Dubai is known as the business hub of the Middle East. The city is situated in the northeastern region of UAE and is one of the fastest-growing economies in the world. The city of Dubai houses various industries like real estate, trade, financial services, and tourism. So, if you want to business setup in Dubai from India, you must know about the type of business setup in Dubai.

These industries majorly contribute to the GDP of the city and UAE. The city of Dubai also offers businesses a tremendous growth trajectory especially due to its unique liberalization policies. It has a diversified market and also offers an open market trading environment with no control or restrictions and barriers over the quota. This makes Dubai an ideal place for setting up a business.

Benefits of setting up business in Dubai

- Setting up a business and managing it in Dubai is simple and straightforward.

- Dubai is a free trade company and therefore there are no taxes on personal income. The government and the regulatory bodies do not get involved in the activities of the private sector.

- Dubai has one of the best infrastructures in the world.

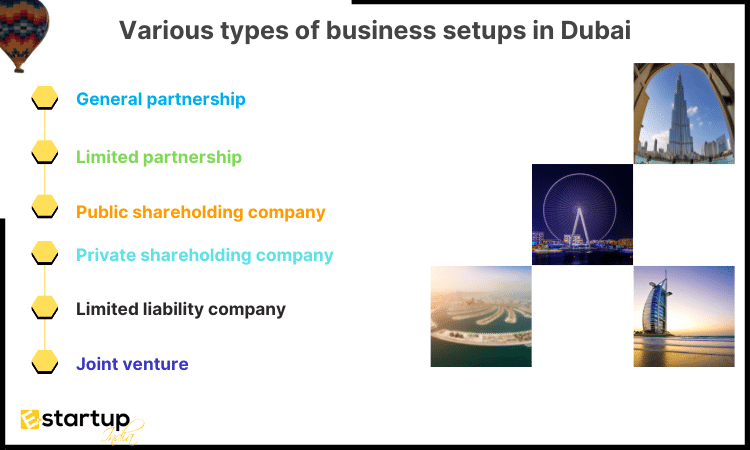

Various types of business setups in Dubai

Before starting a company in Dubai, you need to know the different categories of businesses and corporations in the Emirates. For each type of business, there are different criteria and requirements that you have to fulfill. The major type of business setup in Dubai are as follows:

General partnership

General partnership

This type of business setup in Dubai is only available to UAE nationals. In a general partnership, two or more partners are responsible for the company’s profit and loss performance. These partners are responsible for the debts of the company as well.

The interest of a partner can be conveyed in the following ways:

- If it has been mentioned in the partnership agreement

- Approval from the other partners or all the partners.

The dissolution of the partnership contract might occur in case of the following events:

- Withdrawal of a partner

- Death of a partner

- If a partner gets bankrupt

- The insanity of a partner

Limited partnership

Limited partnership

Limited Partnerships are usually made up of two types of business forms:

-

Limited partnership

All the partners are only liable for their debts only up to the value of their contribution towards the company. Additionally, the limited partner cannot be a part of the management nor will his name be written in the partnership’s name.

-

General partnership

The general partners who have to be UAE residents are liable for the company’s debts.

Public shareholding company

Public shareholding company

A public shareholding company must have a minimum of 10 founders. However, there is an exception where a UAE government is involved. In this case, the number of partners can be less than 10.

The number of directors who will compose the Board Of Directors of the company will be between 3-12. The chairman and most of the directors have to be UAE nationals.

The liability of a shared holder in a public shareholding company is limited to the amount of his capital contribution. All the shares of the company will have equal rights and will be entered into a share registry.

Private shareholding company

Private shareholding company

Like a public shareholding company, this type of business setup in Dubai has to have a minimum of three shareholders. The minimum capital that a private shareholding company must have is AED 2 million. The company’s shares will not be offered to the general public.

Limited liability company

Limited liability company

This business set up in Dubai is quite common and it has to be set up by at least two individuals. The maximum number of partners that are limited liability companies may have is 50. The shareholder’s liability is hedged against the total amount of his shares.

In this business settlement, the Dubai government allows foreign ownership of shares. However, it must not be more than 49% of the company’s capital. A limited liability company can take part in any legal activities other than insurance, business, and other activities that involve money investment on behalf of a third party or other entities.

Joint venture

Joint venture

A joint venture is usually formed by two or more individuals or legal entities. The legal procedure of a joint venture can only be done under the name of one of the partners who have to be a UAE national.

The Dubai government strictly states that in any of these business incorporations, the participation of UAE nationals must not be less than 51%. However, for specific zones like free zones, foreign nationals can own a business 100%. So, are you planning to set up a business in Dubai but do not know the legal procedures? Do not worry, we will help you with your business s

etup in Dubai from India. All you have to do is visit our website and get in touch with us.

Moreover, If you want any other guidance relating to Dubai company registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.