The Central Board of Direct Taxes has further extended the due date for filing a statement under Vivad Se Vishwas Scheme till February 28, 2021. In this article, we will discuss on Vivad Se Viswas Scheme the Last Date of Filing Extended.

Vivad Se Viswas Scheme Last Date of Filing Extended

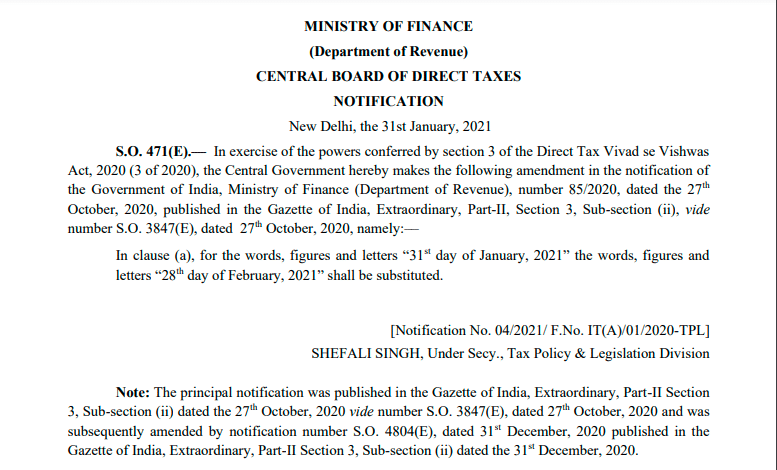

The Central government has again extended the deadline for settling tax disputes under the Vivad se Vishwas scheme without spending any interest and penalty by the month to February 28, 2021, from December 31, 2020. The first deadline was June 30, 2020, then it was extended to December 31. This was announced by the government as a part of the mega financial relief package. This is the third event the deadline for the scheme has been extended.

Further, an individual can file a declaration to avail the gain under the scheme before the deadline and pay the 100% of their disputed taxes on or before February 28, 2021.

Vivad se Vishwas Scheme

Vivad se Vishwas Act has been passed on 17 March 2020. The Scheme proffers a short window for taxpayers to settle their tax disputes by partly paying their tax arrears. To address the doubts of stakeholders and guide the law, the Central Board of Direct Taxes (CBDT).

Also, if the scheme was availed by March 31, 2020. An individual opting for settlement after March 31, 2020, was obliged to pay an additional 10 per cent penalty on the disputed tax amount

However, due to the latest extension in deadline a person can file the declaration on or before February 28, 2021, and make the payment of the disputed tax amount without any further dues on or before March 31, 2021.

Which tax disputes are eliminated from the Scheme?

- Search cases where disputed tax amount exceeds INR 5 crore;

- Cases where the prosecution has been initiated

- Cases including undisclosed income from a reference outside India or an undisclosed asset located outside India;

- Cases of tax disputes following assessment or reassessment made based on information obtained under tax treaties or information exchange agreements.

If you want any other guidance concerning ITR Filing, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the freshest updates narrating to your business.