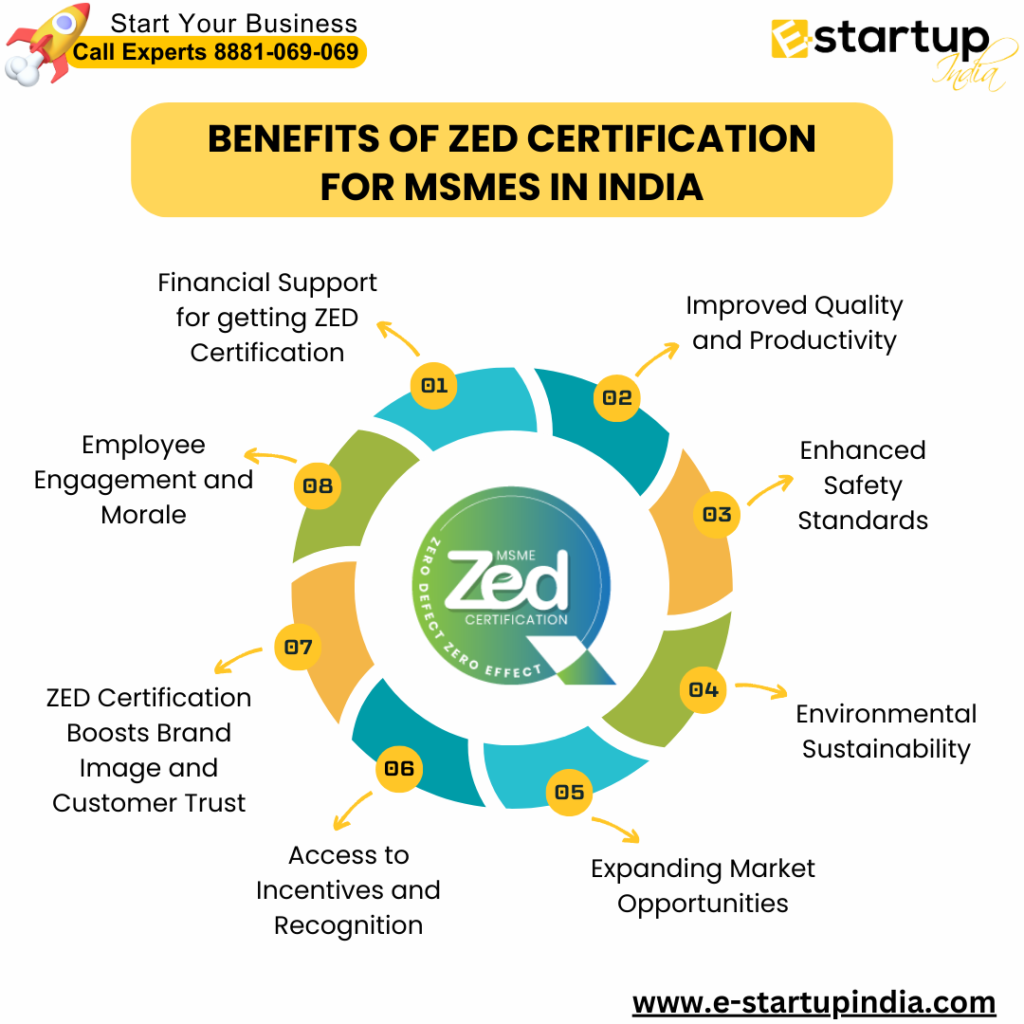

MSMEs face numerous challenges. However, these challenges can be easily tackled with ZED certification. Thus, ZED certification is not merely a badge of honor but a powerful tool that can transform the way MSMEs operate. Let’s understand the benefits of ZED certification for MSMEs in India.

-

Financial Support for getting ZED Certification

One of the most valuable benefits of ZED certification is that the government itself provides financial support to obtain ZED certification. You get subsidies for ZED Certification as per the eligibility criteria, which are:

- Microenterprises receive an 80% subsidy.

- Small enterprises enjoy a 60% subsidy.

- Medium enterprises benefit from a 50% subsidy.

Important Note: Additional subsidies (10%) are granted to enterprises owned by SC, ST, or women entrepreneurs and those located in special regions like the North-East and Himalayan states.

-

Improved Quality and Productivity

ZED Certification mainly focuses on improvement of organization. By implementing ZED Certification standards, and reducing waste, MSMEs can enhance product quality. Thus, helping you with cost savings and higher customer satisfaction.

-

Enhanced Safety Standards

Occupational health and safety are integral to ZED practices. MSMEs that adopt ZED principles often report fewer workplace accidents, a safer working environment, and reduced liability risks.

- Environmental Sustainability

In an era of increasing environmental consciousness, ZED certification helps MSMEs align with global sustainability goals. Businesses getting ZED certification not only comply with environmental regulations but also contribute to a greener future.

-

Expanding Market Opportunities

ZED Certification is a gateway to new opportunities. Businesses adhering to its principles are perceived as trustworthy and reliable. As a result, they get new clients with ease. Both domestic and international customers are attracted to MSMEs having ZED certification.

-

Access to Incentives and Recognition

The benefits of ZED certification also extend beyond financial subsidies. So, you are eligible for government incentives, tax breaks, and support in securing credit after getting ZED certification.

-

ZED Certification Boosts Brand Image and Customer Trust

In today’s market, customers demand quality, safety, and sustainability. ZED certification demonstrates all these values and thus boosting your brand image.

-

Employee Engagement and Morale

Adopting ZED principles also benefits employees. They get to see the improvement, work in a positive work environment and engage in innovative collaboration.

How to get ZED Certification for MSMEs?

To get ZED certification for MSMEs, they will need to file an application on its official website. To file the application for ZED Certification, you will need the following documents:

- MSME / Udhyam Certificate

- Photograph

– Site/Workshop Exterior

– Site/Workshop Interior

– Staff Toilet (Outside and Inside View)

– Raw Materials Storage Area

– Final Product Storage Area

– Fire Extinguisher (Front / Back showing Expiry Date)

– Employees wearing industry-appropriate personal protective equipment PPE kits (like, Helmets, Gloves, Shoes, etc.)

– Industry Safety Posters affix within workshop

- Training Session Attendance records on

– Safety

– Quality

- Delivery Record Sheet

Is ZED Certification mandatory?

ZED Certification is a voluntary requirement. However, as you have seen above there are multiple benefits of it, and that’s why it is good practice to have it. It is like an additional boost to your business that separates you from your competitors.

In case you need any further guidance with regard to ZED certification in India, please feel free to contact us at 8881-069-069.

Now you can also Download E-Startup Mobile App and Never Ignore the latest freshest relating to your business.