any assessee for income tax return filing or a business for performing financial transactions. | It is a number mentioned for deducting tax at source or TDS collection | It is useful to any trader who regularly pays VAT every month. |

| The assessee should mention the PAN number on the 49A form. | The TAN number is mentioned on Form 49B | The form for filing sales tax returns differs from state to state |

| To apply for a PAN number, the assessee should produce documents such as ID proof, date of birth proof, address proof along photographs. | The assessee should just send a signed acknowledgment online | The assessee should mention registration proof, ID proof, PAN number, and other documents as required by the states |

| It is a number to perform any financial transaction. | It is mentioned when an assessee is revealing the actual amount of TDS. | It is mentioned to explain various VAT activities in the state. |

| Non-compliance can attract a penalty of Rs.10,000 | If a person is not following the TAN rules, then he should pay a penalty of 10,000 Rs. | The amount of penalty differs from state to state. |

Conclusion

An assessee should mention a unique identification number when complying with income tax and sales tax formalities. Furthermore, They should mention this unique identification number to carry out different tax activities. The main differences between PAN, TAN and TIN are about the filing procedure and the reason for filing. These numbers are essential for every entrepreneur to perform business activities.

Moreover, If you want any other guidance relating to Pan Registration, and Tan Registration. Please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.