India’s garment industry is among the oldest and biggest contributors to the nation’s economic growth in terms of GDP, employment, and export promotion. Both skilled and unskilled employees are employed in the textile industry, one of the nation’s oldest and second-largest manufacturing sectors. As a result, businesses must understand about GST on Apparel, Clothing and textile products.

What is the Goods and Services Tax?

An easier way to pay taxes, the Goods and Services Tax (or GST), was introduced on July 1, 2017. It is imposed on everyone involved in the nation’s supply of goods and services. Service taxes, excise taxes, and other taxes that were in place before the GST implementation and have been replaced to bring about uniformity in the indirect tax structure.

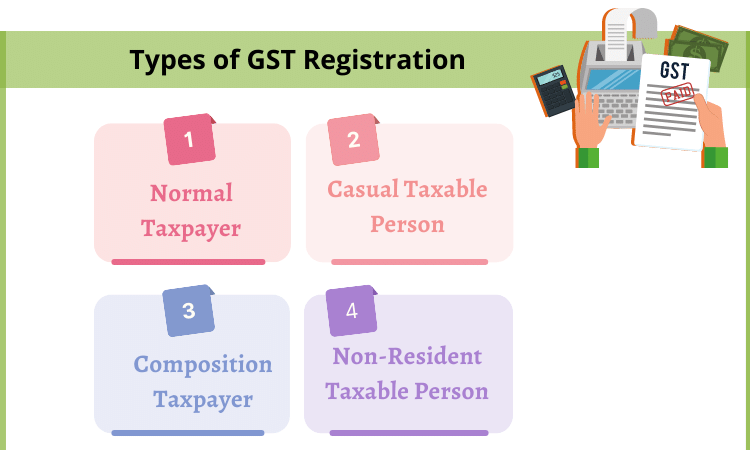

It is an indirect tax and businesses are required to collect it while supplying goods or services. Each business as per their eligibility applies for GST Registration and gets a unique GSTIN.

If you wish to get a new GST Registration, contact our GST Experts at: 8881-069-069 or read our guide at: How to get Gst on Textile Product Registration if I am starting a new online business.

HSN Code and GST rate for clothing

The HSN code’s Chapter 61 regulates knitted clothing and accessories. Non-knit clothes and accessories are included in Chapter 62 of the HSN code. Any article of apparel or clothing will be subject to a 5 percent Gst on Textile Product under both categories if the taxable value of the goods does not exceed INR 1000 per item. On the other hand, 12% GST Rate applies to all types of clothing and garments with a retail value greater than INR 1000.

Learn about HSN Codes at: All you need to know about the GST HSN code and find the list of HSN Code with the rates.

Documents needed to register for GST

- the company’s PAN card

- Documents that serve as evidence of a incorporation of a company including partnership agreements, MOA, AOA. The applicant’s passport-size photo

- Details of the Authorized signatories

- Details of the applicant

- Electricity bills, title documents, copies of municipal khatas, property tax receipts, and rental agreements prove the principal place of business (anyone)

- Proof of Bank Account Information (Anyone), such as the first page of a passbook, a bank statement, or a cancelled check

For detailed document requirements for online GST Registration as per your business, you can write to us at: info@e-startupindia.com

Process for Online GST Registration

- Access the GST Portal for gst registration

- By completing OTP Validation, create a TRN.

- TRN will now be used to submit the GST registration application.

- Enter all the required details according to the application form.

- Follow up with application status.

- After successful verification, download the GST Registration Certificate.

What are the benefit for applying for the gst number in india

Summary

Generally, 12% is the rate of GST on Textile Products and 5% GST is levied if the price of footwear is below 500 and the price of clothing is below 1000. If you wish to start a garment business in India and need any guidance or assistance contact our experts at: 8881-069-069.