The CBIC has issued the notifications for waived off late fees for the late filing of GSTR-4 and GSTR-10

Let’s summarise the Notifications issued:-

Know About GSTR-4 and GSTR-10 Return

GSTR-4 is a return that needs to be filed by taxpayers. The due date for GST Return filing Form GSTR-4 Annual Return is 30th of the month succeeding the financial year or as extended by Government, from time to time. For FY 2019-20, it has to be listed by 31/10/2020.

While GSTR-10 also needs to be filed by taxpayers. GSTR 10 should be filed within three months of the date of cancellation or date of order of cancellation, whichever is later.

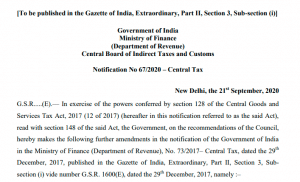

Late Fees for GSTR-4

The CBIC Notification No. 67/2020 – Central Tax on Late GST Return filing fees in case of delayed filing of GSTR-4 for the period July 2017 to March 2020 has been waived off fully in case of NIL tax liability and restricted to Rs. Rs 500 (Rs. 250 CGST + Rs. 250 SGST) So 500 shall stand fully waived in case of tax payable and the late fee shall stand NIL in case there is no tax liability.

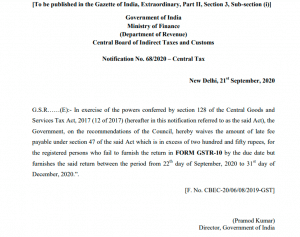

Late Fees for GSTR-10

The CBIC Notification No. 68/2020- Central Tax on Late fees capped at Rs. 500 for the delay in filing Final Return in Form GSTR 10 if it is filed between 22/09/2020 to 31/12/2020. A taxpayer whose GST registration has either been cancelled or abandoned is required to file GSTR-10. Rs. 500 is sum total of fine under Both CGST and SGST Law.

CBIC Extends Due Date of GSTR-4 Return filing for FY 2019-20

If you need any assistance regarding the annual GST return filing procedure or the GST Registration, please feel free to contact our business advisor at 8881-069-069.

Now you can further Download E-Startup Mobile App and Never miss the latest updates relating to your business.