![instabill]() Instabill

Instabill

|

|![instabill]() Instabill - GST Invoice, Payment & Inventory Software

Download for FREE |

Instabill - GST Invoice, Payment & Inventory Software

Download for FREE |

- Offers

![Offers]() |

| - Learning Resources |

- LOGIN/SIGN UP |

- 8881069069

|

|Enjoy the Strategic Location, No Corporate Taxes, Tax Free Zones and much more through Company Registration in UAE, Ras Al Khaimah and Sharjah. Simply share documents. We will deliver the Incorporation Certificate, Mandatory Licenses and the Bank Account in UAE.

Neo Bank provides global bank accounts and cross-border remittance solutions, ensuring seamless international transactions.

Razorpay simplifies payments and business banking for seamless transactions and financial management.

GoDaddy, a global leader in domains and hosting, powers businesses with secure, user-friendly web solutions.

Trusted by millions, Tally automates accounting for accuracy, & compliance for businesses

The United Arab Emirates (UAE), sometimes known as the Emirates, is a Middle Eastern country. Abu Dhabi, Dubai, Ajman, Fujairah, Ras Al Khaimah, Sharjah, and Umm Al Quwain are the seven emirates of the United Arab Emirates (UAE). Nearly 7.8 million immigrants live in the United Arab Emirates, compared to 1.4 million Emiratis.

The political and economic climate of the United Arab Emirates is stable, making it an ideal place to do business. The World Bank's Doing Business 2017 Report places the UAE as the 26th most business-friendly country in the world overall.

Dubai, one of the major cities in the Middle East, offers a wide range of options for international investors looking to establish a variety of businesses. In order to keep the city growing, this city has opened up a wide range of possibilities. In addition, the Middle East is a major supplier of crude oil to the global market.

The country is becoming a major business center, with global corporations and start-ups alike finding a home in the Middle East. Dubai is a great area to do business because of its creative business sector and robust competition in the market.

Investors can select from a wide variety of UAE Company Registration types. Furthermore, There are a wide variety of business licenses and company activities to choose from. All across the Middle East, there are a variety of financial centers that make it easy to conduct a variety of business operations in Dubai.

Foreign ownership of a company is completely unrestricted in the DIFC(Dubai International Financial Centers). Thus, the directors and shareholders of a Dubai-registered business can hold One-Hundred Percent of the ownership of a company.

Now is the right time to start a business setup in Dubai or UAE because of recent changes in business rules making it easy for you to have UAE Company Registration.

Main Land Company

#1. Free to do any Business in Dubai or Outside Dubai

#2. Can open Showroom, Cafe, Saloon, etc in Main Land

#3. You can have 100% ownership Now *

#4. No restriction on the Number of Visas

#5. Easy to open a Bank account for Main Land Company

#6. Most trusted company by Vendors and Foreign Buyers

#7. Easy to manage and Operate

Free Zone Company

#1. Good for Import and Export Business outside Main Land

#2. Easy to setup Online

#3. No Need to Visit Dubai for opening Company

#4. Flexible to take Visa and office

#5. No Need of Yearly Audit *

#6. Most cost-effective for new Business Setup

#7. Easy Documentation

Offshore Company

#1. Good for holding Foreign Assets

#2. Mostly get open for Company structuring

#3. 3 Offshore Zone in Dubai

#4. Exempted from VAT

#5. Not allowed to do business in Dubai Main Land

#6. No Residence Visa for Employees

#7. 100% Ownership and confidentiality of Ownership

| Mainland UAE Company Registration | Freezone UAE Company Registration | Offshore UAE Company Registration |

|---|---|---|

| Only 49% of a company's shares can be acquired by an expat. | A corporation operating in a free zone does not have to adhere to the shareholding regulation. Thus, It is possible for an expat to own all of the company's stock. | Until and unless the firm is based outside the United Arab Emirates, an expat can hold full ownership of the business. |

| Any mainland UAE company must have a real office space of at least 200 square feet. | For a free zone corporation, there is no need for an office. A virtual office is an option for organizations that don't have a physical location. | No physical office can be established in the United Arab Emirates. They are free to have it elsewhere. |

