The government releases the notification for the GST return forms details which are required to be filed according to the due dates for GSTR3-B for December 2020 under GST notification. In this article, we will discuss the notification on Due dates for filing GSTR-3B.

Due Dates for filing GSTR-3B

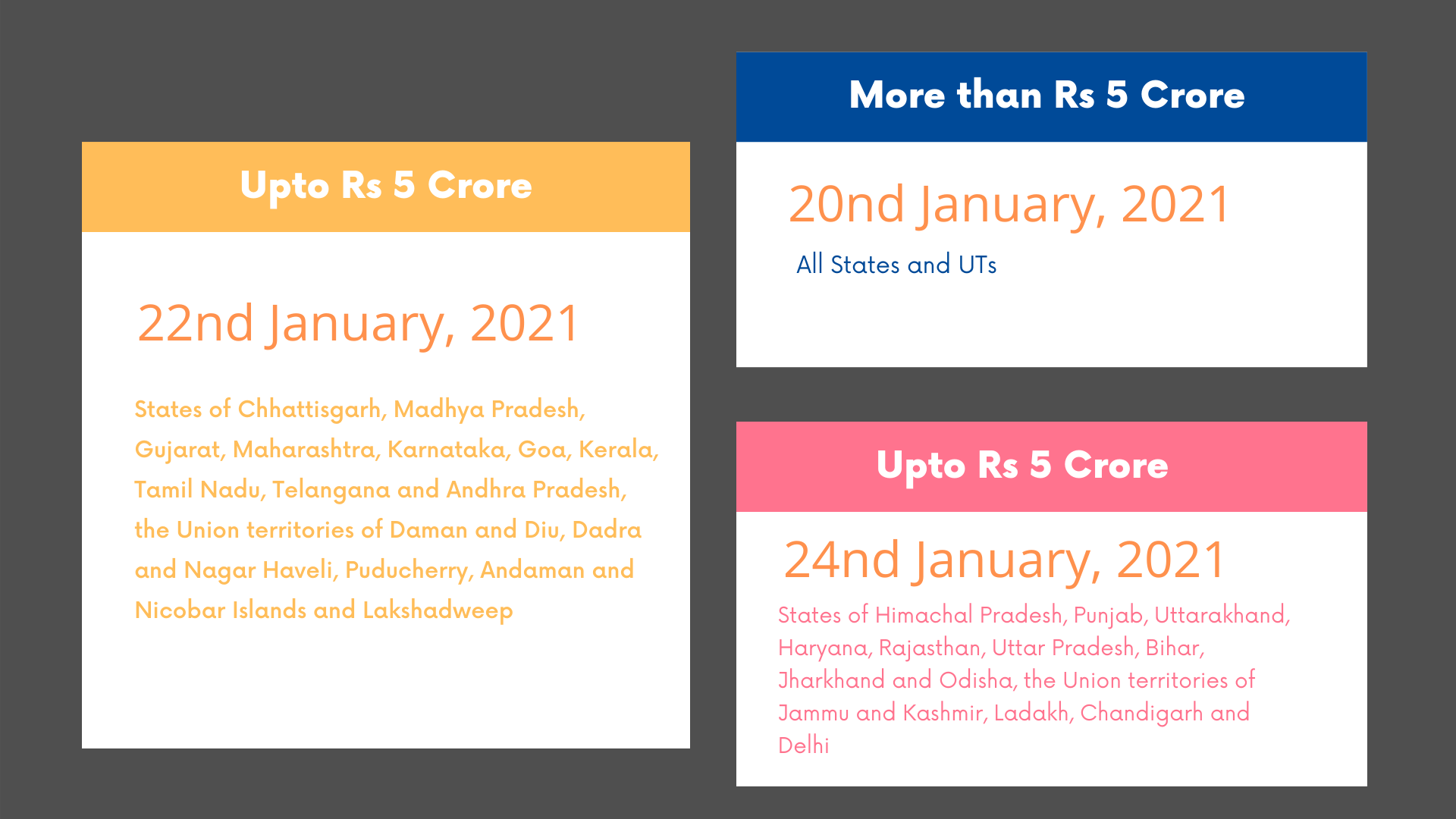

The due date for quarterly GST Return Filing for GSTR-3B of December 2020 has categorised in three groups. First for those taxpayers whose aggregate turnover is more than 5 crore, has to file their Returns on 20 January 2021. The second and third category will be classified with States. The date now being displayed in the GSTR-3B tile is 20th January 2021, for all states and UT’s GSTN clarified.

Annual Turnover Up to INR 5 Cr for GSTR-3B

- Region 1 – (Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, Daman & Diu and Dadra & Nagar Haveli, Puducherry, Andaman and Nicobar Islands, Lakshadweep)

- Region 2 – (Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha, Jammu and Kashmir, Ladakh, Chandigarh, Delhi).

Further Notification for Taxpayers

In November of last year, India noted the highest ever GST revenue at Rs 1.15 lakh crore since the new tax system was introduced in 2017. According to authorized data, GST collections in November of 2020 were 12 per cent more than the related period of the previous year.

GSTR 4 Due Dates for FY 2020-21

The due date for GSTR 4 annual return filing dates for FY 2020-21 is 30th April 2021

Form GSTR-4 is an Annual Return which has carried by Composition Taxpayers, for the FY 2019-20, is now accessible for filing.

GSTR 4 return revisions under 32nd GST council meeting: File annually return rather of quarterly along with tax paid to be a quarterly basis.

In case, you require any sort of guidance related to the GST Registration, please feel free to contact our business advisors at 8881-069-069.

Download E-Startup Mobile App and never miss the most recent updates relating to your business.