In the process of GST Return Filing, some of the GST liabilities come on the cover which had originally missed out by an individual. These further liabilities that an individual’s need to paid via provision given on the GST portal which enables us to execute so. In this article, we will discuss on how to make GST tax liability payment and its significance.

GST Tax Liability Payment | GST DRC 03

DRC-03 is a payment form in which a taxpayer can pay the tax by inflating its liability voluntarily to the show-cause notice (SCN) raised by the Department. Form DRC-03 is the form aiding the implication of voluntary payments made before the notice under section 73 & 74 has issued or payments made within 30 days of issue of Show Cause Notice (SCN).

Causes of Payment in Form DRC-03

Payments for Form GST DRC-03 can be made for any causes –

- Audit

- Investigation

- Voluntary payment

- Show Cause Notice(SCN)

- Reconciliation Statement or Others

When should a taxpayer make payment in DRC-03?

GST Tax Liability payment or Form DRC-03 is filed for creating a voluntary payment of outstanding liabilities u/s 73 and 74 of the CGST Act. A taxpayer can self-determine the tax before issuance of SCN or within 30 days of SCN determination to avoid the hassles of demand and recovery provisions.

- Section 73 – Consider with matters where there is non-payment/under-payment of tax without any intention or invocation of deception or fraud.

- Section 74 – Consider with matters where there is non-payment/under-payment of tax with purpose or invocation of fraud.

NOTE – All the payments require to be made either from input tax credit obtainable in electronic credit ledger or cash balance available in the electronic cash ledger. But, in case of interest and fines, ITC utilisation is not available. It has mandatory to pay in cash.

Necessities before filing DRC-03

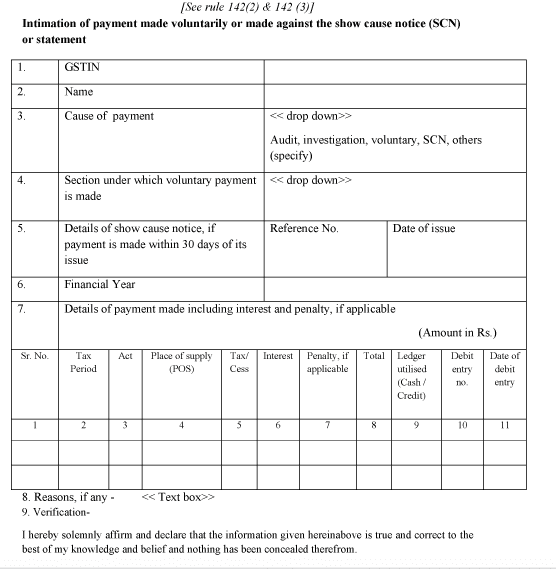

Form DRC-03 has used for forming a voluntary payment of tax or Voluntary payment made either:

- Before the issuance of show cause notice.

- Within 30 days of issue of Show Cause Notice (SCN) in case, the show cause notice has already declared. Below is the format of Form DRC-03:

Steps to Apply Form GST DRC-03

Step 1: Login and navigate to User Services

Step 2: Pick “Intimation of Voluntary Payment- DRC 03” available in the drop-down list of “Application Type”. Then Tick on “New Application”.

Step 3: Select any of the three options under “Cause of Payment*” (Voluntary, SCN, and Others).

Step 4: If SCN is Choose- > Select the appropriate section and related Financial Year; enter the SCN Ref No. and date (either system generated or manual)

Step 5: If the taxpayer chooses others from the options > Provide proper section and related Financial Year.

Step 6: Once the details are properly listed, Select Period and Act (visible on the bottom of the screen). > Proceed to Pay.

Significant Details for GST Tax Liability Payment

A taxpayer obliges to fill various details in DRC 03 which covers GSTIN and name, Cause of payment (Voluntary, SCN, etc.). Part under which payment is executed (73 or 74.Not applicable for voluntary payment), Reference number, if SCN appeared in DRC-01 or DRC-02; Financial year, tax period and ACT; and payment aspects including interest, penalty, and others.

In case, you need any kind of guidance related to the GST Registration, please feel free to contact our business advisors at 8881-069-069.

Download E-Startup Mobile App and never miss the most recent updates relating to your business.