Value Added Tax (VAT) is a consumption tax levied on most goods and services in the UK. Failure to comply with VAT regulations can result in penalties and legal complications. Let’s understand all about VAT Registration in the UK and how to stay compliant.

Who needs to understand VAT Registration and why is it important?

Businesses in the UK must get VAT Registration if their taxable turnover exceeds £90,000 within a 12-month period or if they anticipate exceeding this threshold in the next 30 days.

However, if your business turnover is less than this threshold, you still can get voluntary VAT Registration. Voluntary VAT Registration offers multiple benefits such as reclaiming VAT on purchases.

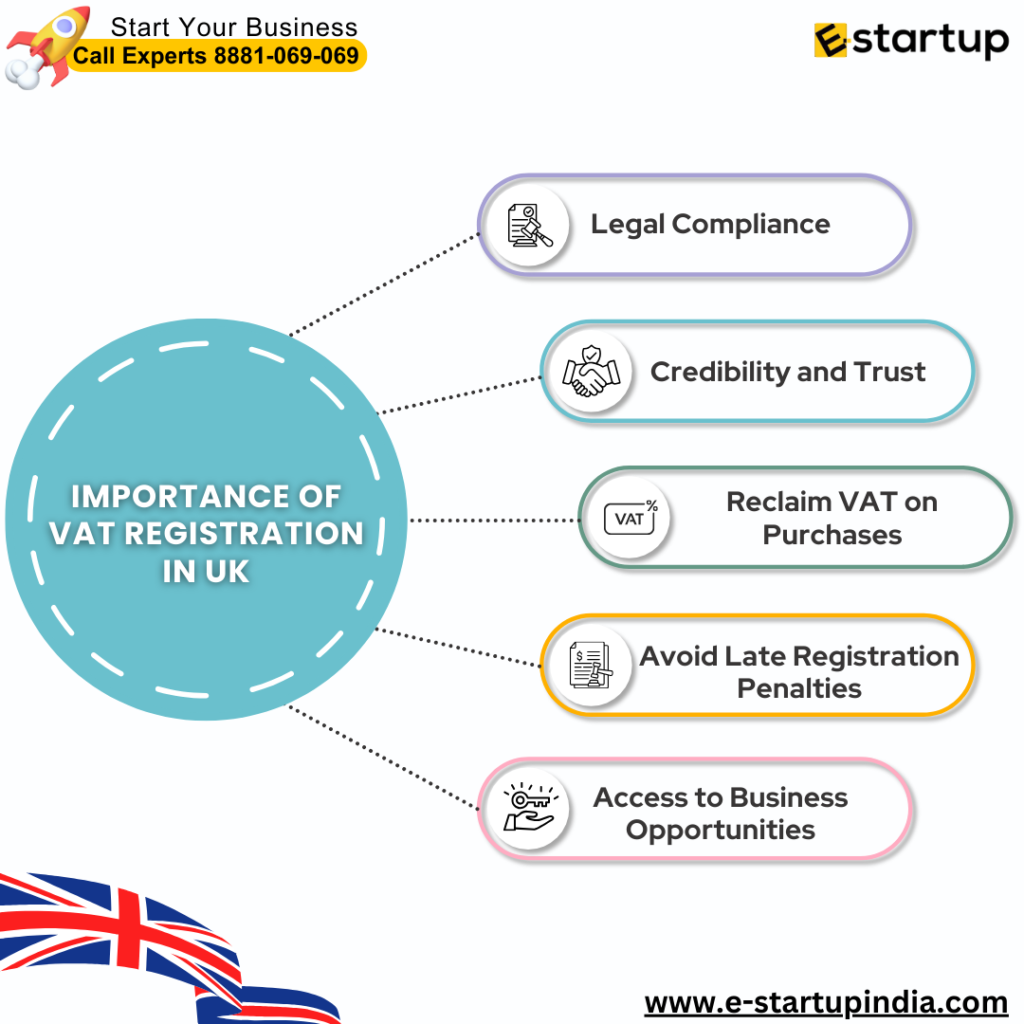

Importance of VAT Registration

Legal Compliance

VAT Registration ensures your business operates within UK Tax Laws and avoids penalties.

Credibility and Trust

VAT Registration enhances your business reputation and it shows legitimacy to customers and suppliers.

Reclaim VAT on Purchases

Businesses can claim VAT paid on business-related expenses. Thus, significant savings for you.

Avoid Late Registration Penalties

Having VAT Registration on time prevents fine and interest charges from HMRC.

Access to Business Opportunities

Some companies only work with VAT-registered suppliers. Hence, if you have VAT Registration, you will be able to get more businesses.

