India’s economy is among the world’s fastest-expanding economies. It is the country’s ambition to have a $5 trillion GDP by 2025. One of the prerequisites for meeting this aim is to increase its exports to $1 trillion by the same year. At this point, the government’s ability to support the export community will be critical. This will be done mostly through export incentives that offer a variety of financial and non-financial incentives. Hence, it is important for every export business to know about export incentives in India. In this article, you will know about the different types of export incentives in India.

What is an Export Incentive?

Export incentives are advantages provided by the government to exporters in return for bringing in foreign cash and compensating them for the costs of moving products and services outside the nation.

These types of Incentives motivate exporters to export more goods and services in a quick manner.

Why are Export Incentives important?

As you all know, exports have a significant impact on a country’s economic growth.

The bigger the exports, the greater the inbound international transfers, the more businesses and work opportunities, the smaller the current account deficit, and thus the better the complete financial growth.

Accordingly, the Government of India promotes export business and provides Export Incentives in India to encourage exporters to sell more products and services outside India and earn foreign currency remittance.

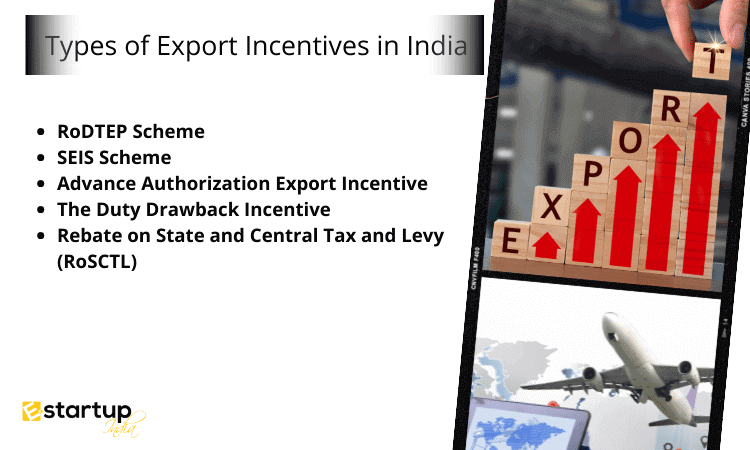

Types of Export Incentives in India

RoDTEP Scheme

- Remission of Duties and Taxes on Export Products, often known as RoDTEP, is the latest scheme or export incentive that came into effect on January 1st, 2021.

- Earlier there was an incentive scheme MEIS which was discontinued due to non-compliance with WTO policies.

- To replace the MEIS or Merchandise Export from India Plan, the RoDTEP scheme was introduced.

- Under the RoDTEP Scheme, exporters will get a refund of taxes and duties paid in India while manufacturing or processing the goods for export.

- Besides, the RoDTEP Scheme ensures that exporters get refunds on duties and taxes which were not refundable earlier. Thus, it is a win-win situation for all exporters, who will get their taxes and levies refunded.

- As a further goal, the RoDTEP aims to boost exports, which had previously been low in comparison to imports. You can learn more about RoDTEP Scheme at –

Scheme for Indian Service Exports (SEIS Scheme)

- Service Exports from India Scheme (SEIS) aims to promote and optimize the export of regulated services from India.

- Service exports can contribute to vital foreign exchange, hence service exporters are also encouraged.

- Under the SEIS Scheme, service exporters in India are eligible for a 3%-7% incentive on their net foreign exchange revenues for designated services.

- A SEIS application must be submitted digitally to the DGFT office in the jurisdiction.

- Having a current IEC Code Registration with minimum net foreign exchange profits of $15,000 USD is all that is needed to be eligible for the Scheme for Indian Service Exports.

- Furthermore, Services that qualify for duty credit scrip will be paid out in net foreign exchange to service providers.

- Customs duties, excise taxes, GST on the purchase of services, and customs duty in the event of failure to meet export obligations under Advance Authorization/EPCG can all be paid with duty credit scrips.

- In addition, the SEIS plan has eased the real user’s conditions, allowing duty credit scrips and products imported using duty credit scrips to be easily transferred.

Advance Authorization Export Incentive

- The Advance Authorisation Scheme (AAS) allows duty-free import of raw materials used in the manufacture of export goods.

- In other words, if the commodities will be used for the production of export products, then they will be exempt from the import charge.

- Under certain situations, imported inputs are free from duties such as Basic Customs Duty, Additional Customs Charge, Education Cess, Anti-dumping duty, Safeguard Duty and Transition Product-Specific Safeguard duty, Integrated tax, and Compensation Cess.

The Duty Drawback Incentive

- It is an incentive scheme that offers reimbursement of government-imposed duties. The Department of Revenue [Customs Department] administers and monitors this initiative.

- Customs and excise charges imposed on imported and domestic materials used in the production of exported goods are repaid under this scheme.

- The duty drawback rate varies depending on the product.

Rebate on State and Central Tax and Levy (RoSCTL)

- Made-up products and garment exporters can make use of RoSCTL duty credit scrips.

- To encourage exports, the government offers tariff credit scripts that may be transferred or sold based on the FOB (free on board) value of the exported goods. This new incentive deposits rebate funds directly into an exporter’s bank account.

Conclusion

In India, starting an export business is highly profitable. You can easily start your own Exim business, through some mandatory registrations such as Import Export Code Registration and follow the important steps mentioned in the guide – How To Start Import Export Business In India. Lastly, the excellent thing is that most of the export incentives are designed to ensure that the exporter receives the subsidies, penalties, and incentives with the least amount of human interaction possible.

Moreover, if you require any kind of guidance related to the Import export code, & Export Incentives in India please feel free to contact us at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.