| The United Arab Emirates does not have any restrictions on businesses that are based on the country's mainland. Furthermore, They are permitted to conduct business in any free zone in the United Arab Emirates. | If you have a firm set up in a free zone, you aren't authorized to conduct business outside of the zone. | Offshore UAE Company Registration allows you to conduct business outside of the emirates. However, you can't conduct business inside the UAE. |

| At the conclusion of each fiscal year, all mainland enterprises are required to conduct an audit. | Performing an audit isn't necessary for every Free Zone company. However, an audit of accounts is required for specific types of businesses. For example, Free zone corporations (FZCOs) and free zone establishments (FZE) must do an audit every fiscal year. | Audit is not mandatory for Offshore companies. However, If they wish to keep track of their finances, they can do it. |

| The size of a company's office or work space is taken into consideration when issuing a residency visa. | Similar to Mainland UAE Company Registration, A resident visa is granted based on the size of the office/work premises. | There is no need for a resident visa for an offshore firm formation because there isn't also any requirement for an office space. |

Dubai Mainland

Many investors opt to set up businesses on the mainland of Dubai. Doing business throughout Dubai and the UAE is a big factor for the mainland's attractiveness. It means if you incorporate a company in Dubai, you can operate your business anywhere in the UAE. There is, however, a detailed process for establishing a corporation on the Dubai mainland. Thus, Those who are interested in business setup in Dubai must meet a number of prerequisites first.

Sharjah Mainland

Among other emirates, Sharjah is the most secure and technologically sophisticated Emirate. Businesses can choose to locate in Sharjah Mainland, which has been divided into commercial zones by UAE government agencies. Furthermore, Sharjah Mainland Business Setup offers enormous development potential.

Businesses have flocked to the emirate's investor-friendly policies since 2000, making it one of the most popular locations in the Middle East. More and more foreigners and overseas companies are deciding to set up business in Sharjah Mainland because of the emirate's rising prominence as a significant business location.

Abu Dhabi Mainland

One of the extremely fast and wealthiest marketplaces in the world is located in Abu Dhabi, the capital of the United Arab Emirates. However, in addition to oil production, the Emirate is well-capitalized in the areas of residential and commercial construction as well as industrial expansion and retail sales. Thus, Abu Dhabi Mainland is a fantastic place to start a business because of its excellent location and diversified and increasing economy.

Ras Al Khaimah Mainland

There are a lot of international investors in RAK because it's one of the most advanced markets in the Emirates and has witnessed tremendous growth. When it has a strong existence in the UAE, it helps create long-term consumer connections and establishes trading relationships in the UAE.

Fujairah Mainland

Fujairah has experienced rapid growth over the previous decade and is now a popular investment destination. Entrepreneurs and investors from all over the world are increasingly interested in setting up commercial operations in Fujairah.

Ajman Mainland

Ajman, which is the smallest of the UAE's seven emirates, has minimal startup and operating costs for businesses. International investors, small and medium-sized businesses, and young entrepreneurs are all drawn to Ajman's numerous benefits.

Umm Al Quwain (UAQ) Mainland

Umm Al Quwain (UAQ) is steadily becoming one of the best places to start a company in the United Arab Emirates. UAQ is regarded to be an ideal place for small enterprises and micro-businesses alike. Since there is so much opportunity for new enterprises in this area, prospective company owners might consider opening up a company here to get their businesses off the ground.

A Free Zone is an area where products and services are allowed to be exchanged at favorable rates of taxation and customs. They provide unique advantages, such as the ability to own a 100% stake in a foreign firm. Thus, A free zone organization is one that has been set up within the authority of a certain Emirate. The Free Zone Authority is a governmental regulatory agency that oversees free zone areas and it issues trade licenses. There are several free zones out of which best ones are mentioned as follows:

ABU DHABI

#1. Abu Dhabi Global Market (ADGM)

#2. Abu Dhabi Airport Free Zone (ADAFZ)

#3. Khalifa Industrial Zone Abu Dhabi (KIZAD)

#4. Masdar City Free Zone (MCFZ)

AJMAN

#1. Ajman Free Zone (AFZ)