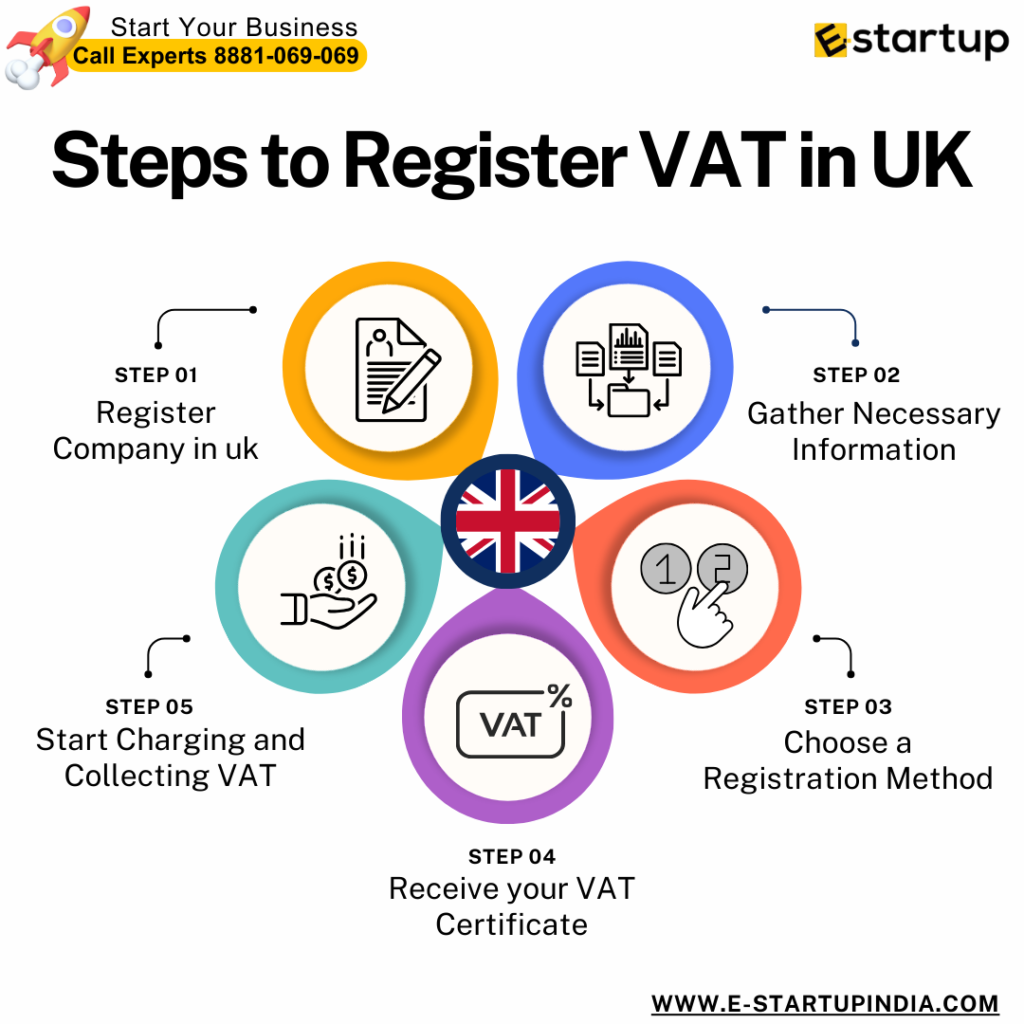

Stepwise process to register for VAT in the UK

Company Registration in UK

Before getting VAT Registration, you need to get Company Registration in UK officially with Companies House. Thus, one must get company registration through an application process as soon as possible.

Gather Necessary Information

The next step is to prepare essential details and documents including business bank account information, turnover figures and application.

Choose a Registration Method

Online Registration

VAT Registration can be easily obtained through the online registration process on HMRC Online portal.

Paper Registration

Another way is to get VAT Registration is through VAT1 form by post. However, this method may take longer to process.

Receive your VAT Certificate

After processing your application, HMRC will issue a VAT registration certificate, confirming your VAT number and effective date of registration.

Start Charging and Collecting VAT

- From the date of VAT registration, charge VAT on your sales and issue VAT invoices.

- Keep records of all sales, purchases, and VAT payments.

How to stay Tax Compliant post VAT Registration

Charge VAT

The first necessity is to add the appropriate VAT Rate to your taxable goods and services. This way you will start collecting VAT.

Issue VAT Invoices

The next requirement is to provide valid VAT invoices to customers.

Moreover, you require any kind of guidance related to company formation in UK, Please feel free to contact us at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.