Starting a Limited Liability Company (LLC) in the UAE? The most crucial thing after business registration in UAE is having VAT Registration. VAT Registration of UAE LLC Company provides you a competitive edge along with legal compliance. Let’s explore everything you need to know about VAT registration for UAE LLC companies, why it’s essential, and how to get started.

What is VAT in UAE and Why is It Important?

Value Added Tax (VAT) is a consumption tax in the UAE. It is currently set at 5%. All businesses, including LLCs, are required to register for VAT if their taxable supplies exceed AED 375,000 per year.

But you can also voluntarily register if your turnover exceeds AED 187,500 annually.

Importance of VAT Registration for UAE LLC Company

For LLCs, VAT registration is more than just a legal obligation. Businesses can claim input VAT credits on expenses and it also enhances credibility of the business. Furthermore, it builds trust with clients and partners. Without VAT registration, you risk fines and penalties, which can also result in shutting down of your business.

Why Should LLCs Register for VAT in UAE?

- Legal Requirement: If your LLC’s revenue surpasses AED 375,000 annually, you have to mandatorily have VAT Registration as per the law.

- Financial Benefits: VAT-registered businesses can reclaim VAT paid on business expenses. Thus, helping businesses in reducing overall costs.

- Increased Credibility: Having VAT Registration for your company signals to the stakeholders that your business is established, compliant, and trustworthy.

