The United Arab Emirates (UAE) introduced Value Added Tax (VAT) on January 1, 2018, as a means to diversify its economy. The VAT system in UAE applies to most goods and services. It is regulated by the Federal Tax Authority (FTA) in UAE. In this article, you will know about VAT in the UAE, including VAT registration, filing, and key tax compliance details.

What is VAT in the UAE?

VAT is a consumption tax charged at each step of the supply chain in the UAE. As a result, the final cost is borne by the consumer. However, businesses act as collectors for the government.

Who Needs VAT Registration in the UAE?

Businesses that provide taxable goods or services and have an annual turnover exceeding AED 375,000 have to mandatorily get VAT registration in UAE. If your business does not meet this threshold, you may still choose to register voluntarily.

When Is It Mandatory To Have VAT Registration in UAE?

If your business’s taxable revenue exceeds AED 375,000 annually, VAT registration is mandatory. Non-compliance to this can lead to penalties by the FTA.

Voluntary UAE VAT Registration Threshold Limit

Businesses with taxable revenue exceeding AED 187,500 but below the mandatory threshold can opt for voluntary VAT registration in UAE. Businesses can use Voluntary VAT Registration to claim input tax credits.

Corporate Tax Registration and VAT in UAE

While corporate tax registration is separate from VAT registration, businesses should handle both to ensure full compliance. Corporate tax relates to business profits, whereas VAT is on consumption. Companies must pay corporate taxes directly. Meanwhile, customers or consumers pay VAT, while the supplier only collects and submits it to the government.

Learn More: Know all about Corporate Tax on UAE Companies

VAT Rate in UAE

The VAT rate in the UAE is set at 5%, applicable on most goods and services. Certain sectors, like healthcare and education have exemption from VAT.

How to Register for VAT in the UAE

Businesses can register for VAT online through the Federal Tax Authority (FTA) portal. Businesses need to create an account, submit relevant documents, and receive their Tax Registration Number (TRN). E-StartupIndia experts can also help you register for VAT in the UAE without you having to worry about any step.

