There has been a change in the form of indirect taxes in India since the introduction of the Goods and Services Tax (GST) on July 1, 2017. The GST is a comprehensive tax that replaced all the previous indirect taxes, including the Central Sales Tax (CST), State Sales Tax (SST), Service Tax, etc. This article discusses the GST provisions and their impact on India’s hotel and tourism industry.

What is GST?

GST is the new taxation system in India that came into effect from July 1, 2017.

Previously, there were multiple taxes that the hotel and tourism industry had to pay, such as VAT, Central Excise duty and Service Tax. With the implementation of GST, all these taxes have been subsumed into one.

The main difference between VAT and GST is that while VAT is a fixed tax levied on every purchase made, GST is a sliding tax where the rate increases as the value of the purchase increases.

Additionally, with GST now in place, businesses will no longer have to worry about customs and export duties which can be quite burdensome.

Rates of G.S.T. in the Hotel & Tourism Industry

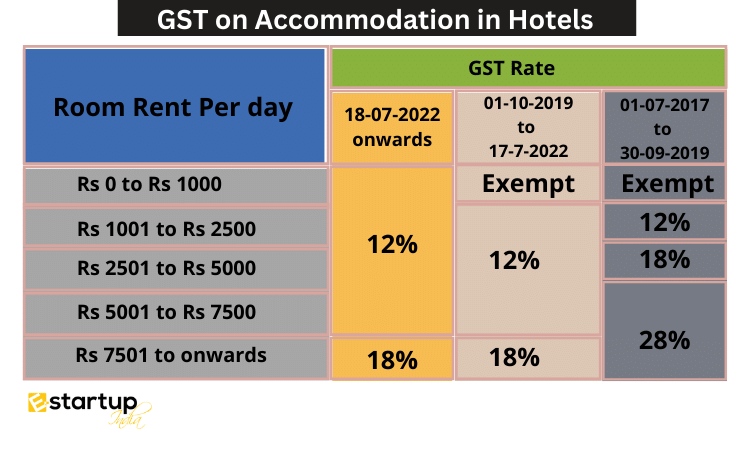

Since 18th July 2022, budget holidays have become 12% more expensive. Service supplies such as hotel accommodations are subject to G.S.T. @ 12% or 18% (S.A.C. Code – 9963).

As part of its efforts to give the tourism/hotelier industry breathing room in 2019, the government lowered the G.S.T. rates for the highest category of hotel room rates. As of 2022, the government will directly tax the lowest class of room rents by imposing a hefty 12% general sales tax on those rooms that are exempt from taxes.

Learn more at: How much GST on Hotel Business?

What is covered by hotel accommodations?

A hotel can be defined as any hotel, inn, guesthouse, club, campsite, or commercial establishment used for residential or lodging purposes. Units of accommodation are billed per day based on a per-unit price.

When shall G.S.T. not be levied by Hotels?

Since 18th July 2022, G.S.T. will not be charged to hotels that do not require GST registration to provide accommodation services. However, these businesses can get Voluntary GST Registration.

G.S.T. Rates on accommodation in Hotels 18th July 2022 and onwards

The G.S.T. Council decided in its 47th meeting to withdraw the exemption for room rents between Rs 1000 and Rs 5000 per day. Furthermore, the GST Rate Changes were introduced which had a direct or indirect impact on the Hotel and Tourism Industry.

GST: Pros and Cons

- As a whole, it is beneficial to both consumers and businesses. You can know more about the Benefits of GST on Business and Consumers.

- It simplifies tax rates and makes tax obligations easier to understand for consumers.

- Businesses will have an easier time complying with government regulations with GST.

- Tax rates will be easier to understand when tourists make travel plans.

- Streamlining the Indian hotel and tourism industry will become more efficient and profitable.

It eliminates the cascading effects that increased prices for travelers, reduce hotel margins, and increase input costs.

Wrap-Up

The GST council has withdrawn various tax exemptions from India’s hospitality and tourism industry. The most important withdrawal is the exemption of GST on hotel rooms up to Rs 1000 per night.

This means that from July 18, 2022, hotels will have to pay GST on all room rates, including the rate of Rs 1000. It is a big change for the hotel industry in India, and you must be aware of all the details to make informed decisions. Keep an eye out for future updates on this topic, as they may impact your business. However, GST Registration and GST Return Filing is beneficial for Hotels and other related businesses and you must get it for your business to avail the benefits of GST. Also read:GST on Catering Services | GST on Banquet hall

Moreover, If you want any other guidance relating to GST Registration online, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.