The Finance Minister announced the Final Budget on July 23, 2024. This year’s budget focuses on jobs, skills development, MSME, and the middle class. Let’s read about all the Union Budget 2024 Highlights & Announcements.

Direct Tax Limit Increased for Salaried Personals

A good news from the budget as the standard deduction for salaried individuals has been increased to Rs. 75,000 from Rs. 50,000. Furthermore, a deduction on family pension for persons having pension income has been increased to Rs. 25,000. These increased deductions are available when you do ITR Filing under the new GST Regime.

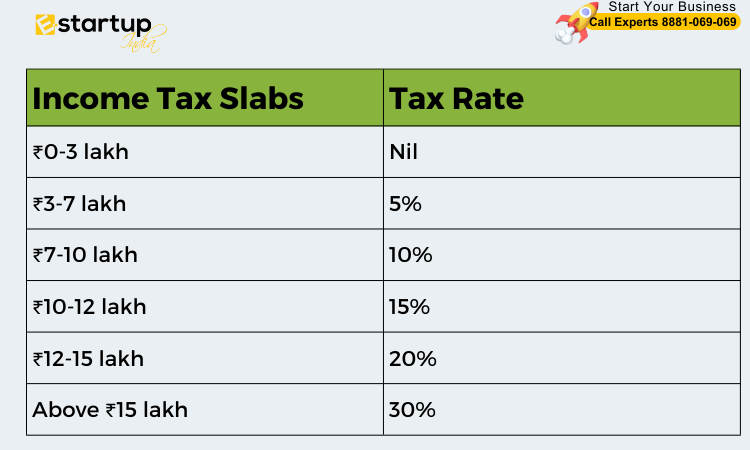

Changes in Tax Structure Under the New Regime

The new tax regime revises the tax structure as follows:

Note: As a result of these changes, a salaried employee in the new tax regime can save up to Rs. 17,500 in taxes.

Tax on Capital Gains Simplified

- Holding period for all listed securities is now 12 months. All listed securities with a holding period exceeding 12 months will now be considered as Long-Term.

- Unlisted bonds and debentures will attract tax on capital gains at applicable slab rates. Thus, these are treated as short-term irrespective of the period of holding.

- Short-Term Capital Gain for listed equity shares, a unit of an equity-oriented fund, and a unit of a business trust increased to 20% from 15%.

- Exemption limit on Long-Term Capital Gains on equity shares or equity-oriented units increased from Rs.1 Lakh to Rs.1.25 lakh per year, taxed at 12.5%.

- Long-term capital gains on other financial and non-financial assets reduced from 20% to 12.5% without indexation benefit.

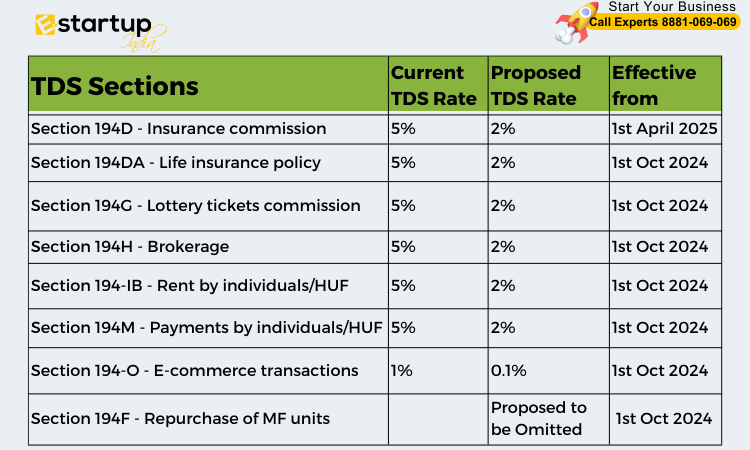

Changes in TDS Rates

Reduced TDS rates on specified payments, effective from either 1st Oct 2024 or 1st April 2025:

Changes in TDS Payments, Angel Tax, STT, ITR Filing and other direct taxes

- The Finance Bill has made a number of changes to the direct tax laws. One such amendment is the introduction of TDS on payments made to partners by firms (section 194T). The section requires that any payment made by a firm to its partners exceeding Rs. 20,000 shall be subjected to TDS at the rate of 10%.

- Another change was abolishment of angel tax which is proposed in the provisions of section 56(2)(viib) thus; this would help Indian start-up ecosystem most. Also, there are proposals introduced in Union Budget 2024 for corporate taxes on foreign companies that include a reduction from 40% to 35%.

