The Union Budget 2022, delivered on Tuesday by Finance Minister Nirmala Sitharaman, was praised for its focus on growth and for introducing several new updates. One of the most significant updates for corporations is the extension of reduced or concessional tax rates. In this article, you will understand the latest updates as the Govt Extends Reduced Corporate Tax upto next fiscal year.

What is Corporate Tax?

Corporate tax may be characterized as a direct tax levied on a corporation’s profits or income. The ITR Filing is levied at the rate specified in the Income Tax Act, 1961, and is referred to as the Corporate Tax Rate.

It is based on a slab rate structure that varies according to the kind of corporate entity and the revenue generated by each business organization. Rates vary by country, and certain countries are regarded as tax havens owing to their low rates.

For example, Online Company Registration in USA from India offers less tax rates and several other benefits.

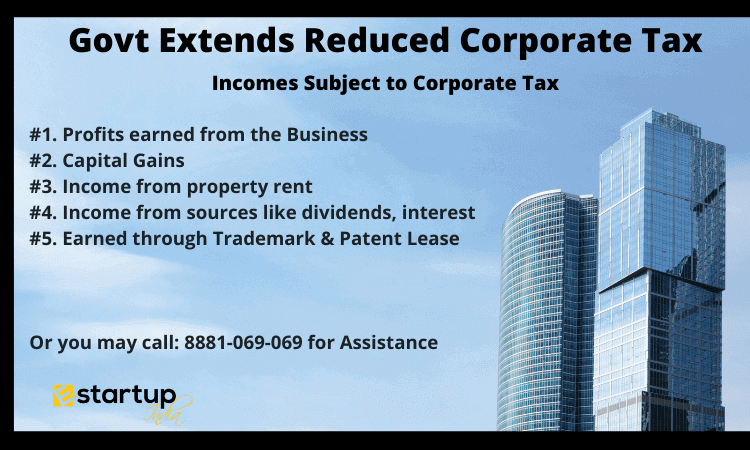

What are the Incomes subject to Corporate Tax?

- Profits earned from the business

- Capital Gains

- Income from renting a property

- Income from other sources like dividends, interest, etc.

- Money earned through Trademark Registration Lease or Patent Registration Lease etc.

What is Section 115BAB of Income Tax?

The government has established a tax incentive program for new manufacturing businesses. Section 115 BAB provides a reduced tax rate of 15% (plus surcharge and cess) to new manufacturing businesses. This is done to foster the growth of new industrial ventures.

Thus, Section 115BAB of the Income Tax Act is applicable to all domestic corporations save those that have been assigned for a concessional tax rate under section 115BA 115BAA beginning with the Financial Year 2019-20 (AY 2020-21), subject to certain requirements being met.

Eligibility Criteria for Section 115 BAB – Reduced Corporate Tax

The firm had company incorporation on or after 1st October 2019 and began manufacture or processing of an article or thing on or before 31st March 2023. Furthermore, it complies with the following conditions.

- A new company is not incorporated by dividing up or reorganizing an existing business, except in the instance of a firm re-established under section 33B.

- Uses no equipment that has previously been used for any other purpose. Plants and machinery that have never been utilized in India before might be used by the firm. Additionally, the corporation can make use of older equipment as long as it doesn’t represent more than 20% of the company’s overall equipment worth.

- Do not make use of a building that was once a hotel or conference or convention center.

- The corporation must be involved in the business of manufacturing or producing any goods, as well as doing research on such goods. The corporation may also be involved in the distribution of goods that it has created or manufactured.

Good news: Govt Extends Reduced Corporate Tax upto Next Fiscal Year

In the Union Budget of 2022, Finance Minister Nirmala Sitharaman left the corporation tax rate steady in the Union Budget of 2022-23 but gave a concessional rate of 15% for one more year till March 2024 for newly established manufacturing enterprises.

In simple words, there is an extension of the reduced corporate tax till March 2024 for newly incorporated manufacturing companies.

Thus, The entrepreneurs who want to avail of this tax relief benefit must apply for Company Formation before 31st March 2023.

Can you withdraw opting for Section 115 BAB?

In order to use Section 115 BAB, the company must do so by the deadline for ITR Filing, which is usually 30th September of the assessment year. However, A decision to use section 115 BAB in a specific fiscal year can’t be reversed.

Moreover, If you want any other guidance relating to Income Tax Return Filing, please feel free to talk to our business advisors at 8881-069-069.

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.