Running an LLC Business in the USA is like running a marathon. You have to plan and stay compliant with the rules at every step. After obtaining LLC Company Registration, you must complete the mandatory annual compliance; otherwise, you will incur hefty penalties and face other legal consequences. Following annual compliance requirements for an LLC also helps in maintaining your liability protection and keeps the state from dissolving your business. Let’s understand the annual compliance requirements for LLCs through this article.

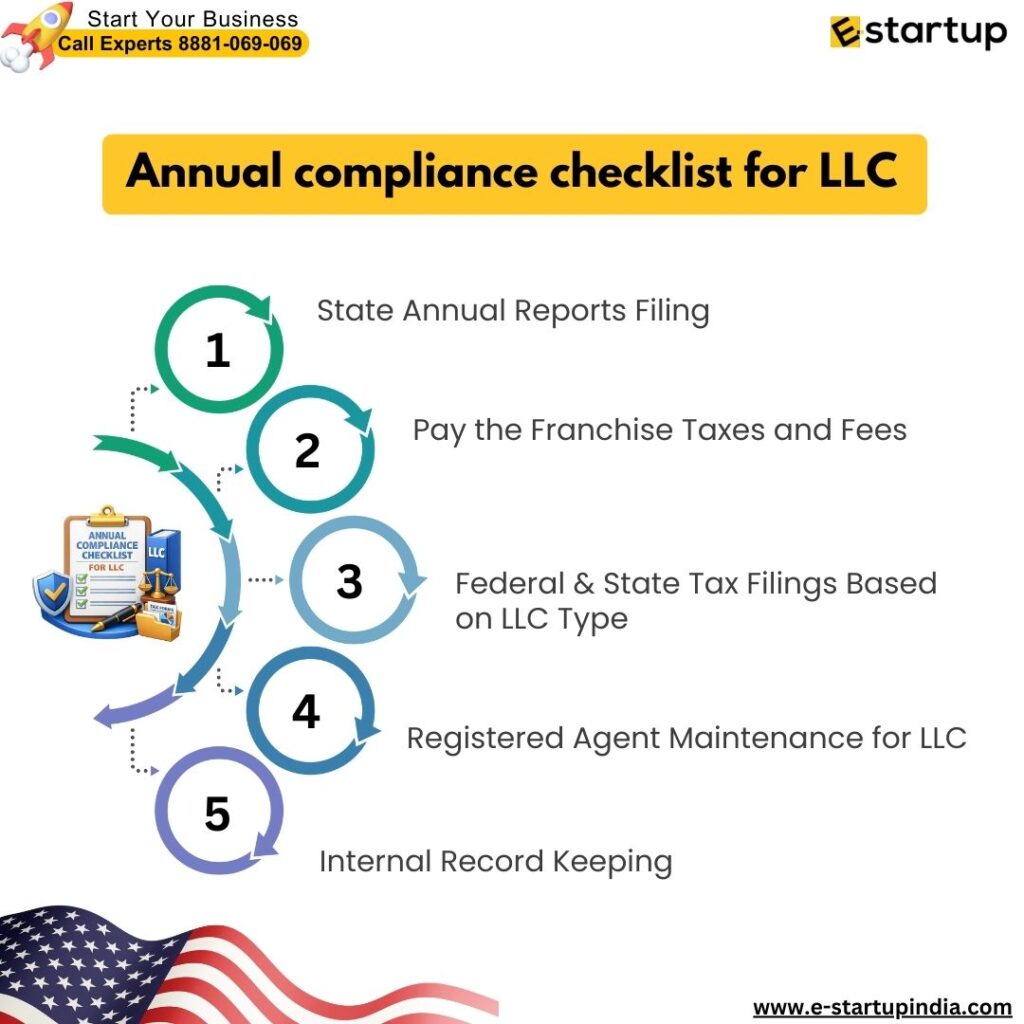

1. State Annual Reports Filing

Almost every state in the USA requires an annual (or biennial) report. This report is usually a “check-in” to update the state on your current business address, registered agent, and member list. However, if you do not file annual reports with the state, you will lose “Good Standing” status for your business.