- Furthermore, Section 80CCD’s deduction for the employer’s contribution towards the Pension Scheme has been increased from 10% to 14%.

- Additionally, STT on futures and options have been imposed at higher rates, from 0.0125% up to0.02% and from 0.0625% up to 0.1%, respectively.

- Changes within other direct taxes were: reopening ITR only if escaped income is more than or equal to Rs.50 lakh but within maximum five past years; reintroduction of Vivaad se Vishwas Scheme for income tax dispute settlement

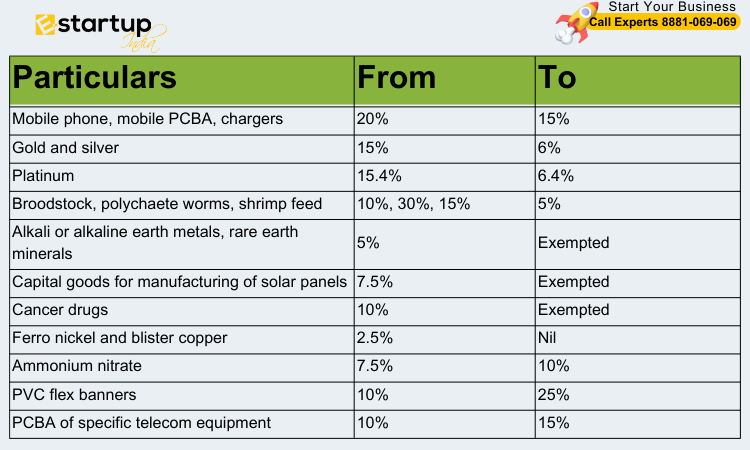

Changes in Indirect Taxation System

Customs Duties Reductions and Exemptions

Reforms in GST

- GST does not apply to un-denatured extra neutral alcohol used in the production of alcoholic beverages.

- New Section 74A addresses unpaid/underpaid taxes, incorrect refunds, and incorrect ITC claims, with notifications sent within 42 months.

Impact of Union Budget 2024 on Various Sectors in Brief

Priority Number One: Agriculture

- An allocation of 1.52 trillion rupees to agriculture.

- More than one hundred and nine new high-potential, climate resilient crop varieties are being released.

- One crore farmers practicing natural farming initiatives.

- Digital Public Infrastructure for agriculture including farmer and land registries.

Priority Two: Employment & Education

- Three ‘Employment Linked Incentives’ schemes being introduced.

- 20 lakh youth will be skilled over five years upgrading 1000 ITIs.

- Concessional Educational loans support scheme is also being provided to students who want to pursue higher education studies at cost.

Priority Three: Inclusive Human Resource Development and Social Justice

- Rural development outlay of Rs 2.66 lakh crore

- Purvodaya plan for the development of eastern region of India; Financial support for Polavaram Irrigation Project;

- New housing projects under PM Awas Yojana

Priority Four: Manufacturing & Services

- Credit guarantee scheme for MSMEs;

- Development of investment-ready industrial parks with “plug and play” facilities.

- Critical Mineral Mission enabling recycling and domestic production;

Priority Five: Urban Development

- Transit Oriented Development plan for fourteen big cities;

- Rs. 10 lakh crore investment under PM Awas Yojana Urban 2.0;

Priority Six: Energy Security

- PM Surya Ghar Muft Bijli Yojana providing free electricity for 300 units.

- Policies on increased pumping storage and nuclear energy;

Priority Seven: Infrastructure

- Rs11,11,111 crore capital expenditure budget in FY22:

- States are offered long-term interest-free loans amounting to INR1.5 Lakh Crore,

- Phase IV of PM Gram Sadak Yojana (PMGSY) was initiated to continue connecting rural areas.

Priority Eight: Innovation, Research & Development

- Rs. 1 Lakh Cr Finance pool catalyse private sector research,

- Anusandhan National Research Fund for basic research.

Priority Nine: Next Generation Reforms

- Land-related reforms and digitization.

- Taxonomy for climate finance.

- Simplified FDI and Overseas Investment rules.

Conclusion

In conclusion, budget 2024 includes a series of changes and initiatives intended at accelerating India’s economic growth, encouraging innovation, and guaranteeing inclusive development. From tax breaks to infrastructure improvements, this budget aims to meet the demands of many sectors while encouraging sustainable growth.

If you want any other guidance concerning Union Budget 2024 Highlights & Announcements, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest and important updates relating to your business.