Want to earn money in the USA? The good news is that you don’t need to be an American citizen to do it. Many foreigners like you can now invest in Airbnb properties in the USA and make huge profits. Let’s understand how.

Why Invest in Airbnb Properties in the USA?

The USA is one of the top countries for Airbnb rentals. When you invest in USA for Airbnb, you get:

- High rental income from tourists and travelers

- Reliable property laws

- A strong Airbnb market in cities like Miami, Orlando, Austin, and Los Angeles

- Access to property managers and service providers

In short, If you plan carefully, you can build a successful Airbnb business even if you don’t live in the U.S.

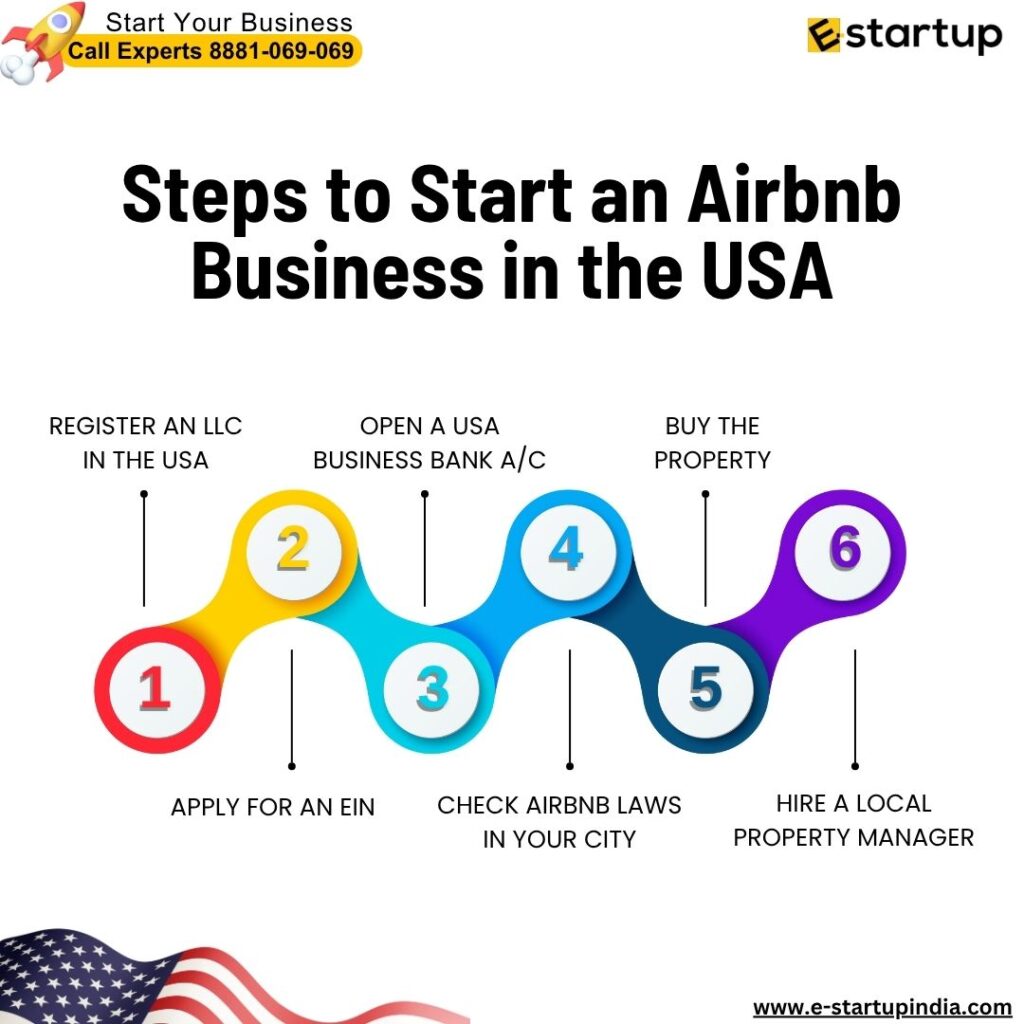

Step-by-Step: How to Start Your Airbnb Business in the USA

1. Register an LLC in the U.S.

Your first step is to register an LLC company in the USA. An LLC (Limited Liability Company) makes everything smoother. It helps you:

- Protect your personal assets

- Look professional to banks, clients, and agents

- File taxes in the U.S.

- Buy and manage property legally

It is recommended to register your LLC in popular states like Delaware, Wyoming, or Florida. In addition, it is best to register in the state where your Airbnb property is located.

See Also: How to Choose the Right State for Company Registration in the USA

2. Apply for an EIN (Employer Identification Number)

After setting up your LLC, apply for an EIN from the IRS. You’ll need it to:

- Open a U.S. bank account

- File your taxes

- Do business legally

E-StartupIndia can help you apply for an EIN online or through a service provider.

3. Open a U.S. Business Bank Account

It is essential to have a U.S. bank account to manage your Airbnb income and expenses. Some banks allow foreigners to open an account online. Others may ask you to visit a branch in the U.S. Feel free to talk to our advisors in this regard.

See alos: How to Open US Bank Account Without SSN?

4. Check Airbnb Laws in the City You Choose

Every city in the U.S. has different rules for short-term rentals. Before you buy a property, check:

- If short-term rentals are allowed in that area

- If you need a license or permit

- How many guests you can host

- If you have to collect taxes

Some cities like New York have strict rules. Others like Miami and Houston are more Airbnb-friendly.

5. Buy the Property

You don’t need to be a U.S. citizen to buy real estate. You can buy the property through your LLC Company Registration in the USA. According to your choice, you can either use a mortgage or pay the amount directly.

6. Hire a Local Property Manager

If you don’t live in the U.S., managing the property yourself can be hard. A local property manager can:

- Handle guest bookings and messages

- Manage cleaning and repairs

- Help you get 5-star reviews

With the right manager, you can earn passive income while living away from the US.

All about Taxes in USA For Airbnb Business

Even if you live abroad, you still have to pay U.S. taxes on your Airbnb income. Keep in mind the following tips:

- You must file an annual tax return (Form 1040NR)

- You may need to pay federal and state income tax

- You might have to withhold tax if you sell the property (FIRPTA)

Final Thoughts

You can invest in Airbnb properties in the USA even if you’re a foreigner. You just need to follow the right steps: set up an LLC, follow the local laws, manage your taxes, and pick the right location. For more information, you can give us call at: 8881-069-069

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.