The tax authority may have initiated suo moto procedures to cancel a taxpayer’s GST registration. However, as a taxpayer, you have the option and power to apply for revocation of cancellation of GST Registration. You can apply online for cancellation of GST Registration on official GST Portal. This article guides you on all the important things to know about the revocation of cancellation of GST Registration.

Form to apply for Revocation of Cancellation of GST Registration

Application Form GST REG-21 can be used to reverse a proper officer’s decision to revoke a taxpayer’s registration in the GST system. It is crucial that you file this application form as soon as you are notified that your GST registration has been canceled. The maximum time limit for applying Revocation of Cancellation GST Registration is 30 days.

For those whose registration has been revoked by the appropriate official for failure to file returns. Only when all overdue returns, interest, and penalties have been filed in GST REG-21 may a reversal application be submitted.

Thus, you need to do GST Return Filing if you want to apply for revocation of cancellation of GST Registration.

Importance of Revocation of Cancellation of GST Registration

As stated by the Government, the taxpayer can no longer register for another GST registration or obtain a new GSTIN after their previous GST registration has been canceled; they must first request for their previous GST registration to be restored.

What is Form GST Reg -23?

Revocation application Form GST REG-21 will be checked by the appropriate official. If he/she is unsatisfied with the application of revocation of cancellation of GST Registration then they will get a show-cause notice i.e. Form GST Reg-23.

The taxpayer is given the opportunity to explain why the GST registration should not be cancelled.

Form GST REG-24 must be filed by the assessee within seven working days of receiving notification in Form GST REG-23.

If the concerned officer is content with the revocation application, he writes down the reason for his approval and then approves the cancellation of GST Registration.

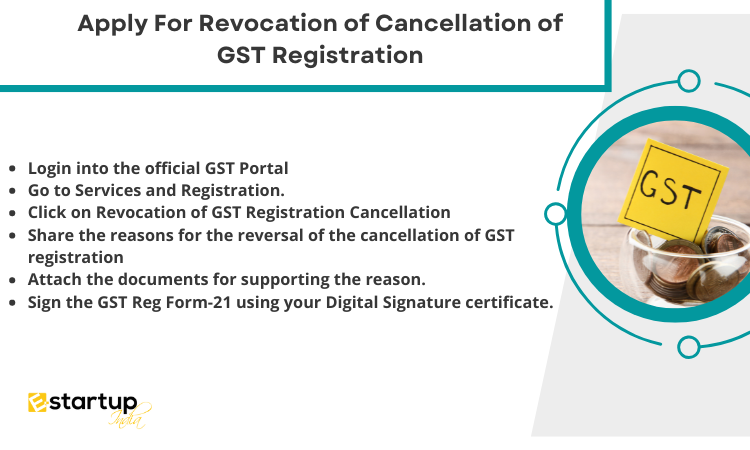

Stepwise process to apply for Revocation of Cancellation of GST Registration

- Login into the official GST Portal

- Go to Services and Registration.

- Click on Application for Revocation of GST Registration Cancellation

- Share the reasons for the reversal of the cancellation of GST registration after entering the required information.

- Attach the documents for supporting the reason.

- Sign the GST Reg Form-21 using your Digital Signature certificate.

After completing the steps above, you will receive a message on the screen that your application is successfully submitted.

Moreover, If you want any other guidance relating to GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.