#2. Ajman Media City Free Zone (AMCFZ)

DUBAI

#1. Dubai Multi Commodities Center (DMCC)

#2. Dubai Design District (D3)

#3. Dubai South / Dubai World Central (DWC)

#4. Dubai International Financial Center (DIFC)

#5. Dubai Silicon Oasis Authority (DSOA)

#6. Dubai Technology Entrepreneur Campus (DTEC)

#7. Dubai Airport Free Zone Authority (DAFZA)

FUJAIRAH

#1. Fujairah Free Zone Authority (FFZA)

#2. Creative City Fujairah Free Zone (CCFZ)

#3. International Free Zone Authority (IFZA)

RAS AL KHAIMAH

#1. Ras Al Khaimah Economic Zone (RAKEZ)

SHARJAH

#1. Sharjah Research Technology and Innovation Park (SRTIP)

#2. Sharjah Publishing City (SPC)

#3. Sharjah Media City (SHAMS)

UMM AL QUWAIN

#1. Umm Al Quwain Free Trade Zone (UAQFTZ)

#1. Companies in the Tax Free Zone do not need to pay any taxes.

#2. Can get lifetime business visa.

#3. Unrestricted ownership for all investors, regardless of where they live or where they are from.

#4. Repatriation of all revenue and capital.

#5. Imports and exports are exempt from all taxes and fees.

#6. Entrepreneurs in Dubai have access to a large pool of talent.

#7. Dubai is a cosmopolitan metropolis with one of the world's largest financial centers.

#8. A corporation in Dubai enables the investors to register a corporate bank account, take workspaces in Dubai, and obtain a resident visa for the firm.

#9. Limited liability companies in Dubai provide investors with a sense of security in terms of flexible operational processes, firm ownerships, lower risk of investments, and hiring staff members.

To have UAE Company Registration from India or business setup in Dubai, you must fulfill the following eligibility criteria.

#1. Minimum One Person and Maximum Fifty Partners can incorporate company in UAE

#2. You are eligible to have any legal business setup except banking and insurance.

Professional Trade License

Professional Trade License is granted to those who are engaged in professional license activities, such as the provision of any form of professional licensing service. Designers, artists, and other types of service providers fall under this category. However, in order to receive a professional license in Dubai, the business must be managed by one individual. However, you must have an Emirati citizen serve as your service agent, also known as Wakeel e Khidmat, in order to be eligible. There will be no direct intervention from this agent in the organization.

VAT

The UAE charges only 5% VAT on all taxable supplies of goods and services at every step of the supply chain. Because it is levied on the sale of goods and services, the value added tax, or VAT, is also considered as consumption tax. However, businesses can take a refund on VAT through VAT Returns. So, VAT is mandatory only in specific conditions such as businesses that sell or import products and services worth more than 375,000 AED per year.

Corporate Tax

The Government of the UAE does not impose any uniform corporate income tax. However, Corporate taxes apply only to large petrochemical industries and international banking organizations. Additionally, Dubai has struck a number of tax treaties with other nations, making it even more attractive to international investors.

Lifetime Investor VISA

In order to attract affluent or highly qualified foreign nationals, the UAE government has introduced a new immigration option known as the UAE Long-Term Residence Visa. Visas given under this category can last anywhere from 5 to 10 years and renew automatically, as per the applicant's eligibility.The new rules and regulations allows foreigners to settle, trade, and get education in the UAE without the requirement for a resident sponsorship and with complete ownership of their company.

Bank Account Opening

Online banking, a stable local currency exchange rate against the US dollar, and no restrictions on money transfers back to one's home country are all standard features at all UAE banks.

#1. Decide the business activity

Depending on the nature of your business, you may or may not be able to open up a firm in some free zones. When it comes to establishing a business in a free zone, there are a number of factors to consider, such as closeness to other firms in the same industry. You also need to consider the transportation options as well. Hence, you will need to decide the business activity as a primary step before business setup in Dubai.