2. Pay the Franchise Taxes and Fees

From the name, it seems like you need to be a “franchise,” like a fast-food chain, to pay a franchise tax. However, in the USA, states charge a franchise tax for allowing you to do business in the state. For example, in California, this fee is a flat $800. On the other hand, states like Delaware charge you franchise taxes based on your entity type. These taxes are core Annual Compliance Requirements for LLCs and must be done at the same time as your annual report.

3. Federal and State Tax Filings for LLC as your LLC Registration Type

By default, the IRS treats a single-member LLC as a “disregarded entity” and a multi-member LLC as a partnership. So, Annual Compliance requirements vary accordingly:

- Form 1065: For multi-member LLCs (Partnership Return).

- Schedule C: For single-member LLCs (filed with your personal 1040).

Doing these annual compliances accurately, your LLC Company Registration remains a benefit rather than a tax liability. You will also be able to get tax refunds through these annual compliances.

4. Maintenance of a Registered Agent for your LLC

You are legally required to maintain a registered agent in the USA for your LLC. A registered agent can accept service of process (legal papers) on your company’s behalf. If your agent moves or you change services, you will need to update the state immediately. Failure to do so is a violation of the Annual Compliance Requirements for LLCs and will also lead to dissolution or hefty fines.

5. Internal Record Keeping

Keeping an updated Operating Agreement and minutes of meetings is vital for Annual Compliance Requirements for LLCs in the USA. If you ever face a lawsuit, these records prove that your business is a separate legal entity and protect your personal assets.

Summary of Deadlines for Annual Compliance Requirement

|

Requirement |

Typical Frequency |

Purpose |

|

Annual Report |

Yearly/Every 2 years |

Updates State Records |

|

Franchise Tax |

Yearly |

State “Right to Exist” Fee |

|

BOI Reporting |

Initial/Updated |

Federal ownership transparency |

What Happens if You Don’t Comply?

Ignoring your Annual Compliance Requirements for LLC can lead to disastrous outcomes. You’ll first encounter significant late fees and interest on unpaid taxes, followed by losing your “Good Standing” status. This means blocking loans, contracts, and license renewals. The most critical phase is Administrative Dissolution, where the state shuts down your company, canceling your LLC Company Registration and exposing you to “piercing the corporate veil.” This strips away personal liability, leaving your home, car, and savings vulnerable to business debts if sued.

To safeguard your assets, treat Annual Compliance Requirements for LLC as a necessity. One must ensure keeping LLC Company Registration intact to avoid reverting to a risky sole proprietorship legally.

FAQ’s

1. Do I need to file an annual report if my business made no money?

Yes, it’s required to update your business info with the state. Not filing can risk your LLC Company Registration.

2. Is the “Franchise Tax” only for big franchises?

No, it’s a fee for doing business as a legal entity, even for small businesses.

3. Can I change my Registered Agent with my annual report?

No, it usually needs a separate filing and fee. Keeping this info current is key to Annual Compliance Requirements for LLC.

4. What’s the difference between an Annual Report and a Tax Return?

An annual report updates company records with the Secretary of State, while a tax return reports income and expenses to the IRS and the state. Both are mandatory Annual Compliance Requirements for LLCs.

5. What is the BOI Report, and is it annual?

The BOI report is a federal requirement starting in 2024. It’s not annual; you file it once after LLC Company Registration and again if ownership or address changes.

Moreover, if you want any other guidance relating to LLC Company Registration, please feel free to talk to our business advisors at 8881-069-069.

Download the E-Startup Mobile App and never miss the latest updates relevant to your business.

Get exclusive secret insights, join my community now

https://www.instagram.com/channel/AbZ1PwsJQ4kORhHM/