According to the Indian government, there have been some significant changes to the rates of GST on gold. GST on gold will be a fixed GST percentage of 4%. This is quite different from the current system where you would have to calculate the GOLD GST rate based on the weight and purity of the solid gold.

Additionally, the government has also announced, that they’d be introducing a new e-invoicing system in gold shops. Such a system simplifies the invoicing process making it easier for businesses to comply with GST regulations.

Let’s see it all in detail.

What is GST on Gold?

GST or Goods and Services Tax is an exclusive tax on the supply of services and goods in India. The GST on gold varies depending on the type and also the services associated with it.

GST’s Impact on Gold

GST registration on gold has significantly affected the gold market in India. Since this introduced a unified tax structure, GST changed how the government would tax gold.

It’s also taxed at various stages like manufacturing, purchasing and importing. This has affected the gold jewellery market in several ways.

With the new GST rate era, the price of gold is going up. There has been a price hike from 1.2% to 3%.

More Transparency

Under the new tax regime, gold dealers must precisely document every transaction. This results in improved accountability for the gold trade in the markets. For a sector where only 30% is recognised as organised, the GST system aims to enhance the transparency in gold dealings.

Economic Significance

The GST rate is closely tied to the industry’s economic growth. Changes in tax rules can affect the financial contributions from the gold trade, influencing how the business supports the economy. A balanced approach between industry operations and tax rules is needed to maintain a strong gold market.

Free Trade Agreement

One of the advantages of the new GST system is the free trade agreement. This allows dealerships to import gold without any customs duty. Importers who have GST registration can get gold from countries like South Korea sans the 5% customs duty.

Boosts Organised Sector

GST is giving a boost to the gold industry’s organised sector. With fair dealings in gold and a simple tax regime, the GST implementation has led to improved customer assurance when it comes to buying gold from organised vendors.

Retailers from the organised sector offer quality assurance, increased customer experience, and uniform pricing, thus getting a competitive edge.

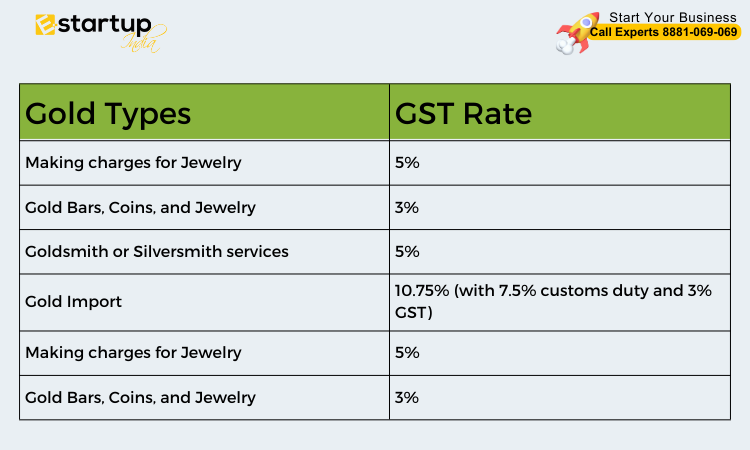

Do you want to know the exact GST rate on types of gold? Check them out below.

GST Rate of Different Types of Gold

Conclusion

As you saw, the new GST rates and regulations have brought significant changes to the gold market in India, impacting costs, transparency, and the organized sector. For businesses and individuals navigating these changes, expert advice is crucial.

Contact E-StartupIndia to consult with the best Chartered Accountants on filing taxes and GST registration.

Moreover, If you want any other guidance relating to GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.