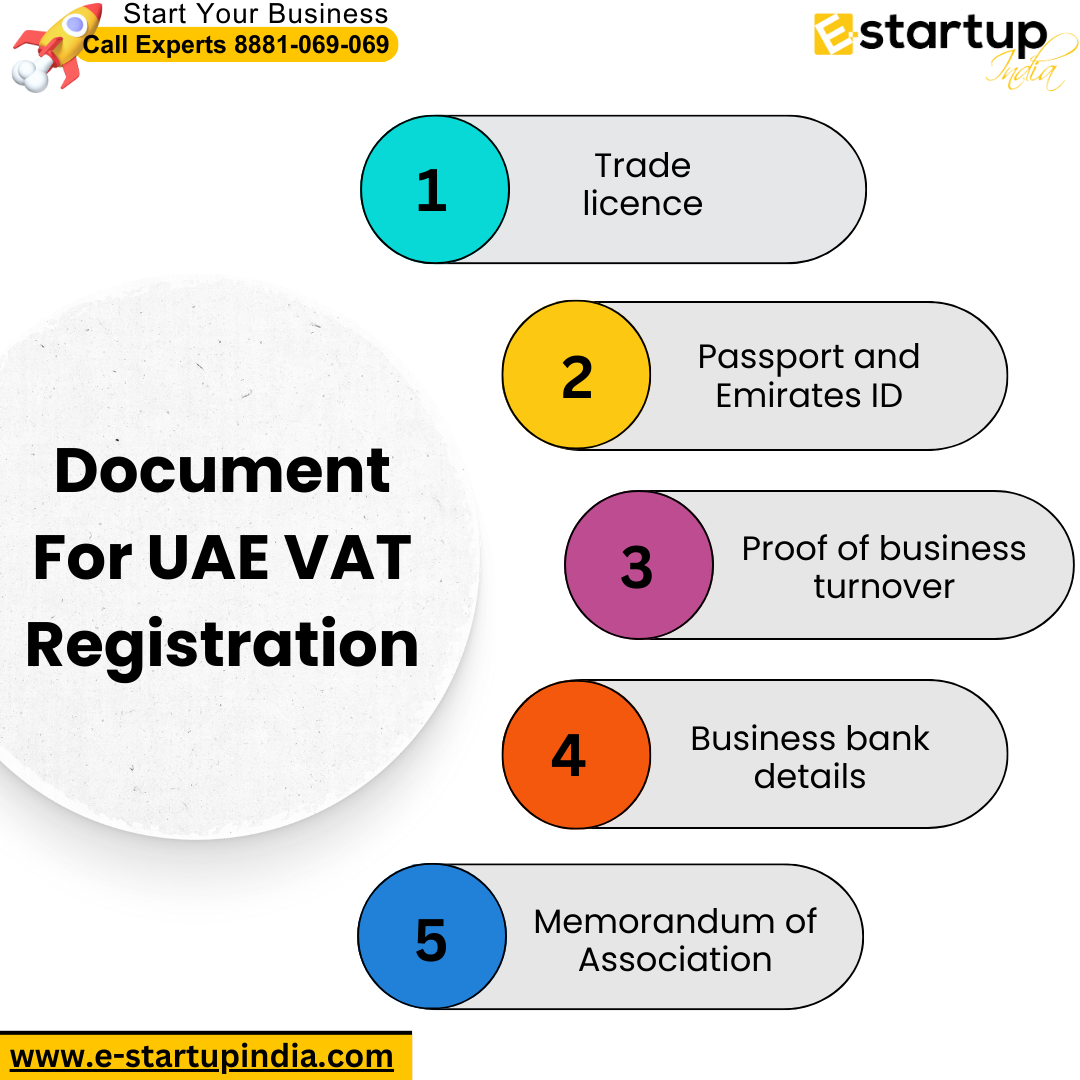

Document Required for UAE VAT Registration

To complete VAT registration in the UAE, you will need the following documents:

- Trade licence

- Passport and Emirates ID of business owner

- Proof of business turnover

- Business bank details

- Memorandum of Association (MOA)

VAT Filing in UAE

Once registered, businesses also need to file VAT returns regularly to stay compliant.

Most businesses file VAT returns quarterly, but larger businesses may need to file them monthly. Failing to submit VAT returns on time results in significant penalties.

How to Claim Input Tax Credit of VAT Paid on Purchases in UAE

Input tax credit allows businesses to reclaim VAT paid on business expenses. To claim this credit, you must:

- Ensure VAT has been charged correctly on purchases.

- Keep proper documentation, such as tax invoices.

- Include the VAT paid in your VAT returns.

Key Benefits of UAE Company Registration for VAT

UAE company registration for VAT ensures compliance with the law and provides several advantages:

- Ability to claim input tax credits.

- Enhanced financial transparency.

- Avoidance of fines and penalties from the FTA.

FAQs about VAT in the UAE

- What is the Tax Registration Number (TRN)?

A TRN is a unique identifier issued to businesses upon VAT registration. It is used in all VAT transactions. - What happens if I don’t register for VAT?

Failure to register can result in fines and penalties which can damage your business and its reputation as well. - Can I voluntarily register for VAT?

Yes, businesses with taxable turnover between AED 187,500 and AED 375,000 can voluntarily register for VAT. - How often do I need to file VAT returns?

VAT returns are typically filed quarterly, though some businesses may need to file monthly based on their size. It is best to consult with an expert and - What is the mandatory VAT registration threshold?

The mandatory VAT registration threshold is AED 375,000 in annual taxable turnover. - What documents are required for VAT registration?

You will need a trade licence, passport, Emirates ID, proof of turnover, and other business details. - How can I claim input tax credit on VAT paid?

Input tax credit can be claimed on business purchases by ensuring proper documentation and reporting it in VAT returns.

Moreover, If you want any other guidance relating to VAT Registration in UAE, Corporate Taxes in UAE, or UAE Company Registration, please feel free to talk to our experts at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.