Understanding the U.S. tax obligations after registering a company is crucial for entrepreneurs and business owners. The federal, state and local tax laws are stringent on taxes.

We’ll highlight the important tax requirements to ensure compliance and see which one is applicable in which situation when you apply for company registration in USA.

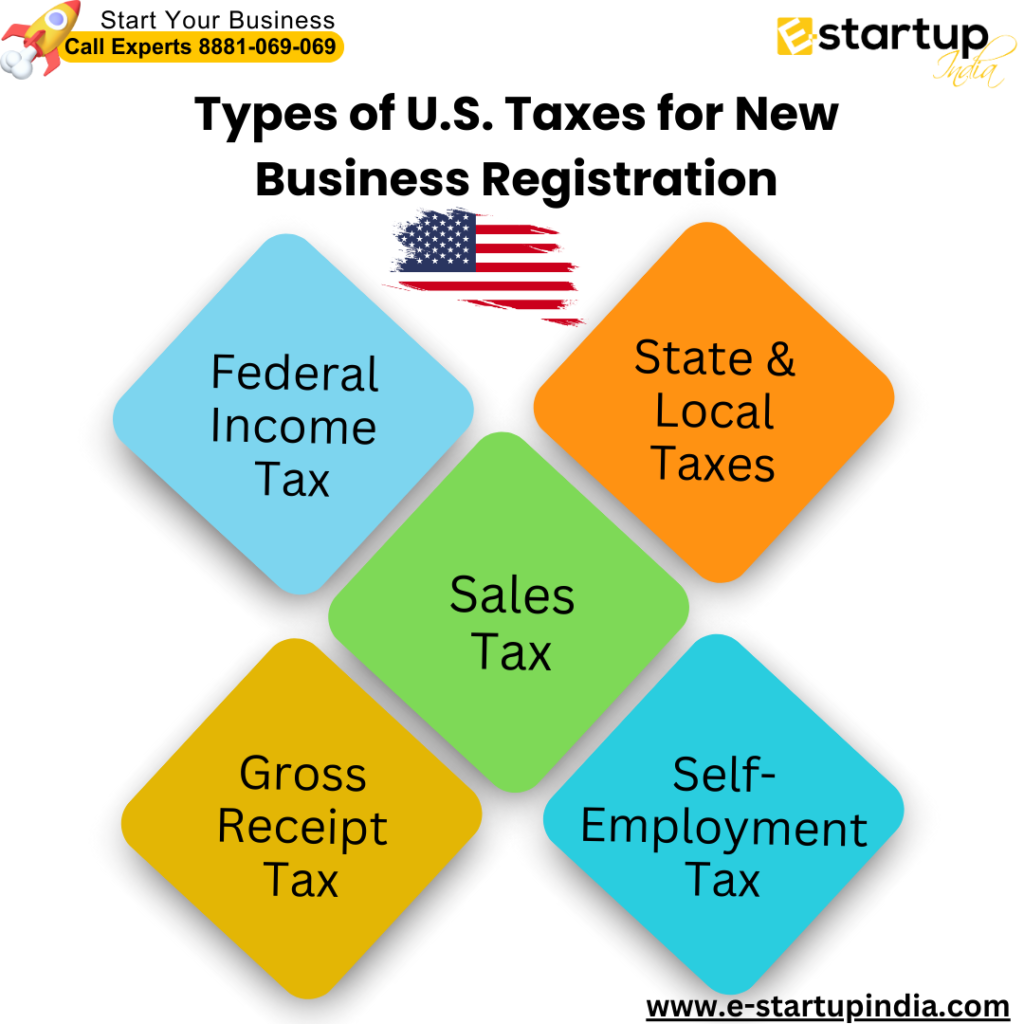

Types of Taxes for Registering New Businesses

There are quite a few business taxes out there. Which taxes should you pay? To understand that, let’s see what each tax is all about and if your business structure fits into them:

-

Federal Income Tax

Irrespective of whether they are LLCs, corporations, or even sole proprietorships, all businesses are subject to federal income tax based on the income they earn. The rate of charging your taxes for a succeeded LLC is dependent on how your business is structured.

For example, the taxation of C-corporations is done at the entity level, while S-corporations and LLCs transfer income and losses to the owners who then report on their 1095 A LLC tax returns.

Read Also: Federal Tax on USA LLC

-

State and Local Taxes

Apart from the submission of federal returns, enterprises are required to pay state returns and local ones in case of a company registration in USA. Some states choose to fill their purse with a high rate of income tax: California and New York as the best examples.

-

Self-Employment Tax

If you are a sole proprietor or an LLC partner, you must pay a self-employment tax. This tax directly goes to Social Security and Medicare. In other words, this tax is aligned with your income from the business, and this should be taken into account when completing a company registration in USA.

Read Also: Tax Benefits to form LLC Company Registration in USA

-

Sales Tax

If your business sells goods or taxable services, it is essential to collect sales tax from your customers. Then submit it to the relevant authorities. Sales tax rates differ from one state to another; therefore understand the local laws.

-

Gross Receipt Tax

A gross receipts tax is a tax imposed on a company’s total sales revenue without allowing for deductions for business expenses, such as the cost of goods sold or employee compensation. Unlike sales taxes, which are typically charged only on final consumer purchases, gross receipts taxes are applied to businesses and encompass transactions between businesses as well. This can result in a cumulative effect, often referred to as a tax pyramid.

While paying the taxes, you must also ensure compliance.

Ensure Compliance While Filing Taxes

- Obtain an EIN: Required for tax filing, business bank accounts, and hiring employees.

- Keep Accurate Records: Track income and expenses using accounting software or an accountant.

- File on Time: Meet IRS deadlines to avoid penalties and interest.

- Understand Deductions: Maximise tax benefits by leveraging business deductions and credits with expert guidance.

Working with an advisor can help to make the process of LLC company registration in USA easier.

Conclusion

Understanding tax obligations after USA company registration is vital for success. Ensure federal, state, and local compliance. Contact E-Startup India for expert guidance on company registration in USA and tax planning.

Moreover, if you need any other guidance on Filing Taxes, opening an LLC in the USA, or USA Company Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.