#2. Find the unique and Legal Company Name

To avoid any misunderstandings or rejections, you should double-check that your proposed company name is in accordance with UAE naming rules through consultation with experts. Inappropriate names and company names that relate to Allah, Him or any social or spiritual organizations, such as the FBI or Gangsters, are prohibited. There must be a partnership or ownership stake in the firm if you want to utilize a person's name in the name of the company. Anyone can reserve the company name by applying with the Department of Economic Development.

#3. Hire UAE National Sponsor

Before filing a company setup registration form, you need a sponsor who is a UAE national. This mandatory requirement in order to comply with Federal Commercial Companies Law No. 2 of 2015 (Companies Law). However, if the applicant wants to set an office within the DIFC, then the requirement of a sponsor would not be required.

#4. Ownership allotment for only mainland UAE Company Registration

51% ownership controlling stake to be held by an UAE national if the applicant wants to set up a company outside the DIFC or in Mainland. However, if you want to have a business setup in dubai at a free zone, you can have 100% ownership of the company.

#5. Prepare an Application for Business Setup in Dubai

An application for your selected business name and activity must be submitted to the proper government agencies, together with other relevant documents such as shareholder's passports. Furthermore, Documents like business plans or a Non-Objection Certificate (NOC), which confirms that you are permitted to have a business setup in Dubai, may be required in some free zones.

#6. Obtain Mandatory License

Some businesses need to apply for licenses to start operating their business in Dubai. After we deliver your company documents, we will apply for a Mandatory License as per your business requirements. After the successful verification from the UAE Government, the licenses will be delivered to your inbox. The three main licenses to operate business in dubai are:

- Commercial License

- Industrial License

- Professional License

#7. Current Bank Account Opening in UAE

After receiving the company incorporation and license documents, we will apply for the Current Bank Account. UAE offers multiple national and international banks. Choose your own bank, or let business advisors set up meetings with a number of banks to help you figure out which one is best for you.

#8. Get Visa Approval

This is the last step in setting up a business in Dubai. Besides getting your own visa, many free zones permit you to have visas for your employees and their families. Hence, consultancy with experts is most valuable here as you will be able to get visas for others too.

Find and Hire UAE National Sponsor

Find and obtain Registered Office for Company

Reserve Company Name

Draft MOA & AOA of the Company

Apply Company Incorporation application with Department of Economic Development and the Companies Registry

Obtain Certificate of Incorporation

Apply required licenses based on business activity. The following licenses are present in Dubai:

- Commercial licenses covering all kinds of trading activity;

- Professional licenses covering professions, services, craftsmen and artisans;

- Industrial licenses for establishing industrial or manufacturing.

