Filing taxes on time in the USA is essential to avoid penalties, interest, and other consequences that can add up quickly. Let’s understand in this article what happens if you file taxes late in the USA.

Late Filing Penalties if you file taxes late in USA

When you file your taxes late in the USA, you face a failure-to-file penalty. This penalty typically starts at 5% of the unpaid taxes for each month (or part of a month) that your return is late, up to a maximum of 25%.

Furthermore, the penalties will continue to build if you owe taxes but haven’t filed yet.

The longer you delay filing taxes in the USA, the larger your penalty becomes. Thus, potentially adding hundreds or even thousands to your tax bill.

Additional Interest on Unpaid Taxes

The IRS doesn’t just impose a late-filing penalty if you file taxes late in the USA.

They also add interest to any unpaid taxes. Interest on unpaid taxes generally begins from the original due date and accrues daily. This interest compounds over time, increasing your total debt.

So, if you’re a business owner in the USA who missed the deadline, the combination of penalties and interest can significantly increase your tax burden.

Impact on Your USA Businesses if your tax filing is late

If you miss the tax filing deadline, your business may lose good standing with the IRS.

Furthermore, whether you’re working on a USA company registration or intend to expand your firm, falling behind on taxes might have an impact on funding, partnerships, and even licensing.

What Happens If You Owe Taxes in USA But Can’t Pay?

You still have choices even if you missed the deadline even if you can not afford the complete tax payment. The IRS provides payment plans that allow you to pay down your taxes over time, reducing penalties. Remember that submitting on time, even if you can’t pay everything at once, can help you avoid the failure-to-file penalty. For more information on this, it’s best to consult an expert.

