If the GST rules don’t apply to you or you’re closing your business or profession, or if the tax officer asks you to cancel, you can cancel your GST registration.

Let’s learn the process to do GST Cancellation through this article.

Steps to do GST Cancellation Online

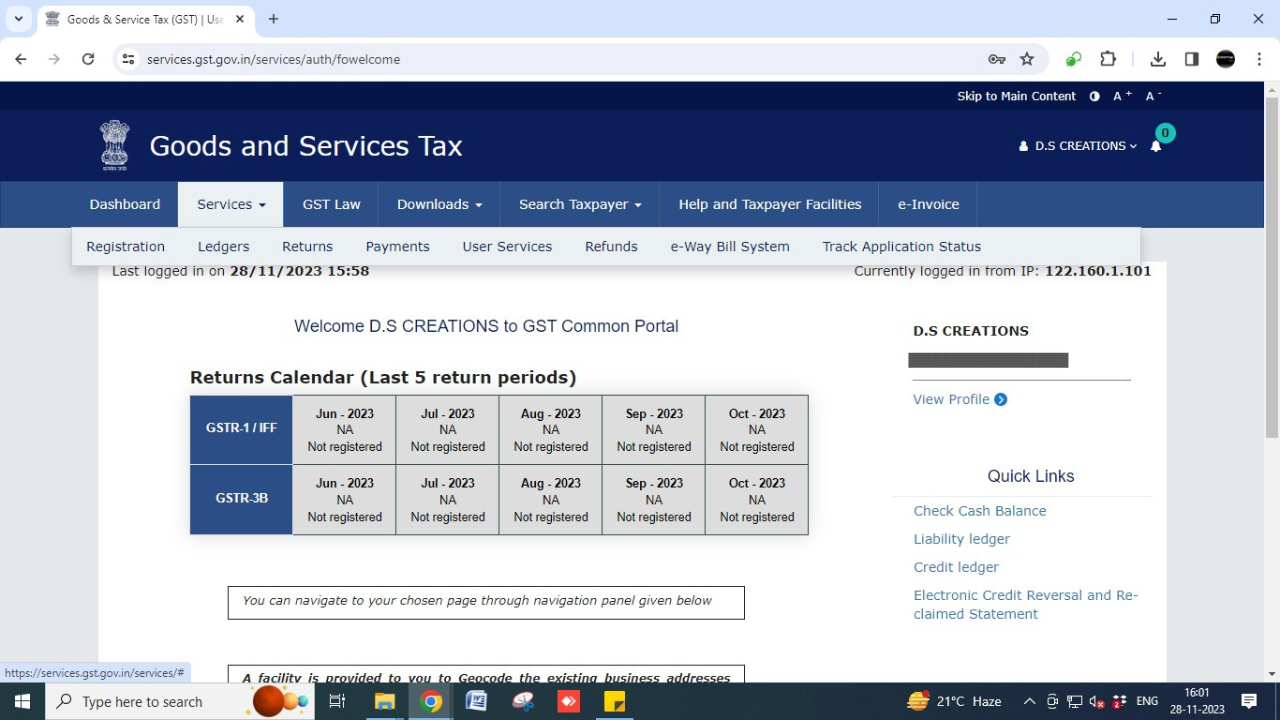

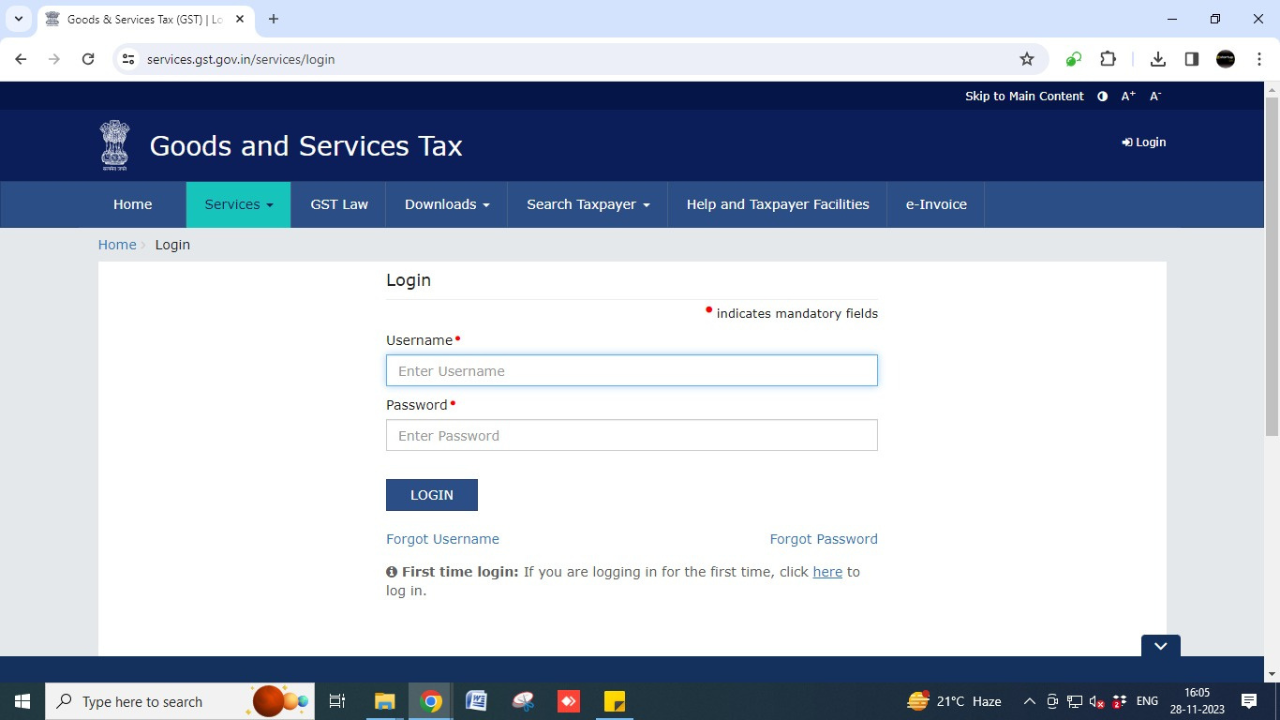

Step 1: Firstly, Log in to the GST portal.

