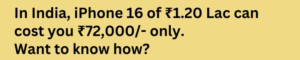

iPhone 16 is one of the most desired phones this year, and it’s just around the corner. If you are thinking of purchasing an iPhone 16. Well yes, iPhone 16 will be a little expensive by adding GST on the purchase price. As you start shopping to get your hands on the latest technology gadgets, in this article we will discuss what is the GST on iPhone 16, and tips to save taxes upon buying iPhone 16.

What is GST?

GST represents the value-added tax which is levied on sale of products by sellers in India. These taxes are also known as sales tax, VAT as well in many countries. This is a broad-based indirect tax that has replaced many indirect state and central taxes with the view of establishing a single tax regime. In India, the rate of GST varies for different product categories that range from 4-28% on value of goods.

GST on iPhone 16

The GST on the iPhone 16 will be 18% of the purchase price of the phone device. Purchase price of iPhone16 shall range from ₹100,000/- to ₹1,20,000/- inclusive of all taxes. Lets breakdown the cost:-

| Particular | Amount in INR |

| Purchase Price | 1,01,695/- |

| GST @ 18% | 18,305/- |

| Total | 1,20,000/- |

How to Save Taxes on iPhone16?

Though GST can’t be evaded, you need to pay taxes while purchasing iPhone 16. But here are ways to reduce its impact on your pocket:

- Purchase an iPhone from your business firm having GST Registration.

- Provide a GST Number to the shop while buying an iPhone. That Apple Store will provide you with a Tax Invoice.

- That tax Invoice will pass on the GST amount i.e. 18% of purchase price, in your business GST.

- While filing GST return on time, you can easily claim input tax credit [ITC], and save upto 18% cost.

- If you’re doing a job, not a business, then ask your employer to buy an iPhone on their business GST number and take reimbursement of tax credit from the employer.

- If you do not own a business and are planning to start a business, you can easily register your business from here.

- Furthermore, when you buy an iPhone 16 in the name of business, the iPhone 16 will be treated as a fixed asset and you can claim depreciation on fixed assets. It will save you upto 30% income tax on the purchase price of the iPhone that you purchased.

Learn More: What Is The Eligibility Criteria For GST Registration?

Conclusion

While GST on the iPhone 16 contributed a significant amount to the total cost. However, buying iPhone 16 in business name can save you upto 48% of the purchase price [i.e. 18% GST + 30% Income tax]. Furthermore, taking advantage of promotions and discount offers on e-commerce websites can also save more money. By applying these tips, you can make a more cost-effective purchase and enjoy the latest iPhone technology without breaking the bank.

Moreover, If you want any other guidance relating to GST Return Filing or GST Updates, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.