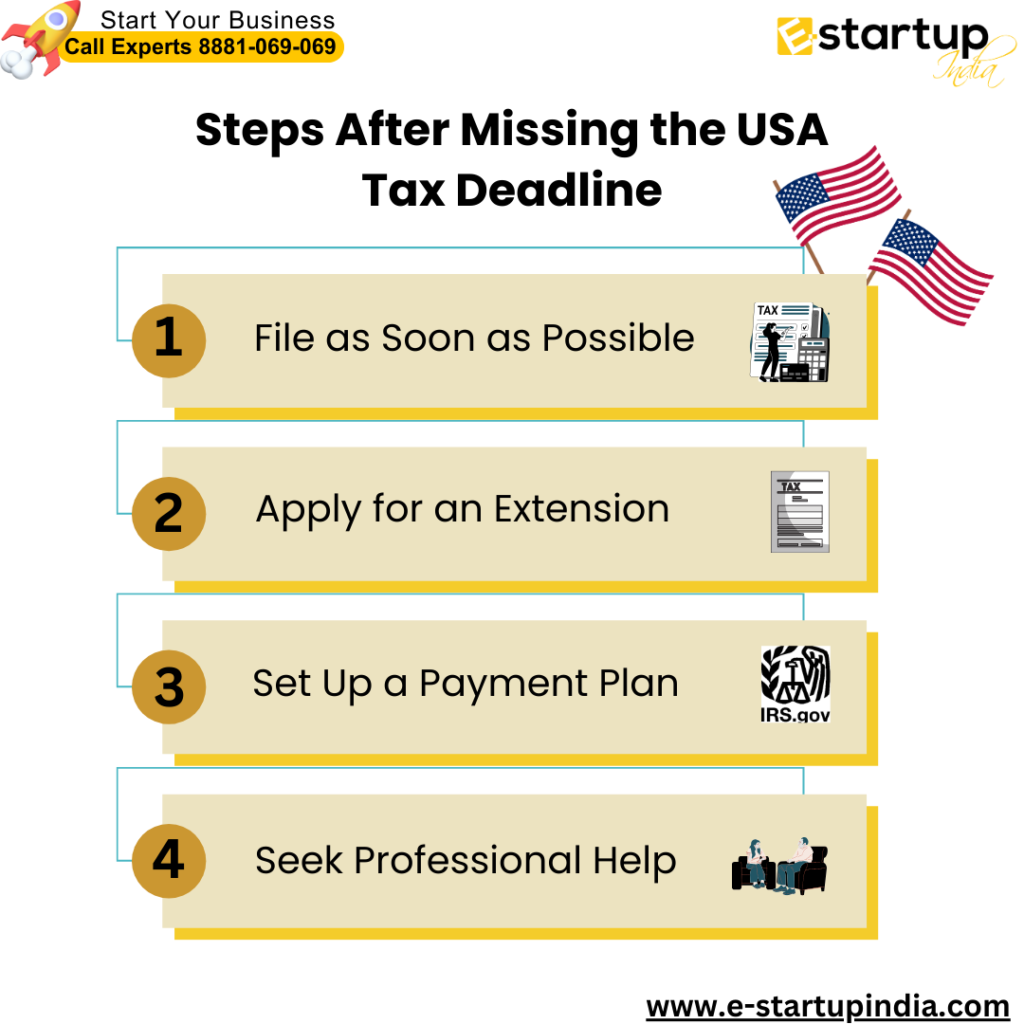

Steps to Take if You Missed the Tax Filing Deadline in USA

- File as Soon as Possible: The earlier you file, the sooner you may decrease penalties.

- Apply for an Extension: If you missed the April deadline, you can request for an extension. An extension does not waive fines or interest, but it does allow extra time to submit all paperwork.

- Set Up a Payment Plan: If you owe money, go to the IRS website and apply for a payment plan.

- Seek Professional Help: Consulting a tax professional might help you file your late business taxes more easily. They can advise you on deductions, credits, and options for lowering your overall tax obligation.

Can tax filing late affect future tax years in USA?

Yes, it can. Late filing or payment might result in audits and limited access to certain deductions or credits in subsequent years.

For example, if you own a business and routinely file late, you may be unable to claim certain business deductions, damaging your total tax strategy.

Regularly filing on schedule establishes a good record with the IRS, which might help your business taxes in the long term.

What If You’re Due a Refund and file tax return late in USA?

If you’re due a refund and file late, there’s no penalty. However, you must file within three years of the original deadline to claim your refund. Waiting too long can cause you to lose your refund entirely.

Read Also: How to make Zero Federal Tax on USA LLC profit by Non-resident

FAQs

1. What is the maximum penalty and interest that can be incurred when filing my taxes past the deadline?

There is a failure-to-file penalty that the IRS charges which is 5% of the tax owed for each month the return is late, up to a maximum of 25%. In addition, any taxes owed which remain unpaid are charged interest daily which can add up quickly.

2. Is late filing of taxes potentially damaging to my credit rating?

There is no direct correlation between the late filing of taxes and the credit score of an individual or business. However, in the event that taxes owed are not paid, leading to a tax lien which does happen from time to time, it would have an adverse impact on the score.

3. Is there a provision or law that would help mitigate the penalty in cases where an individual can provide a justified reason?

Yes, the IRS recognizes that some individuals may not be able to file timely returns or pay their taxes due to a disaster, illness or the death of a family member. The IRS also has a first-time penalty abatement policy for those who have no adverse filing history.

4. What exactly is SFR and what does the IRS use it for?

In the event of not submitting any claim, the IRS may prepare a Substitute for Return (SFR) type of income tax return based on available information such as your liquid income. SFRs do not take into account any of the deductions or credits for which you might be entitled, and as such, taxation may be at a higher rate.

5. Where do I check how much tax I owe for not submitting a return on time?

For that amount, you can either log into your IRS online account or contact the IRS. A professional tax expert can also help you in this case.

Know all about US Beneficial Ownership Information (BOI) Reporting

Moreover, If you want any other guidance relating to opening an LLC in the USA or filing taxes, or USA Company Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.