Starting a journey with your new startup in the UK is pretty exciting, and it will be full of challenges. You will come across many questions you need to find the answer to. One such question would be, what are the different types of company registration in the United Kingdom? Starting with the wrong type of company registration will result in many complications. So, in this article, you will understand the type of company registration in United Kingdom.

The business structure that you will choose will have a significant impact on the amount of tax you will be paying, your ability to raise funds, the amount of administrative work required, and the degree of personal liability.

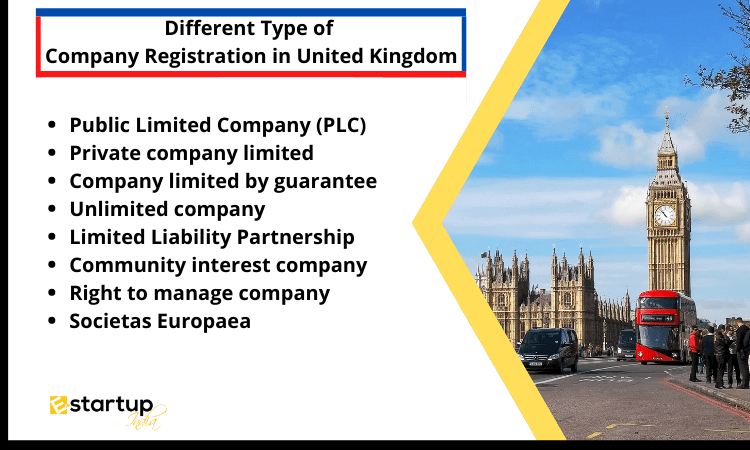

Different Type of Company Registration in United Kingdom

Public Limited Company (PLC)

Public Limited Company (PLC)

A public Limited Company which is often known as a public company is the type that can sell debentures and shares directly to the general public. These companies usually start as private limited companies before they are registered as PLCs to raise funds.

Private company limited

Private company limited

Compared to a public company, a private company cannot be directly owned by any public members. Instead, it can be owned by an NGO, a non-governmental organization, or a small group of shareholders. The sale of the company shares can be handled privately.

But, these companies have the same implications for a private company as it does for any other public company.

Company limited by guarantee

Company limited by guarantee

This type of company formation in the UK is very different from the previous two categories. In this type, the individuals are not responsible for a fixed sum based on their investment. This is because the company status is only reserved for other companies that do not have shareholders. Instead, they have a group of members who act as guarantors or people who can contribute a nominal amount towards the company’s work.

Unlimited company

Unlimited company

The basic difference between unlimited and limited companies is that there is no formal restriction on the sum of money that the shareholders have to pay if the company goes into formal liquidation. In such an event, and only then are the shareholders responsible for completely settling the remaining finances of the company regardless of their amount of investment in the company.

Limited Liability Partnership

Limited Liability Partnership

LLP are not legally treated as partnerships in the United Kingdoms. Instead, they are treated as incorporated bodies. To qualify as an LLP, some or all the business partners have to have limited liabilities. In simple words, this means that they’re only responsible for their own negligence or misconduct instead of being responsible for the whole group as a collective.

A key element of an LLP is that any of the partners can directly manage the business, which is quite different from the other corporations where shareholders have to vote to elect the board of directors.

Community interest company

Community interest company

This status was exclusively granted to the companies that were not interested in maximizing the profits of their shareholders. Instead, they wanted to work for social causes. The intention of these companies was to use their assets and profits for the betterment of the community.

These companies can be easily set up in the UK, and they run on the basis that the profit is not distributed among the shareholders but is used to improve the local area.

Right to manage company

Right to manage company

This type of company is responsible for the transfer of powers for various things that include repair work of a building from the landlord to the leaseholders. All the RTMs have to be set up as a private company limited by guarantee.

Societas Europaea

Societas Europaea

SE companies and business entities can be established in the entire European economic area. They are a special type of public limited company found as a subsidiary of another company or a folding company. These companies can also be created from an existing PLC or by mergers.

While company formation in the UK is possible for a small fee without professional help, it is still better to ask someone with in-depth knowledge of financial and business matters. So if you need help regarding company registration in the United Kingdom, you can directly contact us on our website.

Moreover, you require any kind of guidance related to company formation in UK, Please feel free to contact us at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.