Individuals who have registered for GST are granted a GST Registration Certificate. A GST registration must be displayed clearly at the place of business of those who possess one. This article discusses the validity period of the registration certificate in GST and other important things relating to GST Registration Certificate.

What is a GST Registration Certificate?

In India, a GST registration certificate serves as legal confirmation of compliance with the country’s GST legislation. GST registration is mandatory for every Indian firm with annual turnover more than of the threshold for GST registration. Businesses such as casual taxable individuals, non-resident taxable persons, and others are also required to register for GST as a prerequisite of doing business.

Uses of GST Registration Certificate

Uses of GST Registration Certificate

Taxpayers must display this certificate at their principal place of business and any other locations mentioned in Form GST REG-06.

A fine of up to Rs.25,000 can be imposed for any violation of CGST Rule 18(1). If you’re supplying goods or services to businesses, you’ll also need a GST Certificate.

Forms of GST Registration Certificates

Forms of GST Registration Certificates

GST REG-06 is the official form for obtaining a GST registration certificate. After furnishing the GST Reg-06 form on the GST portal, you can obtain the digital copy of GST Registration Certificate.

The validity period of the registration certificate in GST

The validity period of the registration certificate in GST

Standard taxpayers’ GST registration certificate is valid for lifetime unless it is voluntarily canceled or canceled by the tax authorities.

Taxpayers can apply for Revocation of cancellation of GST registration and utilize the same GST Registration Certificate.

When it comes to non-resident and casual taxable persons, the validity of their GST Registration Certificate is restricted to 90 days.

Can you extend the validity period of the registration certificate in GST?

Yes, in order to prolong the validity of a GST certificate, or to renew it after it expires, an option is available to the taxpaying entity. Taxpayers need to file an application form to extend the validity period of the registration GST.

Requirements for a Extension of GST Registration Certificate

Requirements for a Extension of GST Registration Certificate

A Casual/Non Resident Taxpayer must meet the following requirements before requesting an extension of the registration period:

- A taxable person who is registered as “Casual” or “Non-resident” and has a valid and current GSTIN.

- Prepare the application for extension of GST Registration Certificate before the expiration of the registration given previously.

- Taxpayers are required to pay a sum in advance against their Estimated Tax Liability in their Electronic Cash Ledger in order to prolong their registration.

- Do GST Return Filing till the date of filing form of extension application

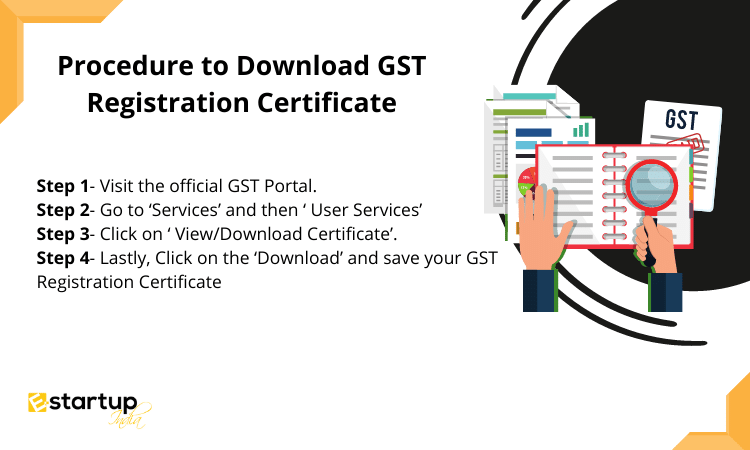

Procedure to Download GST Registration Certificate

Procedure to Download GST Registration Certificate

Step 1- Visit the official GST Portal.

Step 2- Go to ‘Services’ and then ‘ User Services’

Step 3- Click on ‘ View/Download Certificate’.

Step 4- Lastly, Click on the ‘Download’ and save your GST Registration Certificate on your device.

How can I get my GST registration certificate?

Using the GST portal, anybody who is eligible can apply for GST registration. Upon completion of the required application form and document verification, the registration will be granted. Applicants who submit their applications within thirty days after the effective date of their responsibility for registration will have their registrations go into effect at that point. However, if the submission was late, the GST registration will be valid from the day it was granted.

Moreover, If you want any other guidance relating to GST Registration, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.