India’s Goods and Services Tax (GST) landscape is set for a major shift with the introduction of the GST e-Invoice Rule Change 2025. Businesses must now upload their e-invoices to the Invoice Registration Portal (IRP) within 30 days of issuance. Thus, the new rule, mandated by the GST Network (GSTN), is part of the government’s broader effort to enhance compliance. The government is also focusing on streamlining the e-invoicing process.

Understanding Latest GST e-Invoice Rule Change 2025

According to the recent announcement, companies generating e-invoices through the GST system must follow a strict timeline.

By April 2025, all e-invoices must be submitted to the IRP within 30 days of issue.

Currently, there is no time limit for e-invoice uploads, which causes delays and compliance issues.The law applies to businesses covered by the e-invoicing procedure, which is essential for organizations with an annual revenue more than ₹10 crore. This strategy aims to improve transparency and enhance the accuracy of GST returns.

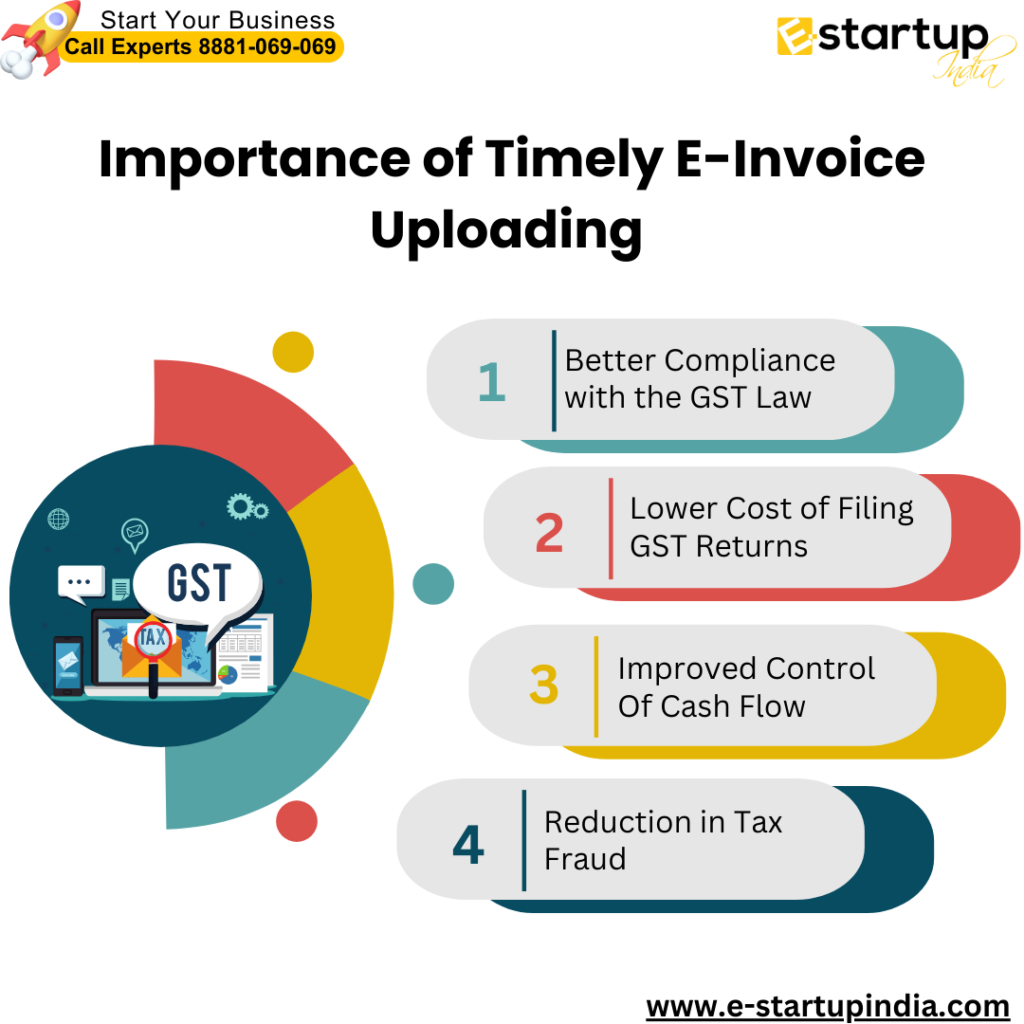

Importance of Timely E-Invoice Uploading

- Better Compliance with the GST Law: Timely E-Invoice Uploading ensures that the businesses do not default on legal obligations and are free from any sanctions or fines.

- Lower Cost of Filing GST Returns: The system automatically uploads data from every e-invoice to simplify GST return maintenance and ensure a seamless process.Late E-invoicing upload results in mismatches that result in challenges in maintaining return filing.

- Improved Control Of Cash Flow: Since the uploads of the invoices are done sooner the ITC claims are more readily processed thus contributing to improved cash flows.

- Reduction in Tax Fraud: Supervised and timely provision of e invoices creates an environment that minimises the chances of making fraudulent claims and false invoices thus supporting proper practices within the GST ecosystem.

Read Also: How to Apply GST for online selling at home online

How to Prepare for the GST Rule Changes

To comply with the GST e-Invoice Rule Change 2025, companies must adjust their processes:

- Automate Your E-Invoicing Process: Use software solutions to generate and upload invoices automatically.

- Stay up to current on GST registration requirements: To benefit from easier compliance, make sure your business is registered with GST.

- Train your team: Educate employees on the new rule and its implications for operations.

- Set internal deadlines: Set shorter deadlines for internally posting invoices to avoid last-minute difficulties.

Frequently Asked Questions (FAQs)

Q1: What is the GST e-Invoice Rule Change 2025?

A: It is a new GST regulation requiring businesses to upload e-invoices to the IRP within 30 days of issuance, effective April 1, 2025.

Q2: Who does this rule apply to?

A: Businesses with an annual turnover of over ₹10 crore who are mandated to follow the e-invoicing process.

Q3: How will this rule impact GST return filing?

A: Timely e-invoice uploads will make GST return filing more efficient and reduce errors in data integration.

Q4: What are the penalties for non-compliance?

A: Non-compliance can result in penalties, loss of input tax credit, and delays in GST return filing.

Q5: How can businesses prepare for this rule?

A: Automate e-invoicing, stay updated on GST registration requirements, train employees, and set internal deadlines for compliance.

Moreover, If you want any other guidance relating to enabling GST e-invoicing, GST latest update, GST Registration, and GST return Filing please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.