GST or goods and service tax was launched on the 1st of July 2017. The tax has replaced almost all the indirect taxes in India. It is mandatory to issue an invoice or bill of supply when the supply value is more than Rs. 200 under GST Registration in India. There are several types of invoices under GST. For every entrepreneur, it is important to know the types of invoices under GST. In this article, you will understand the most important types of Invoices under GST.

What is a GST invoice?

A taxable individual can issue the GST invoice under GST when supplying goods and services to the customers. The supplier can issue an invoice at the time of or before:

- Movement of goods for supplying to the recipient, where the supply involves transportation of goods

- Delivery of the goods to the recipient

If you are offering services, the invoice has to be generated before or after offering service. However, it has to be issued within 30 days from the date of commencement of the service.

If the supplier of services is an insurance company or a financial institution, the invoice has to be issued within 45 days from the day of commencement of service.

You can use InstaBill for generating GST Invoices easily.

How is the GST Invoice Different From the Earlier Invoice?

Before the introduction of GST, there were two types of invoices, tax invoices, and retail invoices.

However, GST Regime has introduced different types of invoices for goods and services.

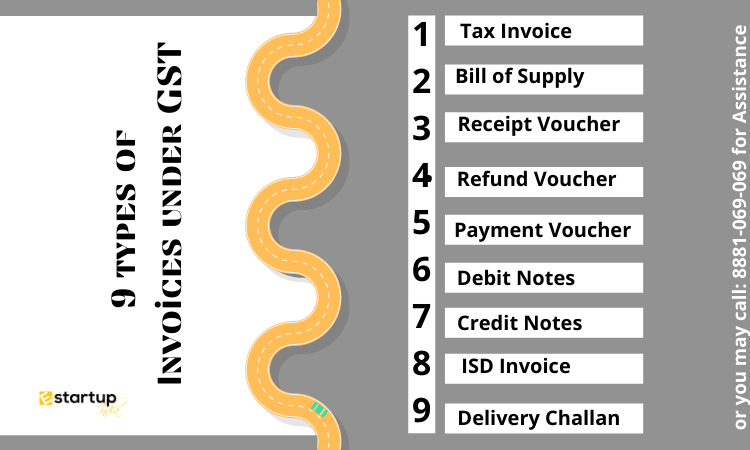

Understand the 9 types of Invoices under GST

-

Tax Invoice

Any person registered under the GST has to issue a tax invoice for all the supplies he is providing. A tax invoice is a bill issued for the supply of various taxable services and goods made to B2B and B2C clients. The tax invoice is also issued while making an interstate stock transfer.

The recipient of the goods and services can take a direct benefit of the input tax credit based on this tax invoice.

-

Bill of Supply

This is a new addition to the GST regime. The supplier has to issue a bill of supply when offering services and goods that are exempted from the tax or by the composition dealer. The recipient can not claim any input tax credit based on this invoice.

-

Receipt Voucher

It is mandatory to issue a receipt voucher when you receive advance payment for the supply of goods and services or both.

-

Refund Voucher

The supplier has to issue a refund voucher when no supply has been made against the receipt voucher received as advance payment.

-

Payment Voucher

A payment voucher is issued by a recipient liable to pay taxes under reverse charges. The recipient can also issue a payment voucher when he is making a payment to the supplier.

-

Debit Notes

You can issue a debit note when the previously issued tax invoice for the goods or services is less than the taxable value. The seller has to declare the value of the debit note in the upcoming GST return filing of the previous month.

-

Credit Notes

A credit note is usually issued when the previous tax invoice for the goods and services or both exceeds the taxable value. It can also be issued if the supply of services and goods is deficient and the goods are sent back to the supplier.

The maximum time limit to issue a credit note is by September following the end of a financial year or the date of filing the annual return.

-

ISD Invoice

This GST invoice is issued to distribute the input tax credit in between the branches that are under the same PAN.

-

Delivery Challan

A delivery challan is issued then the supplier transports the goods before receiving or preparing the tax invoice. It can also be issued for stock transfers in-between states.

The Manner of Issue of the GST Invoices

Invoices should be issued in the following manner:

In case of supply:

- Original receipt to the recipient

- Duplicate to the supplier for maintaining records during GST return filing.

In case of goods:

- Original copy to the recipient

- Duplicate copy to the transporter

- Triplicate of the invoice to the supplier for maintaining a record

Conclusion

In this post, we have discussed the various types of GST invoices. For assistance regarding GST registration in India, GST Invoices, or other services related to GST, you can contact us.

Moreover, If you want any other guidance relating to GST Return Filing or GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.