Open Business Bank Account

Deliver All Documents and Certificates

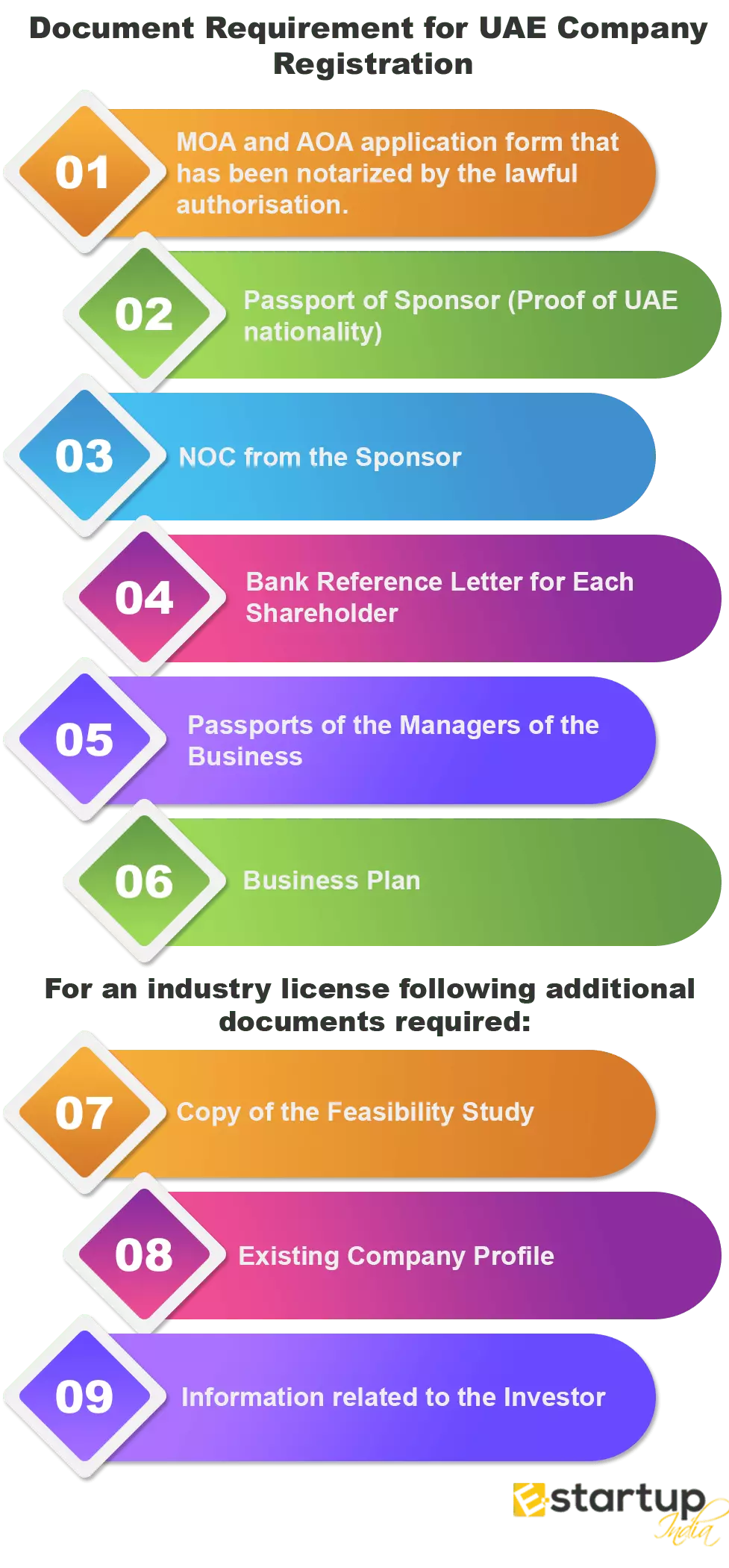

Following are the documents mandatory for Business Setup in Dubai from India.

#1. MOA and AOA application form that has been notarized by the lawful authorisation.

#2. Passport of Sponsor (Proof of UAE nationality)

#3. NOC from the Sponsor

#4. Bank Reference Letter for Each Shareholder

#5. Passports of the Managers of the Business

#6. Business Plan

For an industry license following additional documents required:

#1. Copy of the Feasibility Study

#2. Existing Company Profile

#3. Information related to the Investor

You might also need to provide some other important documents depending upon the business entity that you will form.

The time taken to set up a company in the UAE can vary depending on several factors, such as the type of company, the specific jurisdiction within the UAE, and the efficiency of the application process.

#1. In high-income countries, according to the World Bank, it generally takes 10 days for Company Registration in UAE.

#2. Through the Department of Economic Development, it can take up to 4 days to set up a company in the UAE.

#3. Using the Basher Online platform, you can establish a company in the UAE within 15 minutes.

We have a top-notch team of experts that can quickly and efficiently register an Indian company in the United Arab Emirates. Our services are error-free and hassle-free, and they can help you transform your ideas into reality. Every day since 2014, our experts have been registering companies online and keeping up with the latest modifications in the process. Consequently, we are able to offer you the quick and easy service in India.

There are Chartered Accountants, Lawyers, and Company Secretaries on each of our teams. We have dealt with a range of financial services throughout the years, including export-import, company compliance, taxation, and accounting. In addition, our prices are reasonable.

So, Now it's your opportunity to get your business off the ground legally throughout the world. We're here to help you every step of the way whether you're looking to setup a business in Dubai or anywhere in the United Arab Emirates.

Dubai International Financial Center (DIFC) is a designated commercial area in Dubai. The presence of 7 members in UAE has made doing business in DIFC much simpler. They all have financial centers, each with its own set of rules and regulations.