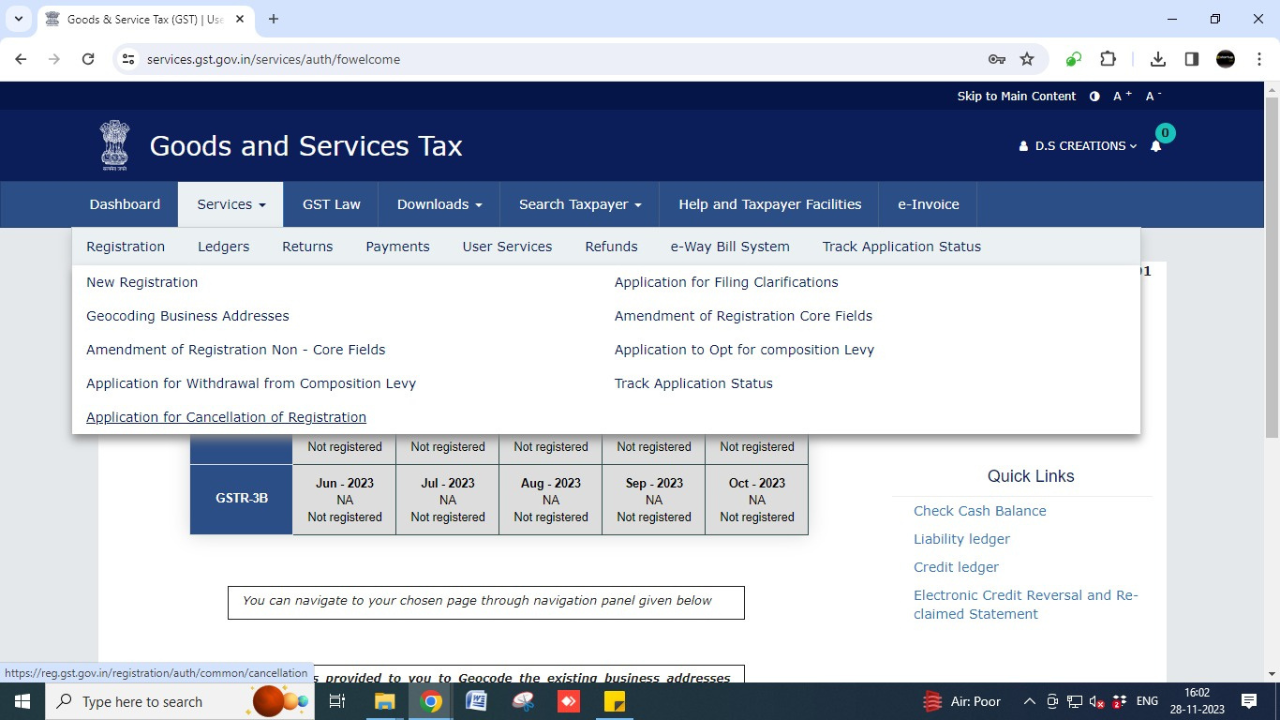

Step 2: Go to Services > Registration > Application for Cancellation of Registration.

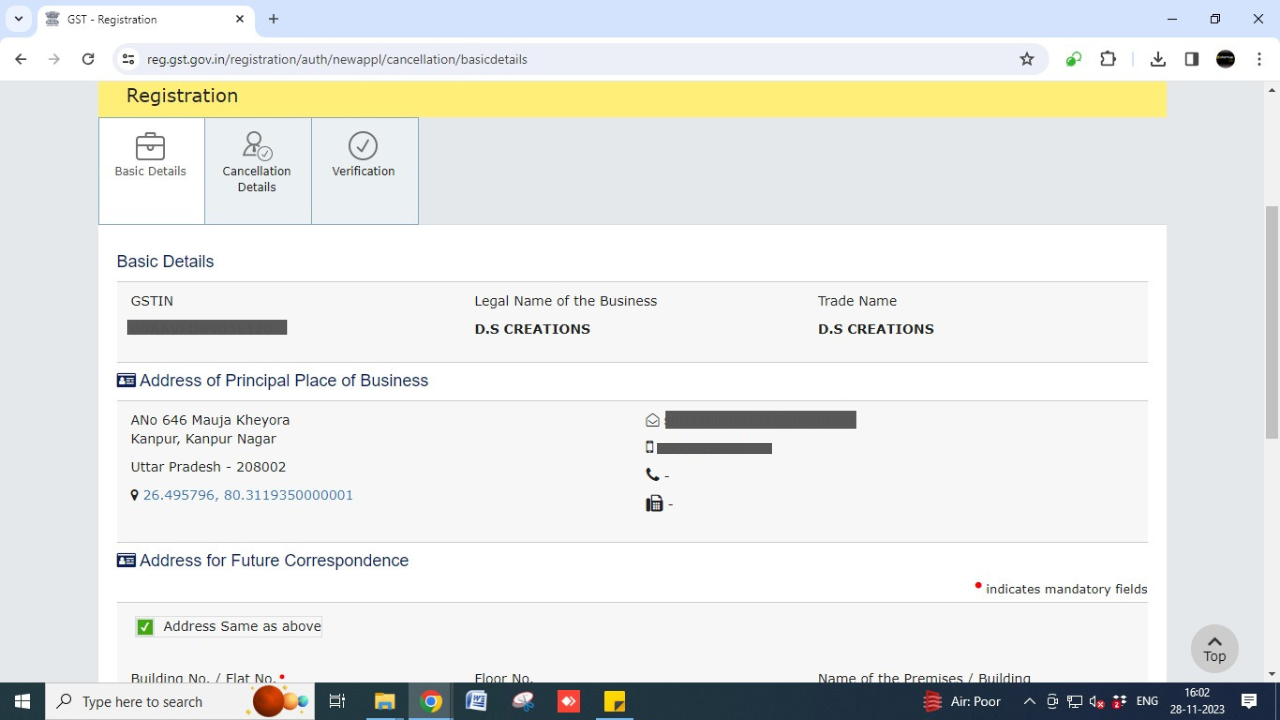

Step 3: On the ‘Application for Cancellation of Registration’ page, there are three tabs. Select the ‘Basic Details’ tab. This tab collects pre-filled information.