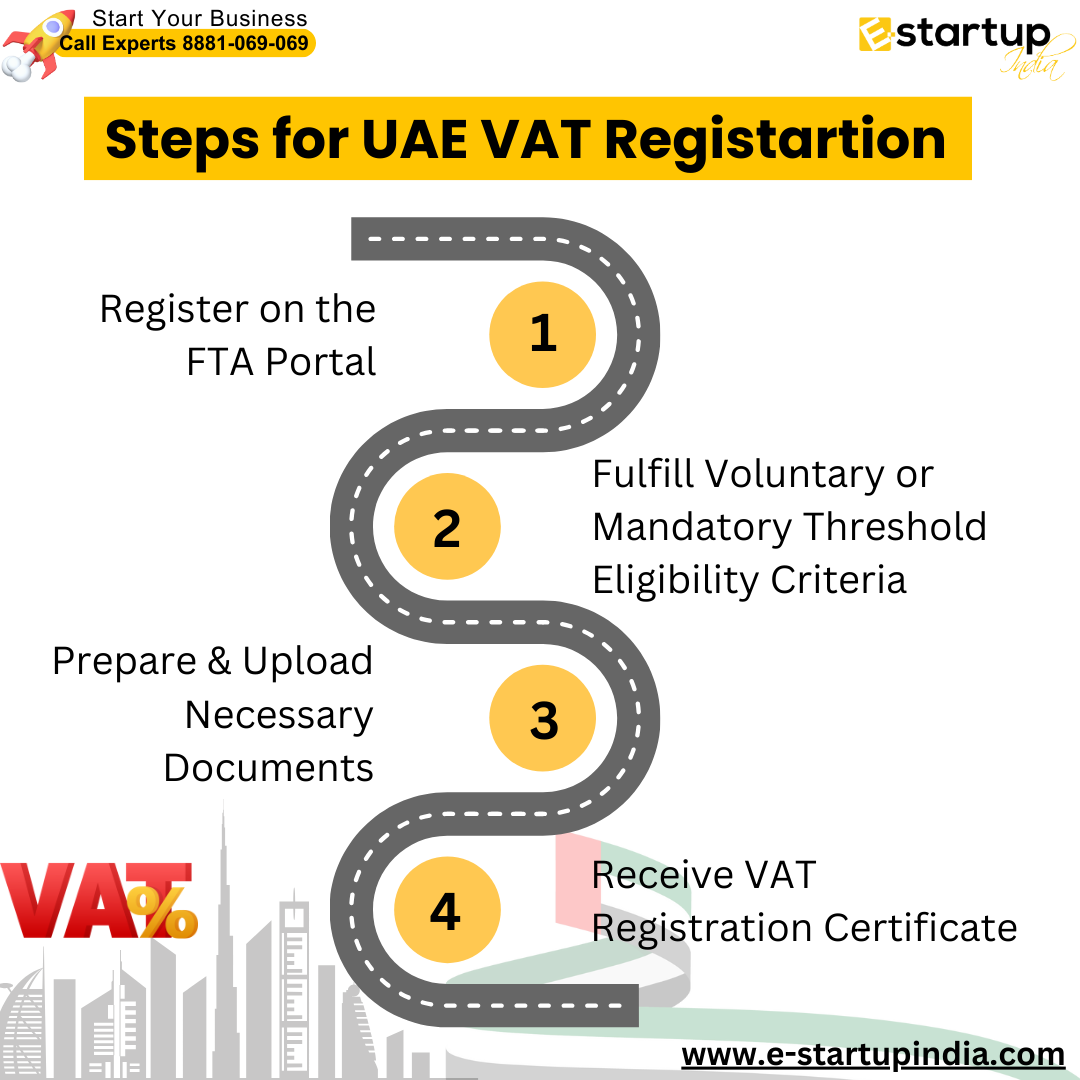

Steps for UAE VAT Registration

- Register on the Federal Tax Authority (FTA) Portal: The first step for VAT Registration of UAE LLC Company is to start by creating an account on the FTA’s official website. This platform is where you’ll submit your VAT registration application and manage future filings.

- Fulfill Voluntary or Mandatory Threshold Eligibility Criteria: You’ll also be required to submit your company’s estimated annual turnover, import/export records, and other financial data to help the FTA assess your VAT obligations.

- Prepare Necessary Documents: You’ll need to gather important documents like your LLC’s trade licence, passport copies of shareholders, Emirates IDs, and a report detailing your business activities.

- Receive VAT Registration Certificate: Once your registration is approved, you’ll receive a VAT registration certificate, which includes your unique Tax Registration Number (TRN). You must display this on all your business invoices.

The VAT Registration process is complicated as you will have to spend time and energy in each step. Furthermore, if you go wrong at any step, you will need to again spend your time and energy in generating a new application. Why not make it simple and easy in the first go?

Hire E-StartupIndia’s experienced professionals for quick and easy VAT Registration of UAE LLC Company.

Benefits of VAT Registration for UAE LLC Company

- Input VAT Credit: One of the biggest advantages is that your LLC can claim back the VAT you’ve paid on purchases related to the business. For example, you can claim the VAT paid on office equipment, supplies, or other operational costs.

- Legal Compliance: Registering ensures that your company complies with UAE tax regulations. Non-compliance with VAT Regulations leads to penalties that can affect your business’s reputation and finances.

- Market Competitiveness: VAT registration makes your LLC look more established and professional in the eyes of clients, suppliers, and potential partners. Thus, opening the door to more business opportunities.

Learn More: Can I Start a Business in Dubai Without an Office Space?

Common Mistakes to Avoid While Having VAT Registration of UAE LLC Company

- Missing the Registration Deadline: You need to make sure to register as soon as your LLC reaches the required turnover to avoid penalties.

- Incorrect Financial Reporting: Ensure that all financial details you submit are accurate and well-documented.

- Not Displaying TRN: Once registered, always include your Tax Registration Number (TRN) on invoices and other financial documents.

FAQs

- Do all LLCs in the UAE need to register for VAT?

No, only LLCs with annual taxable supplies exceeding AED 375,000 are required to register. However, you can voluntarily register if your turnover is above AED 187,500. - What happens if my LLC doesn’t register for VAT?

Failing to register when required can result in penalties, fines, and additional scrutiny from tax authorities, which could affect your business. - Can I reclaim VAT on business expenses after registering?

Yes, once your LLC is VAT-registered, you can reclaim VAT on expenses related to business operations, such as equipment, supplies, and utilities. - How long does it take to get a VAT registration certificate?

It typically takes around 20 business days after submitting your application to receive your VAT registration certificate from the FTA. - What is the VAT rate in the UAE?

The VAT rate in the UAE is 5%, and it applies to most goods and services offered in the country.

Moreover, If you want any other guidance relating to VAT Registration in UAE, Corporate Taxes in UAE, or UAE Company Registration, please feel free to talk to our experts at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.