In order to register a business setup in Dubai, you must have a local sponsor.

The sponsor must be a UAE national if you want to have a business setup in Dubai DIFC or UAE DIFC.

Registration of corporations in Dubai is overseen primarily by the Companies Registry.

Ownership is the fundamental distinction between these two locations. 100% foreign ownership is permitted in DIFC areas. Only 51 percent ownership is permitted in non-DIFC areas.

You may start a business with ease in Dubai since the city's administration offers incentives to international investors. An offshore corporation or free zone can be set up easily. It's simple, quick, and affordable. However, A partnership with UAE residents is required if he or she wishes to launch a business on the mainland. Furthermore, establishing a firm on the mainland is more expensive than doing it in a free zone or offshore.

The United Arab Emirates (UAE) is a federation which was formed in December 1971 between Abu Dhabi, Dubai, Sharjah, Ajman, Fujairah, Umm al-Quwain and Ras al Khaimah. These 7 are known as Emirates and collectively addressed as the United Arab Emirates.

Under the new corporate law, the UAE government makes available citizenship to those companies which fulfill certain criteria. For more information about UAE Offers Citizenship to Businesses Under New Law, read the blog.

January 12, 2026

start your heavy equipment trading business in the UAE with the correct licensing and legal structure— Read the blog to learn the detailed information about starting a heavy equipment trading business in the UAE.

January 9, 2026

UAE 2026 brings new rules, sustainability goals, and flying taxis. Learn why this is the right time for UAE company registration. Go to the blog to find out all the details about UAE 2026 Business Rules, Flying Taxis & Company Registration

December 30, 2025

Serving business owners with an Average 4.8+ Google Rating.

Trusted by Axis bank to cater its clients all licensing & compliance needs.

Providing lending solutions for business needs with NeoGrowth.

Open Neo bank account worldwide & provides cross-border remittance solutions.

E-startup is a Proudly Member of Confederation of Indian Industry.The CII is a premier business association in India which works to create an environment.

E-Startup is duly certified under GOI's Startup scheme and is renowned for our tech-driven solutions for business & legal services requirements for MSMEs.

E-Startup is a Google Partner, which implies we are rigorously involved in assisting SME businesses to market their presence in the digital world.

Private Limited Company | Public Limited Company | One Person Company | Limited Liability Partnership | Partnership Firm | Sole Proprietorship Firm | Section 8 Company Registration | USA Company Registration | UK Company Registration | UAE Company Registration | Singapore Company Registration | Company Registration Hong Kong | Import Export Code | IEC Modification | AD Code Registration | Spice Board Registration | US FDA Certification | ISO 9001 2015 | ISO 14001 EMS | ISO 22000 FSMS | ISO 27001 ISMS | ISO 50001 Energy Management | ISO 45001 | ISO Surveillance | ISO Certification | MSME Registration | FSSAI Registration | Shop Establishment Registration | Barcode Registration | Coffee Board Registration | Startup India Certificate | ZED Certification | Trademark | Trademark Objection Reply | Trademark Opposition | Trademark Hearing | Trademark Formality Check Fail | Website Development | Patent | Copyright | Design Registration | Business Name Suggestion | Logo Designing | Trademark Assignment Service | GST Registration | GST Modification | GST Cancellation | GST Return Filing | GST Invoice Software | UIN Registration | Income Tax Return | Income Tax Notice | Income Tax Refund | Income Tax Assessment | TDS Return Filing | Form 15CA / CB | Professional Tax Registration | 12A and 80G Registration | FCRA Registration | CSR Registration | Project Report | Pitch Deck | Seed Fund Startup India | Accounting for Ecommerce | Virtual cfo services in india | Bookkeeping & Accounting | Private limited Company Annual Compliance | Form INC-22A | Form 15CA / CB | Company Strike Off | Commencement of Business | Fssai annual return | Online CA Consultancy | Income Tax Return Filling | LLP Annual Compliances | Form DIR-3 KYC | Virtual Office for Company Registration | Dubai Company Registration | Business registration for USA | Business registration for UAE |

Instabill

Instabill

|

|