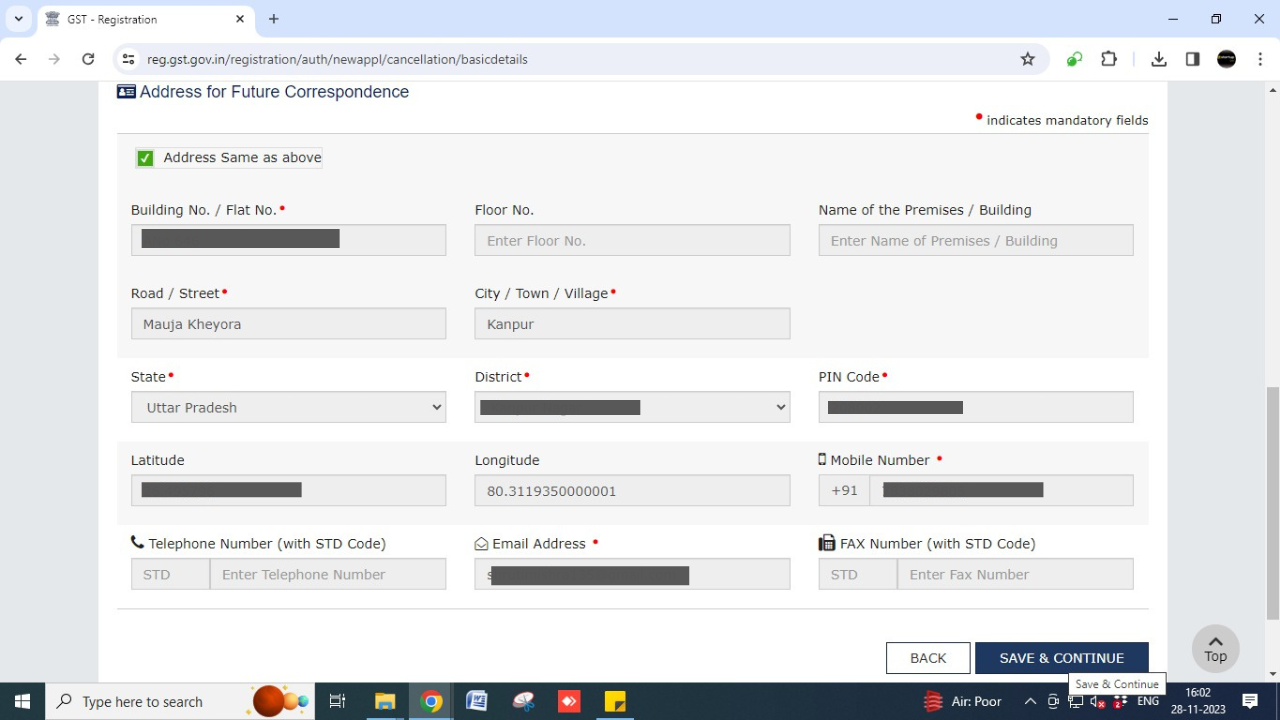

You can either manually fill in the ‘Address for Future Correspondence’.

Or, you can also choose ‘Address Same as above,’ which is the address of the main business place. Click ‘Save’ to continue updating the form.

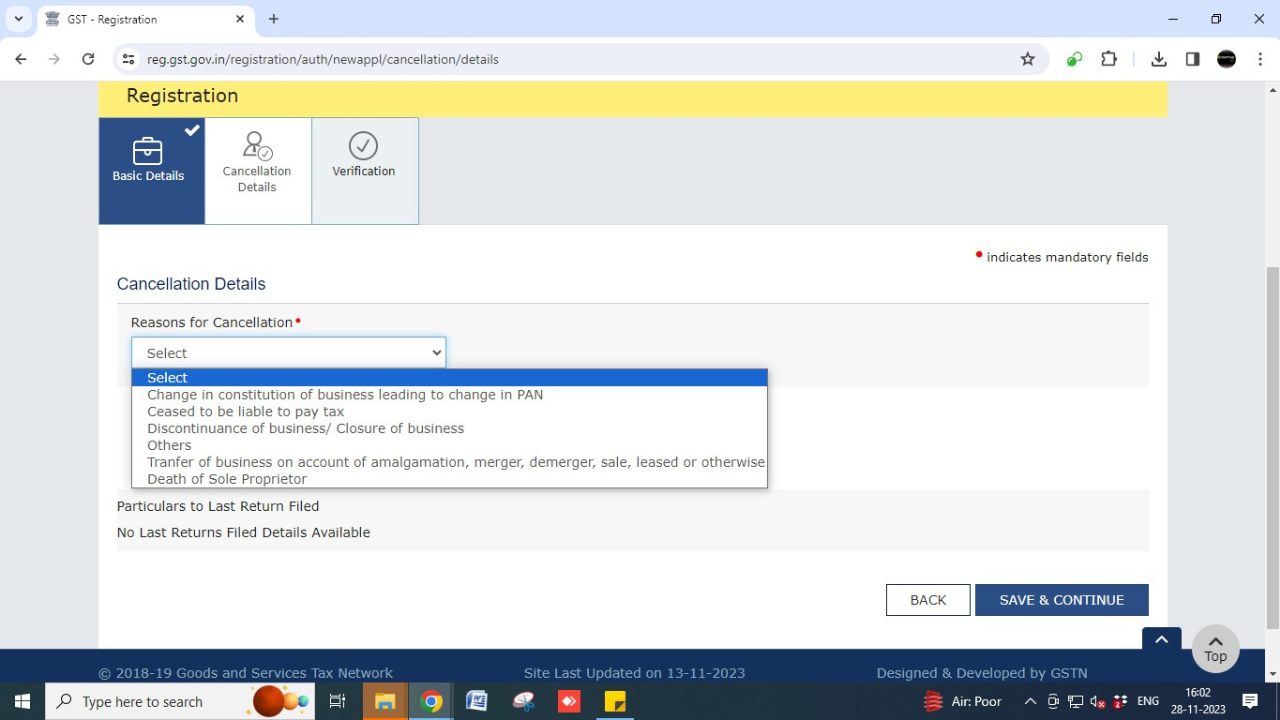

Step 4: Choose the reason for cancellation from the drop-down list

Then, Depending on the reason, different options will appear:

Reasons to do GST Cancellation Online

- Change in PAN due to change in the constitution of business: Select the cancellation date and update the GSTIN of the new entity under ‘Details for Transfer, Merger, or Change in Constitution.’

- Ceased to be liable to pay tax: Input the cancellation date, update stock and tax liability, and details for offsetting from the electronic cash or credit ledger.

- Discontinuance of business/Closure of business: Select the cancellation date, update stock and tax liability, and details for offsetting from the electronic cash or credit ledger.

- Others: Mention the reason for cancellation, update stock and tax liability, and details for offsetting from the electronic cash or credit ledger.

- Transfer of business due to amalgamation, merger, de-merger, sale, leased, or otherwise: Select the cancellation date and update the GSTIN of the new entity under ‘Details for Transfer, Merger, or Change in Constitution.’

Step 5: Click ‘Save and Continue’ to complete the second tab.

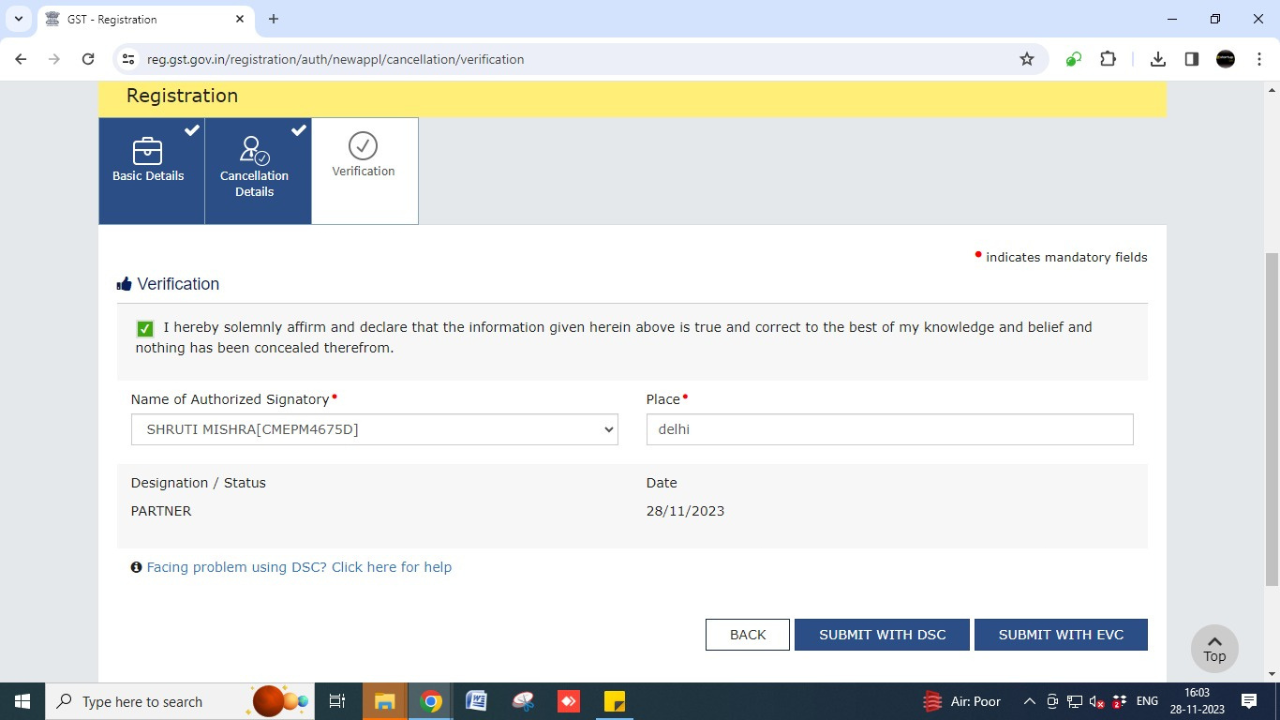

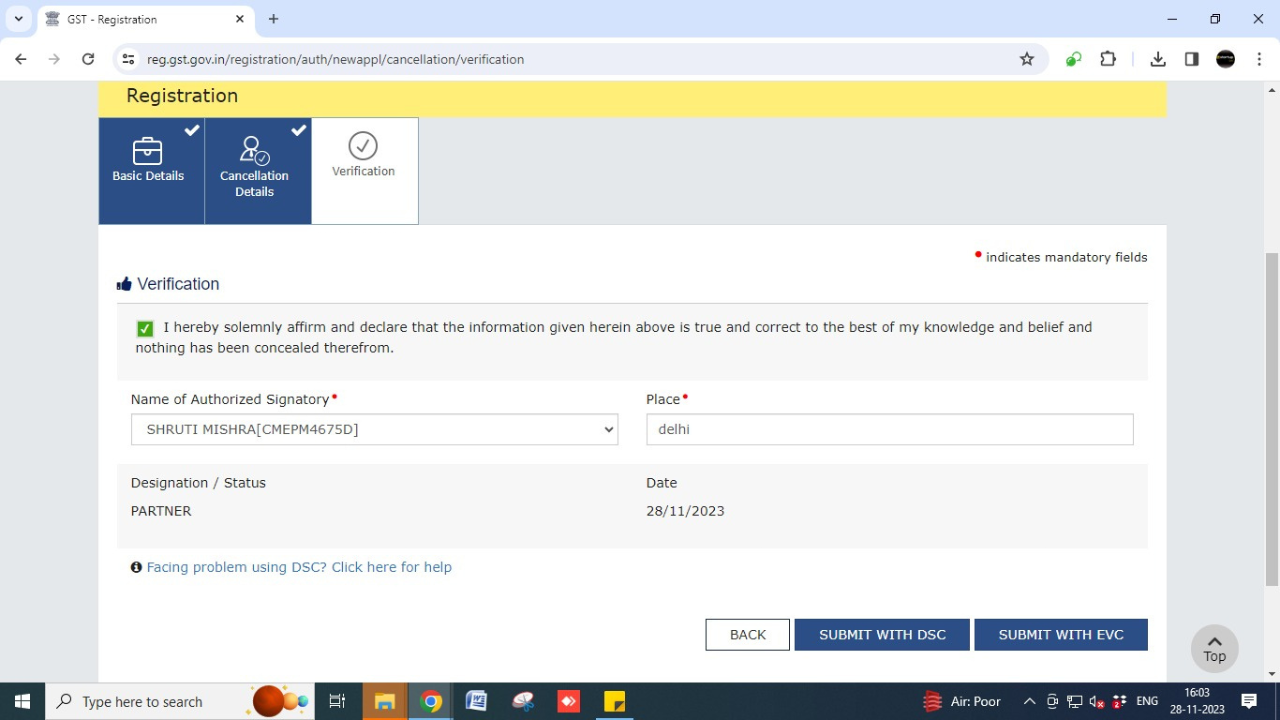

Step 6: The ‘Verification’ tab will be activated. Select the verification statement box. Afterwards, declare that the information is true and correct, choose the authorized signatory from the drop-down list, and enter the place.

Step 7: Sign the application form using the DSC(Digital Signature Certificate) or EVC(Electronic Verification Code) option.

Step 8: Lastly, Input the OTP and click on ‘Validate OTP.’

Important Things to know for applying GST Cancellation:

Eligibility for Cancellation:

Those eligible to apply for GST registration cancellation include:

- Existing taxpayers.

- Migrated taxpayers with approved enrollment applications.

- Tax officers, either voluntarily or upon application from the registered taxpayer or their legal heir in the event of the taxpayer’s demise.

Ineligibility for Cancellation:

Persons ineligible for GST registration cancellation are:

- Individuals registered as tax deductors or collectors.

- Individuals with an already issued UIN.

- Prerequisite for Mergers, Amalgamations, or Constitution Changes:

- For cancellation due to merger, amalgamation, or constitution change, the transferee (new entity) must be GST-registered with a valid GSTIN at the time of applying for cancellation.

Understand more: GST registration on death of proprietor

Treatment of Tax Payable on Stock during Cancellation:

When applying for cancellation, the taxpayer must declare the stock value and corresponding liability. The tax payable is then offset against amounts in the electronic cash or credit ledger. In the case of capital goods, payment equals the input tax credit availed, reduced by a prescribed percentage or the tax on the transaction value, whichever is greater. If no stock is present, the taxpayer inputs zero in the stock value section.

Timely Application for Cancellation:

GST registration cancellation applications must be submitted within 30 days from the date when cancellation becomes applicable.

Filing Returns for Past Periods:

After GST cancellation, individuals can still do GST Return Filing for duration when the registration was active, up to the effective date of cancellation.

Responding to Suo-Moto Cancellation by Tax Officer:

If the tax officer initiates suo-moto cancellation, the taxpayer should respond to the issued notice by accessing

Dashboard > Services > Registration > Application for Filing Clarifications.

Also Read:

In addition, if you need anymore guidance related to doing GST Cancellation, you can talk to the GST Experts at: 8881-069-069

Furthermore, Download E-Startup Mobile App and Never miss the latest updates narrating to your business.